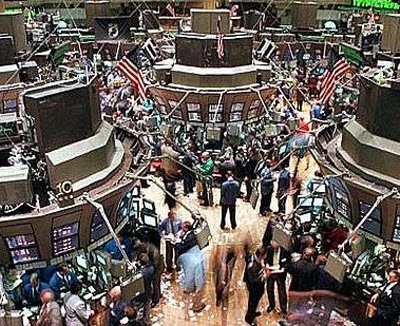

When the stock market opening bell tolls on Monday, much of the technology industry will be paying attention. This weekend has seen some dramatic events that could swing the stock market in wild directions in the coming days and weeks.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":317211,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"D"}']As we noted on Friday, the stock market is in a bloodbath, with the tech-loaded Nasdaq Composite Index falling more than 9 percent during the week. Since it fell through a threshold level, analysts were predicting that the market would keep heading downward. The question is whether the latest weekend news will be enough to reassure nervous investors or will simply plunge the market further, and if tech stocks will get swept up in a larger market trend.

On Friday, Standard & Poor’s downgraded the debt rating of the U.S. from AAA to AA, making everyone brace for a big negative reaction. The Group of Seven leading economies convened a conference call on Sunday to address Europe’s rising debt problems as well as the ratings downgrade.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The European Central back and other finance ministers pledged bold action to calm the markets. And on Sunday, the Obama administration announced that Timothy Geithner would stay on as Treasury Secretary, to reassure investors. Geithner and Federal Reserve Chairman Ben Bernanke pledged to take “all necessary measures” to support financial stability and growth.

Asian markets opened lower. The Nikkei fell 2.1 percent, and markets in China, Hong Kong, South Korea and Australia also declined. The Tel Aviv stock market delayed its opening as early pre-market trades dropped 6 percent. Then the market fell 5.7 percent. U.S. traders will have had the whole weekend to think about it, but who’s to say whether a panic will ensue.

Moody’s, meanwhile, said the U.S. still needs to lower the federal deficit. As we noted, a lot of plans in the tech world and Silicon Valley are riding on the stock market’s health. Groupon and Zynga are still trying to go public. It probably won’t be great to be a tech company reporting earnings this week, as stocks could fall regardless of the news. Game maker Take-Two Interactive reports on Monday, while graphics chip maker Nvidia reports on Wednesday.

In the venture community, private investing shouldn’t be affected by day-to-day stock market swings. But in 2008, we saw venture funds pull back because their own investors had trouble making capital calls as a result of a prolonged drop in stock prices. The capital calls were a downstream effect of the falling markets, with real impacts months after the declines started. But they eventually made venture investors pull back and lose confidence in the market, leading to fewer investments in startups.

We’re a long way from that seeing that set of dominos fall again, but it’s worth remembering that everything is connected.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More