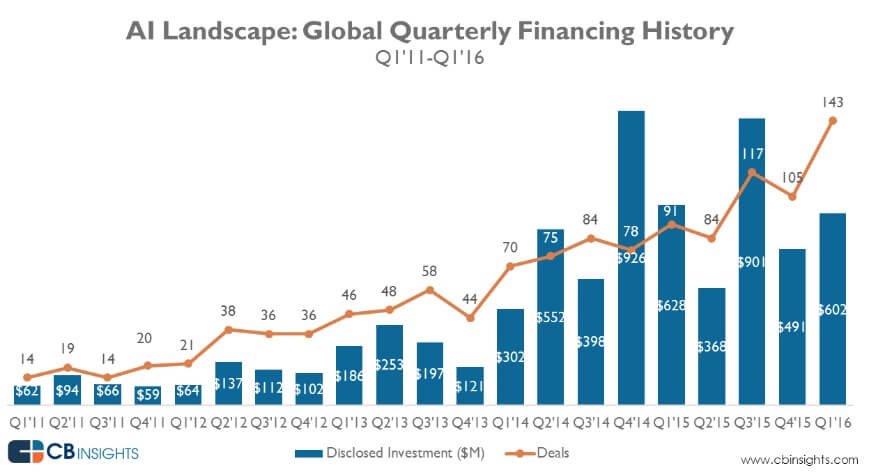

We’re in the midst of the biggest AI boom ever seen in the technology sector. While AI and certain types of machine learning have been in practical use for the better part of 30 years, there’s no denying that the intense investment in the space is sending shockwaves through the industry. CBInsights reports that 2015 and 2016 are shattering records in VC deals and investment by dollars, which has emboldened hundreds of startups that are using AI as a core piece of their products and services.

I’ve been around long enough to know that in the tech sector, where there’s money there’s hype.

While I have no doubt “intelligence everywhere” will become a sell-side reality in the next five years, the enterprise buy-side should be exceedingly cautious about buying into it without a clear plan.

The dangers of a platform war

An IDC analyst recently predicted that, by 2020, 60 percent of AI apps will run on the platforms of just four companies: Amazon, Google, Microsoft, and IBM.

Silicon Valley has always turned new technology trends into platform wars. The same is projected to happen in the AI market, just when CIOs have finally reached a point where they’re no longer dependent on one stack vendor for all their needs. I can still remember the early days of my career when I would meet with IT decision makers and frequently heard the refrain “we’re an IBM shop.” Those statements were made with great pride until the invoice for maintenance and services fees hit the CFO’s desk.

Fast-forward to the post-SaaS, post-cloud, post-BYOD landscape, and any CIO that makes a bet on one platform risks putting their entire strategy back in the hands of a single, powerful vendor.

General purpose AI platforms hold great potential for developers everywhere. Their potential to drive innovation in consumer tech is enormous, but enterprise buyers should be wary of efforts like Salesforce’s Einstein, which is merely a moat to protect recurring revenue on their core platform, not an effort to advance enterprise computing into the intelligence age.

Platform wars are not without benefits: They can accelerate the pace of innovation, drive costs down, and generally force vendors to invest more in R&D despite the persistent urge to ratchet up marketing spend. The end-user, however, almost always gets lost in the platform war.

Consider line-of-business employees who need to close more sales, drive lead generation, or derisk operations. These people aren’t interested in picking horses in the technology race. They just want access to tools that will best help them succeed in their work. CIOs need to ask themselves if committing to a platform is in the best interests of their workforce, because the big vendors have already made up their minds.

Narrow applications = broad appeal

Most enterprise startups know that a platform sale is much more difficult than a departmental sale. Marketing departments are expected to spend $32 billion on technology by 2018, for example. Departments outside of IT aren’t in the business of procuring and implementing company-wide platforms, which is why small vendors can get in the door by building and selling use-case and function-specific applications and solutions.

If that sounds mercenary to you, you should know there’s merit to this approach beyond just making a sale. The end-users of business technology have been acting as freelance procurement officers for years. They are savvy in finding free and open source tools that best suit their needs, and they don’t care about the benefits of standardization if it slows them down and reduces productivity. The point-product approach has realigned supply and demand in a market that was, for too long, operating outside the norms of the free market.

As a result, the best software ROI most enterprises will realize this year will come from department-specific implementations of solutions tailored to that department’s core function. In that sense, the best intelligence for the enterprise is intelligence that has been tuned for department and function-specific applications.

From my days at SRI all the way through to my role at Trapit, I’ve seen enough AI innovations for two lifetimes, and the best stuff I’ve ever seen has been carefully implemented to address a specific need or use case. The most prominent examples of this come from finance, where machine learning has been powering the trading industry for not one, not two, but nearly three decades.

Wall Street hasn’t engaged in the platform war in all that time largely because each organization needs to tune the technology to abide by a human-created investment thesis. Bespoke systems are not an IT strategy on Wall Street; they are the competitive advantage.

With that in mind, CIOs should consider how intelligence can augment their people and unique business processes. The most broadly appealing aspect of any technology purchase is ROI, which is best achieved when a technology is targeted at a well-defined business need.

SAP and Waste Management. Oracle and Overstock.com, JDA and Dillard’s: The list of ERP train wrecks and lawsuits is longer than software executives would like to admit. As an industry, we agreed these systems were often too big, too complex, and required too much custom integration to succeed.

As we consider the merits of “intelligence everywhere,” we need to remember the lessons the industry learned from failed ERP projects.

The risk profile of an investment in an “AI platform” is undoubtedly an ERP doppelganger. I’m confident CIOs will resist the temptation to go all-in on a platform and stick to the best-of-breed mentality. Doing so will ensure a bright future for AI users and vendors alike.

Buyers should, nevertheless, beware. We haven’t finished unshackling the enterprise from draconian software contracts, and the latest tech trend is threatening to take us back to a time when delivering value to end users was only a tangential priority for the entire ecosystem.

Hank Nothhaft, Jr. is CEO and founder of Trapit. He developed Trapit while serving as an entrepreneur-in-residence at SRI International. Prior to SRI, he served as group product manager at WebEx, where he stewarded the virtual conferencing company’s flagship Meeting Center service through an acquisition by Cisco.