This sponsored post is produced by SimilarWeb.

Viber: $900 million acquisition. Snapchat: $3 billion acquisition offer. WhatsApp: $19 billion. All were acquired at massive prices. Why so much? Because messaging is an integral part of phone usage.

Of course, app usage tends to follow behavior patterns by the type of app. Some app categories have very high churn, which means that to succeed, the app developers need to have crack marketing working non-stop on user acquisition. Other apps serve such a utility function in our lives that users never churn and the app becomes part of the daily routine.

Low churn for big returns

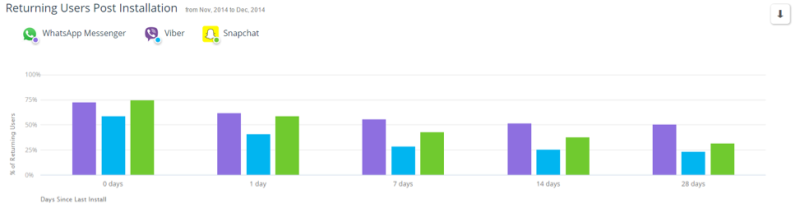

If we look at WhatsApp, we see that 30% of their users churn after only half a day of use, which may seem high but the industry average is close to 84%. WhatsApp’s ability to retain users and hold them for a long lifetime is driving its tremendous value.

Looking at Viber and Snapchat, we see that four weeks after user installation, these apps are holding onto at least 24% of their users — which is much higher than the communications category average of 1.84%.

Is it the category or the app?

The answer is that it’s both. Messaging is a utility which drives up the value of an app, but building the network behind the app is just as important. The larger the network the more valuable the app is.

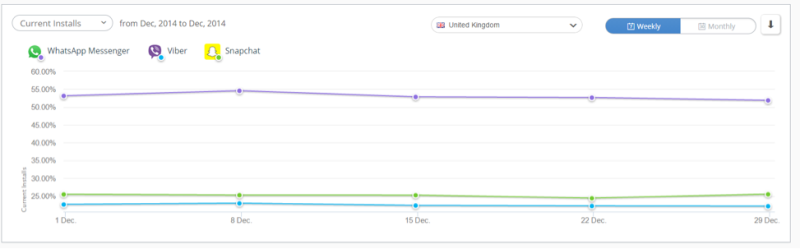

In the United Kingdom, WhatsApp is installed on half of all Android devices.

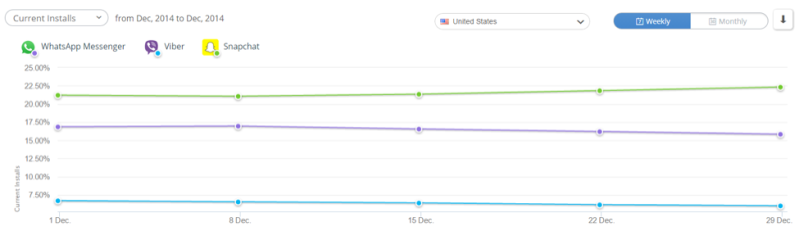

In the United States, one in four Android devices have Snapchat installed.

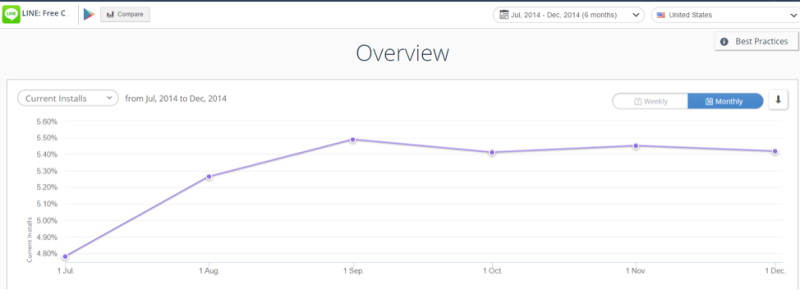

In January, the app, Line, was ranked #6 in the U.S. Google Play Store, so while it remains a highly popular app in many Asian countries, it has had a harder time gaining acceptance in the U.S. SimilarWeb is measuring Line on only 5.5% of Android devices in the U.S.

So what’s the next big app?

Predicting the next big app is much easier now that we can see numbers that drive value. For a messenger app, having low churn and a large base of users are key performance indicators. Leading to the question: who fits that profile?

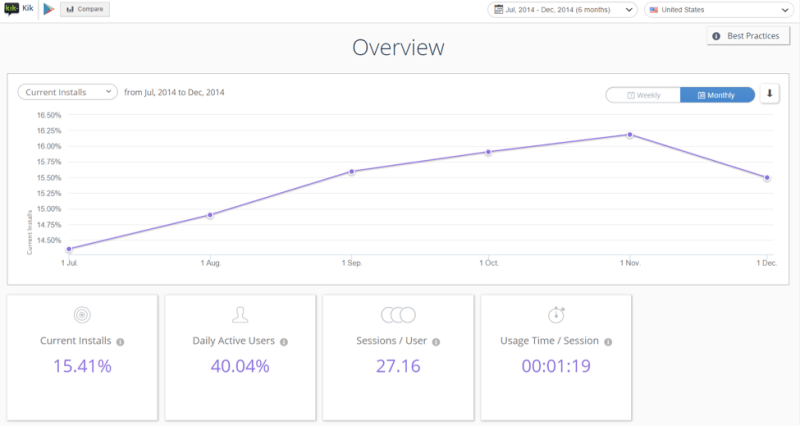

Kik seems to be a prime contender. Despite a small setback in December, Kik has been steadily growing their user base in the United States.

Kik also has much lower than average churn compared to the category standard, meaning that they will continue to grow with less effort than other up-and-coming messaging apps.

Conclusion

By looking at the data behind user churn and user base size, it becomes easy to understand the value of an app. Facebook’s massive acquisition of WhatsApp becomes much more cost-justifiable because they know that users acquired will continue to stay with the app. Developers looking for investment should look at their retention rates to judge the value of their new apps, while investors can use retention and engagement statistics to better predict future valuation.

Data in this article came from SimilarWeb’s December 2014 App Engagement Insights.

Go deeper: Get the whitepaper, Most used Android apps in America, and get the full story.

Go deeper: Get the whitepaper, Most used Android apps in America, and get the full story.

Sponsored posts are content that has been produced by a company that is either paying for the post or has a business relationship with VentureBeat, and they’re always clearly marked. The content of news stories produced by our editorial team is never influenced by advertisers or sponsors in any way. For more information, contact sales@venturebeat.com.