Yesterday, a new crop of startups from Y Combinator’s (YC) accelerator presented to a full house in the hopes of investment, press, and general buzz, and among them will be some non-profit companies. After YC accepted its first non-profit, Watsi, in its Winter 2013 class, it’s been steadily growing the number of non-profits in its classes, and Zidisha had the chance to participated in the Winter 2014 class.

Zidisha is a peer-to-peer microlending site that’s leveraging basic Internet technology to provide a more affordable and scalable alternative to lending in developing countries. While traditional loans have an average interest rate of about 37 percent, according to the company, Zidisha only charges roughly 5.8 percent interest.

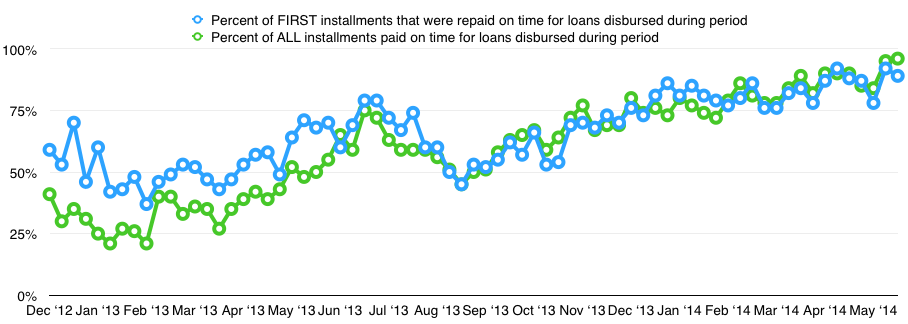

Since graduating from YC, Zidisha has made some strides in one key area for a lending marketplace: eliminating non-performing loans.

How did it do this?

We caught up with the young non-profit and its team shared with us some of the changes it has recently implemented, and while some were adjustments to its process, others involved adding some more tech to the mix.

On the technology side, Zidisha is leveraging the weight of online identities by now requiring loan applicants in most countries to apply with their Facebook profile to verify their identity and make it more difficult for third parties to create proxy accounts. Understandably, as a loan service for relatively small amounts and without very extensive background checks, this requirement is both a fraud precaution and something still feasible for people in developing countries.

Zidisha has also been working with Bayes Impact, a non-profit that just graduated from Y Combinator’s program, on developing algorithms to better detect fraud and assess credit risk, something many consumer lending companies have been doing with non-traditional data. Bayes Impact works with non-profits to help them leverage data science for their missions.

On the process side, Zidisha has created a tiered system for borrowers to increase their credit, tightened its on-time repayment standards, and switched from a monthly to a weekly repayment system in most countries. The tiered system is incentivizing borrowers to repay their loans on time as good performance allows them to increase the amount they can borrow, and displaying borrowers’ on-time repayment score gives them additional motivation to keep it high. As for switching to weekly repayments, “It proved easier for most borrowers to make small weekly payments than to save up bulk sums each month,” said Zidisha community manager Vikas Lalwani in an email to VentureBeat.

Zidisha also added an invite bonus program, both benefiting borrowers who invite trustworthy new borrowers to the site, as well as Zidisha itself as it gains more quality borrowers.

As a result of all these changes, it’s been seeing a much higher rate of on-time repayments for both first-time loans as well as all of the loans it facilitates.

As it continues on with these new improvements, Zidisha is looking expand into new regions, especially on the lending side, and to grow its operations in its existing markets.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More