Don Mattrick knows that no quick-fix scenario exists for Zynga. When he took the job as chief executive of the social game publisher a year ago, he promised a multiquarter turnaround process. Now, after the company reported weaker-than-expected earnings last quarter, it looks like the turnaround will take even longer. Zynga is taking its lumps with investors, warning that it will have tough quarters ahead.

Zynga’s market value is about $2.55 billion, down from $5.1 billion back in March and $9 billion at the time of its initial public offering in 2011. The company has been trying to make a shift from Facebook to mobile, and it has finally gotten more bookings on mobile versus the Web. But it held back on worldwide launches for its revamped Zynga Poker and Words With Friends mobile games. This hurt quarterly performance, and it also shifts revenue from 2014 to 2015.

But Mattrick believes he has a great market opportunity and can plan for the long term while taking short-term hits. Zynga has $1.5 billion in cash and real estate, and it acquired NaturalMotion, a leader in high-end mobile games, for $527 million. All Mattrick needs now is a gigantic hit like Kim Kardashian’s Hollywood. We caught up with Mattrick last week to talk about the business.

GamesBeat: I know there’s some good news in your earnings, but there’s also some news that disappoints investors. How do you explain that?

Don Mattrick: Hopefully authentically, in a head-on and open way. We are talking about what we’re trying to build and why we make choices as a company. The headline, for me, is that we’re making progress. Our transformation is underway.

A lot of things are going on in the business. Some things are shifting out as far as dates to light up live services. We know what we need to do to improve product quality. In my opinion, it’ll improve the longevity and lifespan of our services in the future. We understand that it comes at a short-term cost as far as 2014 financial performance.

We’re making choices toward the medium and long term. I believe that I’ve been consistent and up-front with investors, that would be the lens we’d use to look at the world. That’s an appropriate lens when you’re trying to build a leadership company with these great assets and great people.

We have progress and things we’re encouraged by. In particular, a year ago when I joined there was a baseline question about how Zynga derives revenue from the mobile universe. Can you get your bookings to match your web bookings? We’ve made progress on that. We’re on track to have the majority of our revenues this year come from iOS and Android.

We’re making progress in terms of the capabilities of our executive team and core leaders inside the company. We’re making deliberate investments. We’ve shared that we have 50 percent of our R&D spend focused on new, whether it’s taking our existing services to the next level, or just new experiences all up. We’re investing to be the at-scale future leader inside of this category.

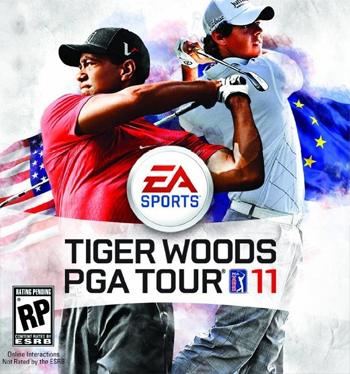

I’m excited to announce our partnerships with the NFL, the NFLPA, and with Tiger Woods, to give context to our sports brand and the aspirations that link with that, Zynga Sports 365. We think that no one has built the 21st-century sports mobile sports experience that works on smartphones and tablets. We have some great exclusive partners to work with and develop that.

GamesBeat: For the Tiger Woods deal, that was a license that EA dropped because of Woods’ personal scandal. What did you think about that opportunity?

Mattrick: I’m going to separate Tiger the athlete from Tiger the individual living his personal life off of the golf course. What we know about Tiger Woods is that he’s the most recognized globally iconic athlete in the world today. When he participates in a golf tournament, people come and watch and try to handicap his competitive skills. He’s an amazing competitor and athlete. I worked with him in the past, as did others on our team. He’s personally passionate about gaming and entertainment.

We saw an opportunity that no one, in our opinion, has executed in an optimized way on smartphones and tablets. We thought it would be fun to work with him and innovate. That was how that relationship came together.

In our relationship with the NFL and NFLPA, we were pleased that they chose us to be their exclusive partner in the manager category. As you can guess, lots of people court the NFL for their license and endorsement. We have a great multi-year opportunity in front of us.

It’s exciting to build sports products, because they’re an evergreen category. People love them. I love them. There’s nothing that’s been brought to market against the vision and aspirations that our team has. We see it as a growth opportunity and an exciting area.

GamesBeat: I was surprised that the NFL license was available on mobile. How did that come about?

Mattrick: They’ve been studying the category. Multiple companies had expressed interest to them. Again, myself and the team made a pitch to the NFL and the players’ association sharing what we see as a consumer opportunity and sharing our capabilities to run a multi-year live global service. We were pleased that we won the competition and were able to secure those rights.

GamesBeat: Can you describe the performance for the second quarter? Did anything come out lower than you thought it would?

Mattrick: For Q2, we’ve given guidance. We’ve had our bookings and EBITDA come in to the lower end of the guidance range that we provided. The quarter met our expectations. We’d love it if we exceeded expectations versus net, of course. In relation to Q3 and Q4, we looked at our slate. We looked at the timing of products, both from Zynga and NaturalMotion. We made a deliberate decision to spend more time, as painful as that is.

I can understand how shareholders want to see the transformation completed. They want to see our company in growth mode. I think I’ve been clear about the principles that we’re using, which is, make the best decision for the medium and long term. The short term, for me, is a single quarter. We shifted things out that move revenue from 2014 to 2015. We reset prior guidance for a lower number this year.

The other thing I shared with everyone is, why can I do that? I can do that for two reasons. One, I believe that there’s a great market opportunity and that we’re building out to live in the market for multiple years. The second part is that we have a strong balance sheet. We have $1.5 billion in cash and equivalents like real estate we own. We have no debt.

This business is not going away. We have the time to persist and compete and realize our full potential. I want to support our staff and our teams. I’m recognizing their hard work. We’re trying to make the most informed decisions for the benefit of consumers and shareholders. Sometimes things just take a bit longer. That’s the situation we’re in. We’re going to continue to work hard and create new things. We aspire to grow in the future. I believe we’ll get there.