As startup accelerators continue to propagate, founders are left wondering if these programs really help entrepreneurs achieve their goals. Is the effort worth giving away equity, investing time, and creating incremental costs? Do accelerators really help new companies “jump the line” and speed their development?

Traditional accelerators provide funding, mentoring, networking, training, and events for some defined period, usually three months. In return for their services, programs ask for compensation from companies invited to join, typically a small amount of equity (6 to 9 percent) and/or seed capital (around $15,000 to 20,000).

The success rates of accelerators are generally defined by the amount of capital their member companies raise when they graduate from the program. We decided to examine if this is really the right success metric for determining their relative success and whether accelerators are truly “entrepreneur friendly.”

Our research

Value created by entrepreneurs, investors, and accelerators can best be determined by their exit value. This is challenging to measure or compare across companies since most accelerators are so new that they have not seen any exits yet. And of course anytime we are talking about private companies, funding and exit data is not always accurate or easy to come by. For this post, we compiled data from Crunchbase, Seed-DB, VentureSource, and news releases.

Step 1: When can Accelerator results be measured?

We studied five of the best-known accelerators — Y Combinator, TechStars Boulder, TechStars Chicago, TechStars Seattle, and DreamIt — to identify when an accelerator should begin seeing meaningful exit data from their graduates. Our observations led us to the conclusion that accelerators need at least four years after a graduating class to determine their quality of results.

Step 2: What results do Accelerators see?

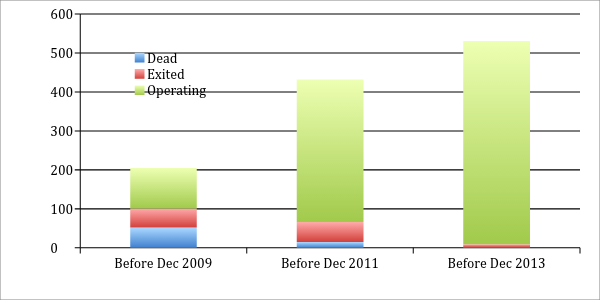

Based on the analysis from Step 1, we looked at aggregated data from nine accelerators that had graduating classes before 2009 (YC, TS Boulder, iVentures 10, AlphaLab, DreamIt, LaunchBox, Betaspring, TS Boston, Capital Factory, and Momentum). The combined programs had 266 identified graduates and the following results:

-

Realized gains/losses

-

21 percent exited and 25 percent out of business

-

$162 million funding with $831 million in exits with an 5.1x return multiple

-

-

Unrealized gains/losses

-

11 percent expected exits and 43 percent expected out of business

-

$1.1 billion in funding with $13.4 billion in expected value with a 12.5x expected return multiple

-

What was our method for determining unrealized gains and losses? For many companies (Dropbox, AirBnb, etc), public data was available on valuation. For others, press releases that mentioned companies valued above $40 million were designated YC companies and were matched based on web traffic and pundit guesses. (If the company was valued above $40 million, they still received an exit value of $40M.) Finally, we looked at evidence of company traction from Compete.com. If a company had less than 100,000 web hits and low press traffic, we assigned it an exit value of just $1. (This amounts a pretty conservative methodology since the returns from Dropbox, Airbnb, Sendgrid, SCVNGR, and OMGPOP had expected exit valuations greater than nine figures.)

Based on these historical results, we found that companies in accelerator graduating classes from before December 2009 returned 11.3x on capital invested. These are fantastic returns for entrepreneurs, VCs, and accelerators.

Step 3: Does the accelerator matter?

Obviously this 11.3x figure factors in outsize returns from a few rock stars. What happens we compare against accelerators that have more typical returns? We wanted to separate out these results by examining the four other programs that graduated members before December 2009. (Two of these programs are no longer in operation.)

Of the 61 companies in this group, 20 percent exited or are expected to exit with a total return of 1.2x. This is a vast difference in the return from the five programs with mega hits, indicating that entrepreneurs might want to evaluate newer accelerators by other less easily quantifiable factors, like the track record of the managing team in building companies.

How to evaluate an accelerator

The short answer is, it depends. Founders should first consider whether the accelerator program’s focus meets their strategic needs. Every accelerator has different priorities; some focus on fundraising, some provide space, while others have the ability to provide direct introductions to customers.

Direct involvement may be the most important factor, even if it cannot be easily quantified. A 2007 Kauffman study found that angel investors can get outsized returns if they offer a high level of diligence and direct involvement. Thus, we think its critical that entrepreneurs and VCs consider an accelerator by whether its leadership has done their homework on their prosective members’ underlying markets, and by whether they have teams ready to dedicate time and resources to help their business.

The accelerator should also have a strong track record and aligned interests. Look for programs that focus beyond fundraising to include business development activities.

Shalin Sheth is a Senior Associate with Second Century Ventures and NAR REach, the strategic technology accelerator by the National Association of Realtors. Shalin helps REach identify, evaluate, and execute investments and support portfolio companies. He has over decade of experience in technology with companies like Google and early stage startups.