Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

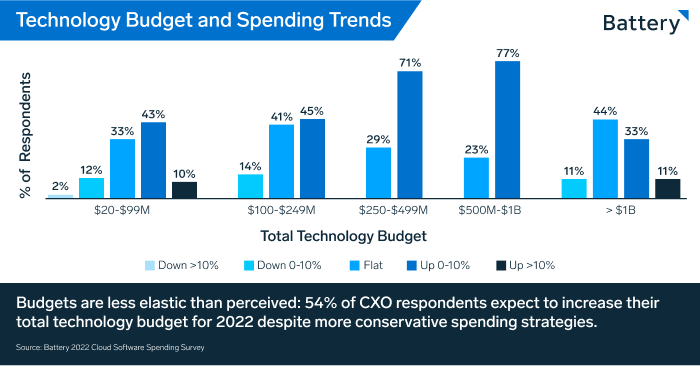

Despite ongoing economic uncertainty, the majority of CXOs – 54% – plan to increase their total technology budgets for next year, and more than 75% plan to increase their budgets in the next five years.

Technology startups have been on edge lately as financial markets have whipsawed, and many investors have become more discerning about the companies they fund. But a recent survey from Battery Ventures of 100 technology buyers across industries revealed that while companies are changing their tech-buying habits, their overall budgets won’t shrink — in fact, most budgets are expanding or will continue to expand in the next year and beyond.

Among the few buyers who will reduce technology budgets, the approach will center on vendor consolidation and entail streamlining usage, rather than reducing headcount or optimizing SaaS licensing.

As priorities have changed and clarified, technology buyers report a renewed interest in security, data, development tools and artificial intelligence/machine learning.

AI Scaling Hits Its Limits

Power caps, rising token costs, and inference delays are reshaping enterprise AI. Join our exclusive salon to discover how top teams are:

- Turning energy into a strategic advantage

- Architecting efficient inference for real throughput gains

- Unlocking competitive ROI with sustainable AI systems

Secure your spot to stay ahead: https://bit.ly/4mwGngO

Where tech spending is going

Long-term sales prospects are similarly positive for enterprise tech startups in those fields. The vast majority of survey respondents report plans to increase budgets in the next five years for the following:

- Security (92%)

- Data (84%)

- Dev tools (69%)

- AI/ML (79%)

The State of Cloud Software Spending survey also explores trends in software adoption and procurement, finding that approval times for enterprise contracts are either unchanged or slowed down. Interestingly, bottoms-up adoption of software tools is playing a larger role at development/testing phases, with more and more engineers allowed to self-select tools. Overall, the landscape of software spending appears to be very resilient, despite ongoing economic uncertainty.

Methodology

The Battery Ventures Cloud Software Spending Survey explores the technology purchasing planning of 100 chief technology officers, chief information officers, chief information security officers and other technology buyers across industries from financial services to healthcare to manufacturing, representing roughly $29B in annual technology spend. Responses were collected online and in follow-up calls from August 5 to August 10, 2022.

Read the full report from Battery Ventures.