The hottest enterprise startups will take investment from In-Q-Tel, regardless of whether or not they need the cash.

Today, a well-funded enterprise company called Apigee revealed it has taken a highly-strategic investment from the firm. But the details of the deal have deliberately been kept under wraps. It’s a similar story to Huddle, the cloud collaboration startup that had just closed a sizable funding round when In-Q-Tel offered to invest. For the founders and board of directors, it was a no brainer to take the additional check.

Why is In-Q-Tel treated with such reverence by business software providers? It is the investment arm of the CIA and specializes in funding technology that is secure enough for government agencies. It was founded during the dotcom boom when the agency was drowning in data that it needed a secure technology to manage.

“In-Q-Tel is a great stamp of approval on any company, and opens up a huge market,” said Alistair Mitchell, Huddle’s CEO, in an interview. As a direct result of the In-Q-Tel investment, Huddle gained two large customers: the Department of Homeland Security and the National Geospatial-Intelligence Agency.

It’s an ego boost to get a phone call from In-Q-Tel, but more importantly, it’s a direct path to major government customers. In-Q-Tel has had its hands in virtually every enterprise success story, and has invested in a lot of the technology we use in our daily lives.

“Much of the touch-screen technology used now in iPads and other things came out of various companies that In-Q-Tel identified,” said Jeffrey Smith, the former general counsel of the CIA, in a rare interview with NPR. Google Maps is another example of In-Q-Tel-backed tech.

Don’t miss the shortlist of In-Q-Tel’s portfolio investments in the gallery below.

Government customers are also a strong indicator of a company’s commitment to security. According to Mitchell, Huddle won new clients in the health and financial sectors, who viewed the In-Q-Tel investment as proof the product was sufficiently “vetted and accepted by the best.”

When pressed, Apigee wouldn’t reveal much about its relationship with In-Q-Tel, or the amount of funding it received. The company’s head of marketing Dave Jordan said little more in an interview than they were “thrilled” about the investment and “looked forward to expanding our relationship with In-Q-Tel and its government partners.”

Jordan and the Apigee team view this investment as a sign that it’s core product, an API management platform, will become more of a priority in Washington D.C. Developers can use the platform to build applications that will prove useful to the various government agencies.

Curious about In-Q-Tel’s current portfolio? Here are some of the firm’s most cutting edge investments.

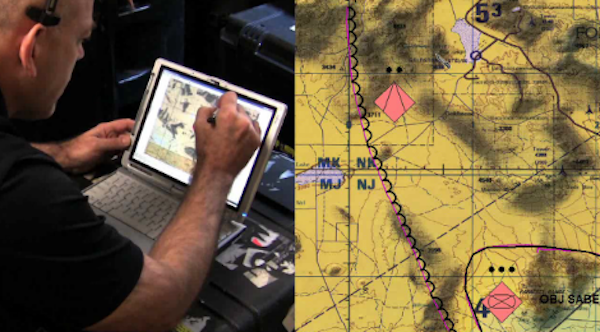

Top image via Adapx

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More