After trading closed for the day, CNBC published a report claiming a mistyped order for billions, not millions, triggered the mass selloff.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":181572,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"B"}']Today, the blame has shifted to the high-speed algorithmic trading that’s become the way Wall Street does business in the past two decades. As a New York Times report put it, “The glitch that sent markets tumbling Thursday was years in the making, driven by the rise of computers that transformed stock trading more in the last 20 years than in the previous 200.”

So what happened? Here’s the for-dummies version of the Times’ report. Don’t confuse yesterday’s automated trades with the Gaussian copula function blamed by many experts for the mortgage-finance crisis which led to our current recession.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

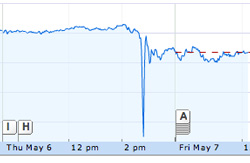

- At 2:45 PM New York time on Thursday, there was “a huge, anomalous, unexplained surge in selling, it looks like in Chicago.”

- The source of the selloff is still unknown (or so the official story goes.) But the sudden trades set off more automated trading done by computers.

- The tradebots did what they had been told to do. Every time active share prices dropped below specified thresholds, the computers sold off more shares.

- By 2:46, the Dow industrials were down from Wednesday’s close of 10,868.10 to 9,869.62, nearly a ten percent loss in value.

- As Jim Cramer screamed “Just go buy Procter & Gamble!” on CNBC, prices turned around and climbed nearly as fast as they’d fallen. By the time Cramer finished his sentence, Procter & Gamble was back at 61.

- By 3:00 PM in New York, the market had straightened out. But the Dow is still down 200 points from Wednesday.

[Homepage image: LEGO Terminator from Brickshelf]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More