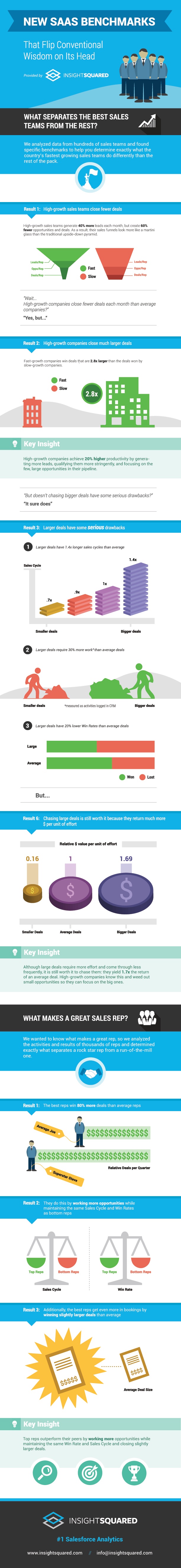

Fewer sales making you more money?

That’s one of the rather surprising results of an InsightSquared study of hundreds of software-as-a-service startups. InsightSquared is a business analytics solution for Salesforce, which gives it some very interesting insight into what works — and what doesn’t — for SaaS companies.

SaaS economics, of course, are different from traditional sell-something-once-and-collect-the-cash companies. ARR, or annual recurring revenue, is the key metric, not sales, and that changes everything.

InsightSquared’s data indicates that higher-growth SaaS companies make fewer sales than slower-growing competitors. The reason is that they focus on higher-value deals — 2.8X the size, on average. Those deals take longer to consummate, but they return 170 percent of the effort and resources that goes into them.

Interestingly, the data also shows that top reps at SaaS companies don’t necessarily have better win rates — they just work more opportunities than average reps.

Here’s all the data, in visual form: