Xuqa began as a social network two years ago and distinguished itself by finding clever ways to make money — most notably getting paid by market researchers to administer surveys to its users. While the site is profitable, the company decided five months ago to change direction: Build out its survey technology to integrate with any social network or online community site.

Xuqa began as a social network two years ago and distinguished itself by finding clever ways to make money — most notably getting paid by market researchers to administer surveys to its users. While the site is profitable, the company decided five months ago to change direction: Build out its survey technology to integrate with any social network or online community site.

The new focus fits in with a broader trend: Companies trying to gather more accurate information so they can better target products and marketing campaigns towards desired consumers. They are also relying on other methods for finding granular information about users, such online behavior tracking software and ad networks that reach niche communities around the web

The company renamed itself Peanut Labs. It now embeds surveys into other sites and shares revenue with them that it receives from market researchers — including large corporations doing internal research, and data-analysis firms that sell market data. Users take a preliminary questionnaire about their interests to help Peanut Labs target them with the most relevant surveys. They’re motivated to fill out survey by the promise of points, gifts, etc. Users can choose how often they want to be notified of new survey available to them. About ten percent of users on partner sites take the initial questionnaire, and 25 percent of those take the surveys.

The company counts Live Journal, several successful Facebook applications, and around 60 other companies as partners. Peanut Labs says it reaches over 20 million users, mostly within the sought-after under-24 demographic. Four months after launching, Peanut Labs is turning a profit from its new strategy.

Co-founder and chief executive Murtaza Hussain, who so far has kept the company’s transformation quiet, agreed to have coffee with me this morning.

Co-founder and chief executive Murtaza Hussain, who so far has kept the company’s transformation quiet, agreed to have coffee with me this morning.

He’s a story, himself: A 21 year old dropout from Williams College, who started his first web company while growing up in Pakistan. At age 14, he and his friends were the middle men getting paid by multinational companies that wanted to develop strong online presences in the country — Murtaza and Co. outsourced the actual development work.

VB: What led you to your new direction?

MH: To start out with, I dropped out of college after launching Xuqa and seeing it get some traction — alongside my older brother and his friend, who are now 23 and 24. We raised an angel round from BV Capital and rode the wave for awhile, going from 0 to 1.6 million users around the world, and raising an additional $1 million from BV. This is back when social networks were new and cool so we got a good valuation for the investment. Life was good.

Then, there was a turning point: We saw that we’d burned through half our funding and had about six months’ worth left, as we weren’t making any money. We started trying to monetize. We tried literally anything and everything. We started off with CPM ads, premium SMS services, video ads, lalalala. The CPMs were horrendous. We were getting $0.10 per impression from the ad networks we were using.

By complete accident, we stumbled upon market research. An entire vertical of online services. A problem waiting to be solved, because so much market research was still happening offline — especially for the under-24 user demographic that we had using our site.

We started giving users “peanuts” to take surveys. Of course, these peanuts cost us peanuts.

[Note: Xuqa uses a virtual-goods system — “peanuts,” instead of money — to allow people to earn and distribute reputation points in order to earn the respect and admiration of their peers on the site; hence the new name.]

Another vertical was lead generation because we knew about a bunch of stuff about people. We could give people peanuts for signing up for things we knew they’d be interested in. For example, a user who told us they liked movies might get a free promotion from Netflix.

This pushed us to profitability. We’re still making around a dollar per active user per month in the US although a lot of our traffic is outside the US, which is a different beast altogether.

VB: This wasn’t enough to stay focused on being a social network?

MH: The problem after all this was that that we got to over a million users, got to profitability, but the model was to sell to Viacom or CBS.

I think it was around this time that these older media companies realized they didn’t know what they were doing — that it didn’t make sense to buy a smaller social network and then try to figure out how to grow it.

Our opportunity with Xuqa has become pretty limited. We had a whole bunch of Turkish users. We didn’t even try to do anything there, it just happened. We were also the second biggest social network in Iran, but we just blocked them a week ago. There’s no money there — and it was costing us money to run server-intensive things on the site, like poker. The Iranian government actually blocked it at one point, but there were Xuqa users within the government who went and unblocked it. This time, it was a business decision.

VB: What’s working so well for Peanut Labs? Tell me more about this new market.

MH: We’re helping social networks monetize, something they’re bad at doing, just like we were. We have over 60 sites publishing our surveys, including some major ones: LiveJournal, OkCupid and we’re talking with some other growing social networks. We’re also live on Second Life.

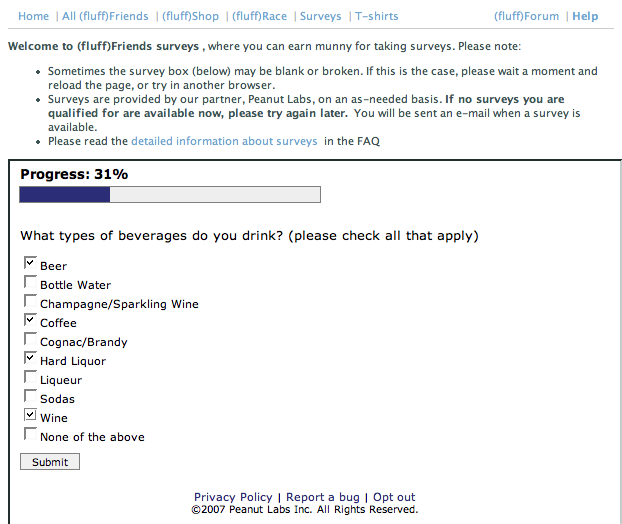

On Facebook, the “(fluff)friends” application — which has over a million users — is already making good money on our surveys (screenshot below).

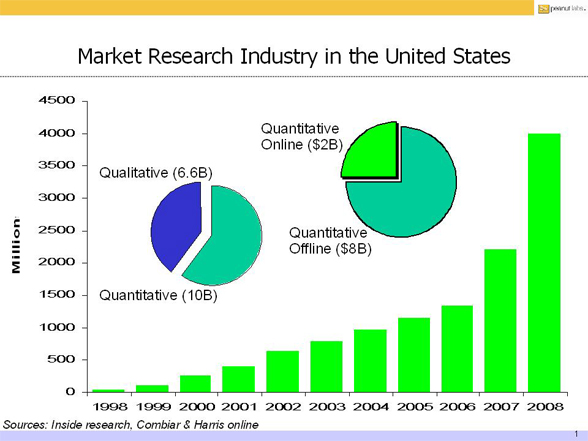

Over $17 billion was spent last year on market research, most of which was for scientific surveyors like what we do. We’ve become the largest provider of online surveys to the under-24 crowd. We currently reach 20 million users. Our closest competitors include Greenfield and Global Market Insite, but they’re full service and not focused on the demographic we are.

Studies from the last couple of years are showing that online research like our surveys are now as statistically valid as offline research — and offline is naturally more expensive. [Other companies are also trying to tap into online mark research through embedded widgets on social networks, including online polling company Vizu.]

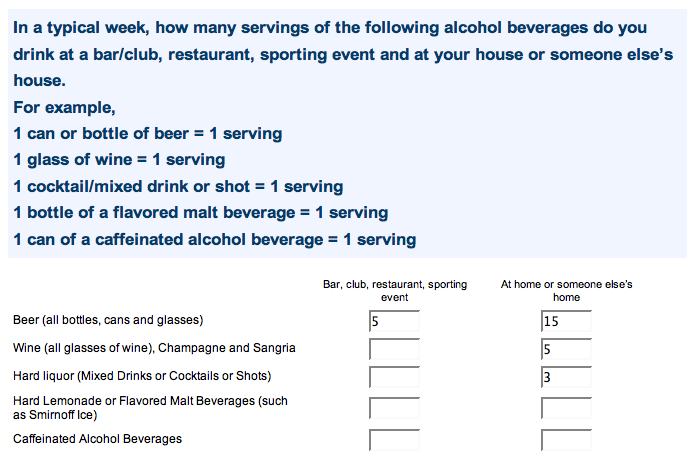

[A survey this author was led to:]

[Market data provided by Peanut Labs:]

Note:

Quantitative = methodologically sound surveys, other numerical data

Qualitative = focus groups, other less numerical data