Social mobile gaming company Zynga made Wall Street investors cringe this week. It beat earnings expectations in its fourth fiscal quarter earnings report on Wednesday, but chief executive Mark Pincus offered cautious guidance for the next quarter and delayed two major games.

The company’s stock fell, and its valuation slipped from $1.9 billion to $1.7 billion. Zynga still has a lot of potential and a long way to go to make up with Wall Street, as it offered timid projections about its upcoming first quarter. And it delayed Dawn of Titans and CSR 2 (the sequel to CSR Racing) until the second half of 2016. The company also lost users in the quarter because it didn’t launch any new games.

Pincus’ moves will be closely watched, as the company he founded in 2007 has struggled like King (which Activision Blizzard is buying for $5.9 billion yesterday) to recapture the allure that enabled it to stage a successful initial public offering back in 2011. The game industry is consolidating, as the market is concentrating in the hands of fewer players.

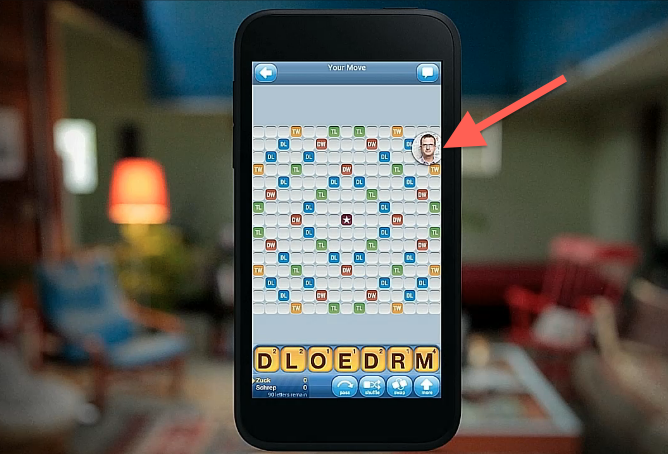

But Pincus is optimistic. He expects the company to launch 10 new games in 2016. He believes that the company’s improving monetization of existing games and users — for titles such as social casino slots, Words With Friends, and Zynga Poker — show how the company can still execute on its live operations for current businesses. We talked with Pincus about what the company is doing to improve.

Here’s an edited transcript of our conversation.

GamesBeat: How do you think the quarter went?

Mark Pincus: It’s more of the same in the sense that the teams have been making great progress on our execution as far as live mobile franchises. We saw strong performance from our core live mobile categories — Slots, Words with Friends, Poker. We came in on bookings at 182, above the high end of our guidance. We came in the middle of the range on EBITDA at $1.7 million. We continued to make good progress moving to mobile. Monetization is up.

Since I’ve come back — this is the completion of my third quarter, or second complete quarter — what I’ve been focusing on with the teams is, first, narrowing and intensifying our focus on these core franchise opportunities, which are clearly ahead of us, and stemming audience declines we had in Words with Friends and Poker, which we’ve done. They’ve seen nice turnarounds. They’ve been growing on a bookings level and they’re seeing nice turnarounds on an audience level.

When I got here Poker was having audience problems. Their audience declined 10 percent in Q3. Words with Friends’ audience was declining. Slots was in a nice growth place, but we’ve increased that growth. Now, in Q4, we saw Poker still decline, but by a much smaller amount, to four percent, and in Q1 we’ve turned it around. They’ve grown their audience 12 percent. With Words with Friends we went from seven percent decline in audience in Q3 to flat in Q4. They’ve grown nine percent in Q1. With Slots their audience grew six percent in Q3, but we doubled that growth to 15 percent in Q4.

The first thing I wanted to do when I came back was restore a focus on being great at live, focus on our current customers and growing what we’ve got. The teams are showing strong progress against that. The second part of the story is on new. We didn’t ship what we hoped to ship last year. The games weren’t ready. They weren’t in a place where they were going to deliver on the promise. We’re coming into this year in a better position — partly because of what we didn’t do last year, but also on the momentum we’re seeing with Slots. We have at least 10 games we expect to launch this year. Seven of those are already in soft launch. It gives us better visibility into those launches and into the year than we had at this time last year.

The third part of the story, to me, is getting the company focused on being resourceful — narrowing what we’re executing on, making lots of hard decisions based on delivering better bottom line profitability. We’re not happy with the level of profitability we had last year, but I’m happy that we were profitable. People seem to forget that. That was profitable without anything new launching except Slots. Now we’re in a much better position to deliver growth and profitability this year. 10 games we’ve been carrying from a cost standpoint are going to become contributors.

GamesBeat: The number of users — can you talk about that? It did go down, even in mobile. Does that reflect that you didn’t have a new launch to boost that?

Pincus: The number one reason for that decline year over year was versus new games, like Looney Tunes, the prior year. The sequential decline was driven by a drop-off in some of these newer game launches, including FarmVille Harvest Swap and Empires & Allies. But if you look at it, while our overall mobile DAUs were down five percent sequentially in the quarter, our core live mobile franchises were actually up one percent.

GamesBeat: The outlook for the first quarter — what is affecting that? It does look lower.

Pincus: The number one thing impacting it is seasonality. We saw a similar decline in Q1 of last year. Historically Q1 has been our weakest quarter. That’s the biggest difference from Q4 coming into Q1.

GamesBeat: You’re probably not benefiting from that slate of games in Q1.

Pincus: Yeah, the soft launch games don’t really contribute on revenues. We have four games all launching in the first half of the year, out of those 10. In our internal expectations for the year, those make a significant difference.

GamesBeat: Is there any outlook you want to give on any particular games, like Dawn of Titans or CSR 2?

Pincus: In terms of specific outlook, those games will launch in the second half of the year. Dawn of Titans in particular has real hit potential. That’s our highest data opportunity.

The way I think about the business growing through the year and into the next year is similar to the success we’ve had with Slots. We had a good quarter last quarter with some strong game launches, but we didn’t create breakthrough hits. They were good contributors on bookings and they’ll be good contributors on profit, but they’re not topping the charts. In order to de-risk our business going forward, it’s important that we can build a profitable and growing business whether or not we get to chart-leading hits.

We want to go after chart-leading opportunities. That’s what Dawn of Titans is. But we don’t want to be dependent on those for our forward business plan.

GamesBeat: You have Tim LeTourneau back, we see.

Pincus: He’s a good familiar face to have in the building. I’ve loved working with him in the past. Some of the most innovative social gaming features that we’ve brought to market were driven by Tim and by the kind of positive, creative culture that he fostered.

GamesBeat: As far as the bigger picture, what’s your view of the mobile industry right now?

Pincus: It’s going through, on the one hand, a maturing phase. We’re seeing brands and franchises matter more. They hold established positions. Breakthroughs are being driven by large, important brands.

The part that we hope to change is that it’s fallen into a cadence where everything today is driven by the highest ARPDAU, highest LTV, supporting the highest ad spends. In a lot of places it’s ad spends against existing players. Where we would like to break out of it is, number one, on our live games and established franchise brands. We see an opportunity to reactivate lots of players and customers we’ve had in the past. That’s a big part of the Words with Friends story, where they’re seeing tailwinds. They’re seeing strong reactivations, people coming back. That’s behind us wanting to bring back big brands like CityVille and FarmVille in the future. That’s continuing to drive organic installs for Farmville Country Escape in the market today.

Our number one operating strategy that we’re focused on internally this year is delivering on organic engagement and organic growth. The biggest opportunity we have to change the game in mobile is to drive innovative content features that get back to social, that inspire people to play together. When we do that, it’s going to move our retention, move our LTVs, move our growth, move our ability to buy users in the market.

That’s a big part of the story we’ve seen in the last three quarters with Words with Friends. The team hunkered down and focused on quality features that engage the audience. They inspired our players to take more turns together with the weekly challenge. That moved the ad-based LTV of players to the point that, for the first time in the history of the game, we could start advertising and buying traffic accretively, which started to happen last quarter and has continued into this quarter.

To me, that’s the most interesting opportunity in front of us in mobile – getting back to innovative social in a way that moves engagement and can drive growth where it’s coming from an organic place first, not selling content for more money.

GamesBeat: It’s impressive that with no new launches, except in the slots area, you’ve been able to stay breaking even and do as well as you have.

Pincus: I tried to highlight, in the letter — people lose sight of the fact that our business, from web and mobile, does generate a very large amount of quarterly gross margin, which we ought to be investing well against our new games and growing our audience. There’s a cash generation machine underlying this. There’s an opportunity for us to be a lot more efficient and more innovative in how we invest that money. We ought to be able to grow a profitable business whether or not we get to a single breakthrough hit.

GamesBeat: It’s a pretty heavy slate for this year. That’s also good.

Pincus: The heaviest part of it, though, is made up by Slots, which is leveraging proven engines, proven brands, and a proven model in the market. The way I look at the year, there’s less execution and market risk around what we’re doing in Slots than there is around some of our higher-beta launches like Dawn of Titans and CSR, which on a single-game basis are going for much bigger market outcomes. But we’ve had to work harder to get there.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More