Copy. Paste. Payments.

Today, startup WePay could cut into PayPal’s business by bringing this simple formula to merchants looking to accept online payments and donations without having to do any of the heavy lifting.

Founded in 2008, WePay says it offers the simplest way to accept online payments. The Palo Alto, Calif.-based company has raised $19.2 million to date and claims to process hundreds of millions of dollars in payment volume annually.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

“Our main customers are individuals and small businesses looking for a quick and easy way to collect money online. We found that other payment buttons were not doing the trick,” WePay CEO Bill Clerico told VentureBeat.

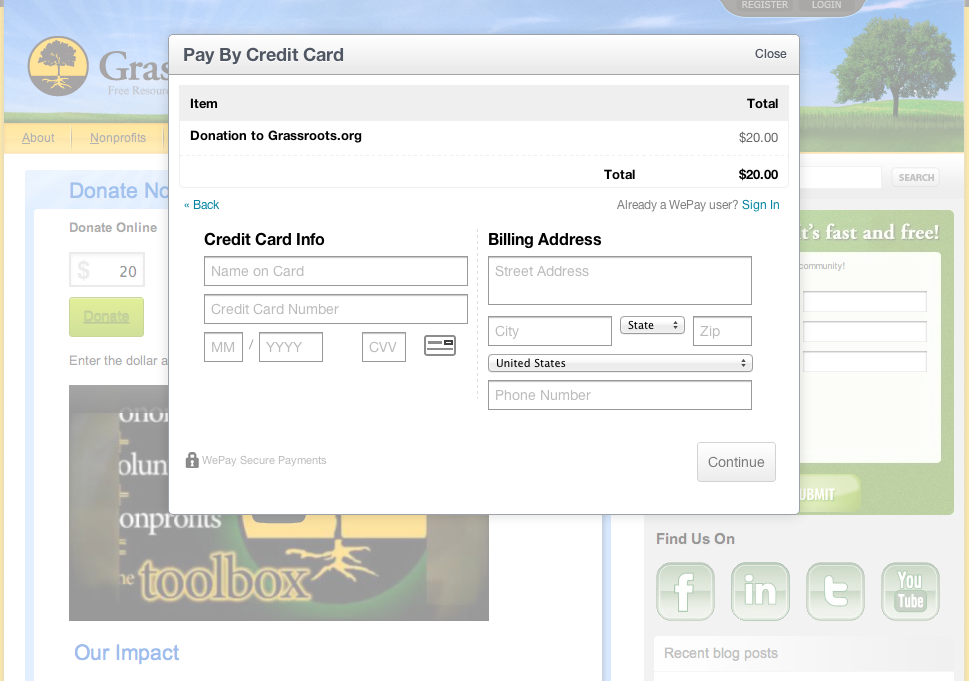

WePay Payment Buttons, released Wednesday, underscore the company’s interest in universal appeal; they give anyone the capability to grab some YouTube-style embed code and stick a payments button on a website. The payments buttons come in “Buy Now,” “Donate,” and “Register” varieties to allow sellers to create plug-and-play e-commerce experiences.

The WePay checkout process also takes place on the merchant’s website, as opposed to directing a customer to a separate site to complete a transaction (as PayPal does).

“PayPal has a 500-page instruction manual for their ‘Buy Now’ button, and even if you manage to put it on your site, customers are redirected to PayPal for checkout. We’ve dramatically simplified the process,” Clerico said. “We think this is truly revolutionary for millions of businesses that don’t accept payments online yet, simply because it is too complicated.”

With its easy-to-intall system, four-year-old WePay believes it can give PayPal a run for its money. But it’s going to be a marathon race that will require much more than fancy new shoes — buttons in this case — to beat the incumbent.

PayPal brought in about $1.4 billion in revenue for parent company eBay in the second quarter of 2012, and it’s not going anywhere. In fact, PayPal is about to become a more universally accepted payment method when it lands at 7 million retail stores in 2013.

But in going after mobile payments, perhaps PayPal is leaving the door wide open for its young and nimble challenger to win over the digital business of the littlest of web shops.

Buy now image via Shutterstock

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More