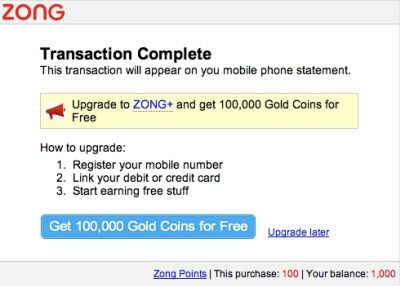

The Zong+ platform, launched in October, lets people use their mobile phone numbers to pay for virtual goods and other items in games and social networks. But the twist is that, rather than going through mobile carriers who charge big fees, Zong fulfills the transaction by charging the purchase to your credit card. So the user pays a much lower transaction fee than they otherwise would.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":160926,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,mobile,","session":"B"}']With Zong+, a user can pay for virtual goods — such as weapons or clothing — in an online game by typing in their mobile phone number, which is easier to remember than a 16-digit credit card number. Users link their credit card number or any other kind of payment card through a one-time sign-up process.

Aeria Games started using Zong+ six weeks ago in its free-t0-play online games. Now, 32 percent of Aeria’s Zong-related mobile payment revenue is coming from Zong+ users. And Zong+ transactions generated an average payout that is 12 times higher than traditional mobile payments, due to higher payout rates and flexible prices. Zong+ transaction costs are about 67 percent lower than traditional mobile payments.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Zong+ is also making consumers more loyal. Repeat payments are up 48 percent, and Zong+ users averaged 4.3 transactions per month, compared to 2.7 transactions for others. David Marcus, chief executive of Zong, said that the results exceeded expectations and that the company now has 20 new games publishers, bringing the total to more than 1,000. Those include Playdom, Slide and Kongregate; the total reach is more than 500 million online users, and its reach through carriers is 1.5 billion users. In the past six weeks, Zong has added three countries to its reach, and it plans to add six more soon. It is now available in 29 countries. In 2009, Zong processed mobile payments for 10 million users. Rivals include mobile payment companies such as Boku, which recently raised $25 million, as well as PayPal, credit card companies, and other direct payment providers.

The rapid growth of Zong+ should be a lesson for U.S. mobile phone carriers: They should lower the rates they charge customers for completing billing transactions. Or they’ll lose them.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More