Last week, Atlassian made a very smart move by acquiring Trello. While $425 million implies a high multiple (given Trello’s revenue run rate was around $10 million last year), I believe it positions Atlassian to become the next big enterprise software company. I project it will reach a $50 billion market cap in 10 years by taking over software for teams. Here are four reasons why:

1. Product-driven culture

I am a long-time user of both Atlassian and Trello’s solutions, and one of the first things I noticed about these companies was that each of them took an entirely product-focused path to expansion. In particular, Atlassian’s rise over the past 15 years came on the strength of products like JIRA and Confluence, which won over developers by being good enough to sell themselves. In fact, the company prides itself on not having traditional sales reps, even though pretty much every other business software company employs an army of them. That’s incredibly impressive given Atlassian’s revenues and customer count. This company lives and dies on building products that work and sell themselves.

Its leadership reflects this product-centric view and is doing a great job building a long-lasting engineering and product culture. I’ve used LinkedIn data to run some numbers about Atlassian’s engineering retention, and computed how long it would take for the company to churn through all of its current software engineers (a “wipeout” period*). It’s currently at an impressive 29 years, which makes Atlassian’s development team more sustainable than those at buzzier companies like LinkedIn, Facebook, Twilio, and Dropbox.

This is probably a big part of the reason the company’s flagship product has become the industry standard, with tens of thousands of customers. With JIRA, Atlassian built a very extensible framework not just for product development but for prioritizing any project task or ticket and for creating automation via triggers and workflows. So much so that companies now use this platform for all types of use cases – at my company, we even use it to support our human resources and recruiting processes. Atlassian repurposed the platform as the foundation for JIRA Service Desk, a newer product that specializes JIRA for customer support and IT teams and is now its fastest growing product line.

Many people don’t realize that Trello has demonstrated the same product acumen as Atlassian. At first glance, some might think of a Trello board as just a “to do” list, but it’s much bigger than that (I’ll expand on this in a moment). The company nailed the details while not bloating the product, delivering key features like checklists, dates, assignments, power-ups (where you can link cards to pull in information from other SaaS systems), progress meters, labels, attachments, and new feeds, etc. With these capabilities, Trello has delivered a near-perfect agile/kanban experience while managing to make its core collaboration tools incredibly simple and intuitive.

2. A broadly applicable team platform

What’s especially impressive is that Trello achieved this without getting specialized – its product is broadly applicable and used by everyone from product teams to wedding planners. Atlassian President Jay Simons highlighted a rare parallel to this approach: “The beauty of Excel is that it is a piece of tech that can be applied to a financial planning model of a Fortune 100 company and your Christmas shopping list and everything in between. Trello has a lot of the same characteristics that speaks to that flexibility and simplicity.” This gives Atlassian a product that goes beyond the product/development space (which it has dominated), opens up its addressable market, and most importantly gives the company an opening to win over any function in the business.

The potential for growth is very high if Atlassian builds a universal platform around Trello to further its mission of going after all teams. The product should move beyond its current “power-up” approach of pulling data in from other systems, and expand towards providing orchestration support to manage workflows and puppeteer other systems directly from Trello cards. I know lots of users like myself who live in Trello, and would love to use it as a portal and gateway interface for all of their key enterprise SaaS systems. After all, people want to prioritize their work globally vs. within different backend services, which necessitates inefficient context-switching and makes it difficult to connect the dots across systems.

3. Opportunity to reach the largest enterprise teams

If Atlassian can do this right, it could make a serious dent in new functional areas without having to sacrifice Trello’s general usefulness and approach. The biggest teams by far for most companies are their sales and marketing departments – two primary functions underserved by Atlassian today. This reveals how much potential for growth the company has.

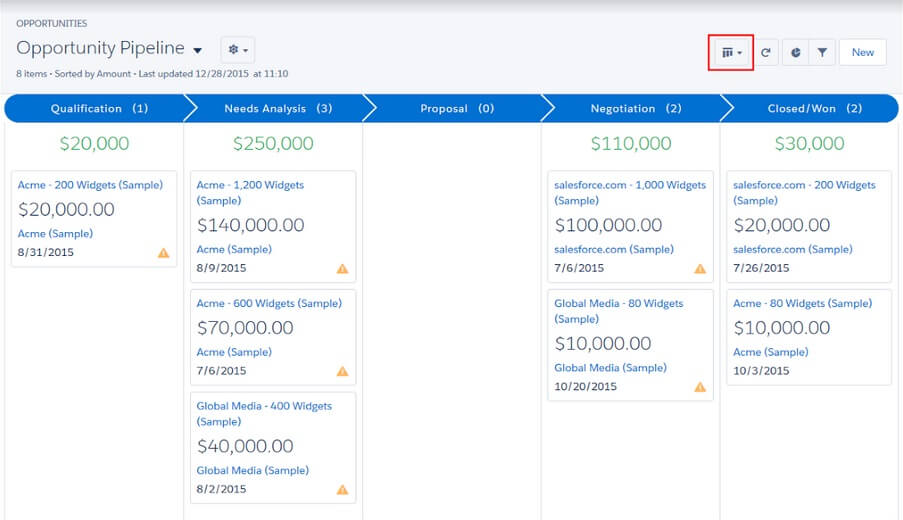

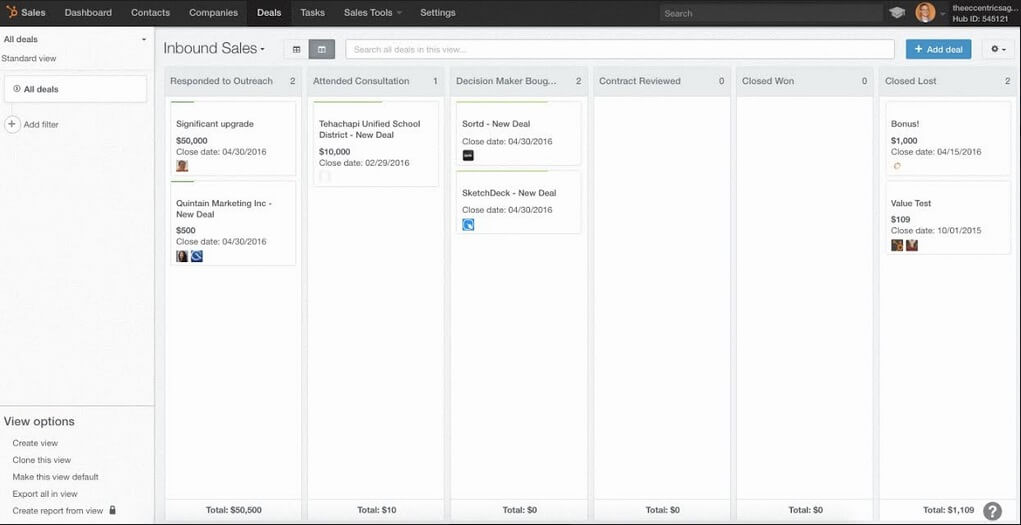

What’s interesting is that if you look at the recent advancements in product experiences for those functions, they look roughly similar to Trello …

The major difference between these drag-and-drop “board” interfaces and Trello is that they lack its depth and functionality. As I mentioned above, Trello cards encapsulate many complex features that are missing in these basic kanban lookalike experiences. And this powerful platform could be even more useful with seamless bi-directional integrations that sync and push tasks and updates back into CRM and marketing automation systems. Atlassian could even build a marketplace with pre-assembled boards for sales that include the right columns and pre-configured integrations (i.e. with Salesforce / Microsoft Dynamics / Marketo / Eloqua power-ups), which teams could then clone and customize as needed.

4. Healthy financials

My final point is that Atlassian is financially very strong, having been responsible with the money it has in the bank (especially relative to other unicorns and unicorpses). The company was profitable for 10 years before its IPO. It generates $500 million in revenue per year, is basically at break-even EBITDA, and has positive free cash flow — all while growing revenue 35 percent year-over-year. Atlassian’s customer acquisition costs and payback period must be very efficient as well, given its lack of a formal sales team. These are all strong indicators of a great business.

If you extrapolate the current growth rate in Atlassian’s stock price over the next 10 years, the company would be worth $120 billion. However, its growth will slow down over time. So if you assume current growth over the next two years and then a growth rate similar to Salesforce’s past 10 years for the remaining eight years**, you reach a market cap of $56 billion for Atlassian in 2027.

Given all of this, I don’t think it’s much of stretch to predict that we’ll be hearing a lot more from Atlassian in the coming years. This is a sleeper company (mainly due to the fact that it is heads-down building great product) that continues to successfully advance its vision of “unleashing the potential of teams.” If Atlassian continues to make the right bets like it did with the Trello acquisition, there’s no question it will become the next software behemoth that’s eating enterprises.

* I derived Atlassian’s wipeout period from the following data: 939 current engineers / (475 past-not-current engineers / 5343 days since incorporation * 365 days in a year).

** Ten years ago Salesforce’s market cap was closer to Atlassian’s current market cap

Vik Singh is founder and CEO of Infer.