With the rise of Apple Pay, Android Pay, and Samsung Pay it was only a matter of time before banks started using mobile technology to let consumers make in-store purchases.

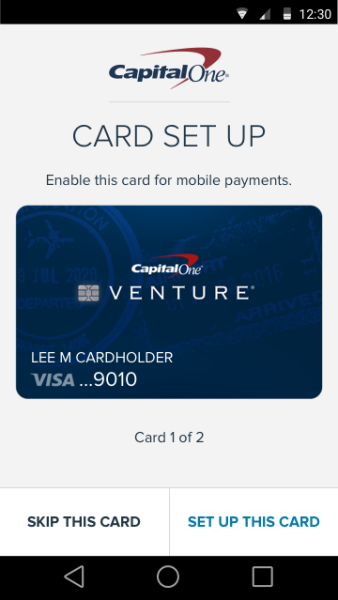

In an update to its mobile wallet, Capital One is adding contactless payments to its Android wallet app. Starting today, Capital One customers can now use the app to pay at stores that accept near-field communication (NFC) payments.

Capital One first launched its wallet app on iOS just before Apple rolled out its mobile payment technology; an app for Android soon followed. The mobile wallet is supposed to complement Capital One’s banking app and is focused on tracking user spending through push notifications. Every time a user makes a purchase with their Capital One card, a message pops up on their phone confirming the transaction. The app also allows users to collect and access various rewards and coupons. Now, with the ability to make purchases, the Capital One Wallet has a more direct relationship to consumer shopping.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

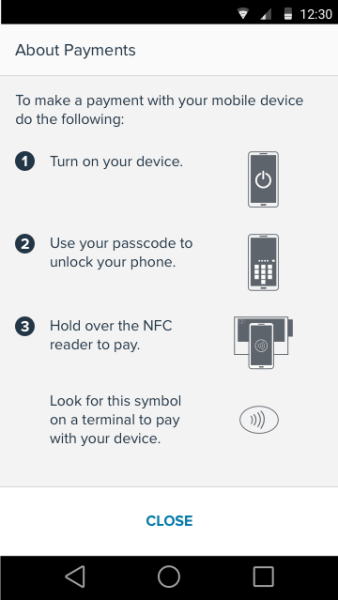

To turn on NFC payments for the Capital One Mobile Wallet, users can go into the phone’s settings and find the NFC and payments menu to grant access to the Capital One Wallet.

Adding mobile NFC payment capabilities to a bank-branded app won’t necessarily be an immediate game-changer for mobile payments, but it offers some indication as to how mobile payments are evolving. Tom Poole, managing VP at Capital One Mobile, said he expects other banks will offer customers a similar functionality soon.

Banks have a number of incentives for leveraging this technology. Not many people are using mobile wallets to make purchases with retailers currently, however, as the payment method gains popularity, consumers will tether to a familar system. Capital One is wise to try to woo customers onto its platform early. Having a mobile app also allows Capital One a more direct relationship with its users on mobile.

Purchases made with NFC tokenization are also much more secure than those made with magnetic stripe credit cards, which are still dominant in the U.S.

Unfortunately for iOS users, Capital One’s mobile wallet in-store purchasing experience won’t be coming to Apple products anytime soon. Though Capital One customers can add the wallet app to Apple Pay as a payment option, Apple Pay is still the only app that can facilitate NFC-based transactions on iOS. Apple Pay has sole access to the iPhone’s NFC chip and charges banks a transaction fee for facilitating purchases using its technology. Opening up access to its chip may mean relinquishing that fee. Apple Pay is also generally protective of its hardware and overall app ecosystem. If the company ever does give developers access to its NFC technology, it will no doubt be under strict terms.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More