The e-commerce industry has broadened in scope in recent years. Originally confined to transaction activity between large financial institutions, e-commerce then expanded in the 1970s and 1980s to include what was termed “EDI” (Electronic Data Interchange) between large companies who could afford the dedicated computing power and related IT department.

The e-commerce industry has broadened in scope in recent years. Originally confined to transaction activity between large financial institutions, e-commerce then expanded in the 1970s and 1980s to include what was termed “EDI” (Electronic Data Interchange) between large companies who could afford the dedicated computing power and related IT department.

Since the rise of the Internet, the definition of e-commerce it has expanded to include Internet purchasing, mobile, and, more recently, social and peer-to-peer financial activity.

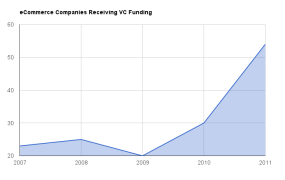

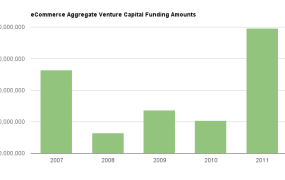

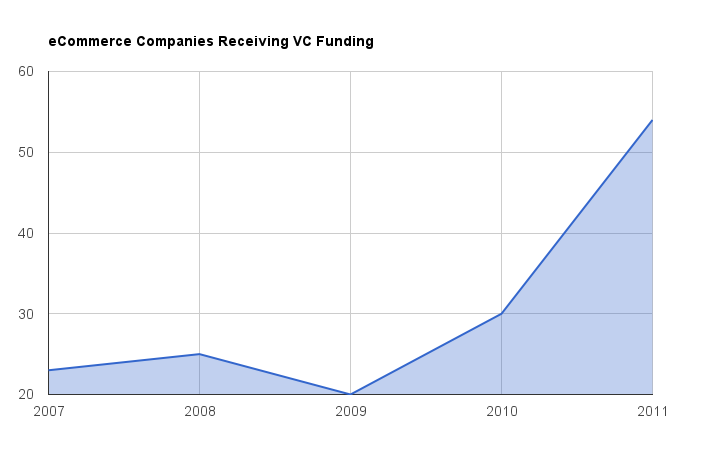

Venture capital-backed e-commerce funding surged higher in 2011 in terms of transaction numbers and dollar amounts, as the proliferation of mobile devices and the growing popularity of social media continued, offering new opportunities for retailers as well as tech companies able to capitalize on these trends. 2011 marked a definitive recovery from the 2008-2009 recession and financial crisis for VC e-commerce funding. Fifty-four deals were completed totaling nearly $400 million, easily surpassing the previous peak in 2007.

Recent History

2008: Wireless stored value payment solutions provider Transaction Wireless raised $2.25 million in a Series A round of financing from Mission Ventures and Okapi Ventures. The company created a platform that enables global retailers to provide customized digital gift cards with integrated marketing messages to engage and build loyalty with existing and prospective customers.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

2010: 8th Bridge raised $5 million in Series A funding from Split Rock Partners and another $10 million in Series B funding to expand its operations and extend its social e-commerce solutions, which run inside Facebook as well as on standalone eCommerce sites.

BeachMint brought in $5 million from New Enterprise Associates and Anthem Venture Partners for its rapidly growing portfolio of fashion-oriented, social eCommerce sites. The company’s focus is on bringing together social media and eCommerce across distinct vertical markets within the fashion industry. BeachMint raised $23.5 million in mid-2011 as it launched its StyleMint line of celebrity name apparel, adding on another $35 million in late January, 2012 from a syndicate that included Accel Partners, Goldman Sachs, New World Ventures and Millennium Technology Venture Partners, as well as previous investors.

Today

E-commerce companies continue with efforts to effectively fuse and leverage growth in social media and mobile eCommerce. Yardsellr, for example, raised $5 million in series A funding to expand its Facebook social eCommerce site.

In June 2011, Square raised $100 million in a third round of financing from Kleiner Perkins Caufield & Byers and Tiger Global Management for its peer-to-peer e-commerce technology, which includes a credit card scanner for the Apple iPhone and Android phones. Square aims to create a whole new class of e-commerce between individuals and small businesses. Other existing players such as Intuit and PayPal are not sitting still and have introduced their own mobile e-commerce solutions. The large credit card companies (Visa, MasterCard, and American Express) are also developing and launching mobile initiatives and partnerships.

Own raised $1.2 million in seed financing from VCs including Detroit Venture Partners to continue developing its retail media tablet “register” that aims to provide faster, better order processing within a mobile eCommerce platform at the point-of-sale in retail locations.

Charts

The number of e-commerce companies receiving venture capital financing dramatically increased in the 2010-2011 period as multiple trends played out.

E-commerce financing amounts in the aggregate have also tracked the growth in the number of investee companies.

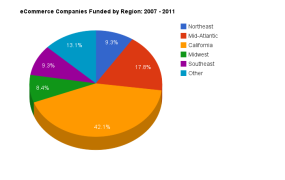

California accounted for the lion’s share (42.1 percent) of e-commerce companies receiving funding, followed by the Mid-Atlantic region at 17.8 percent.

Rapid growth in smartphones, tablets, the growing popularity of social media and the ongoing convergence of digital media and e-commerce platforms and channels has injected new dynamism into an e-commerce industry that had been previously focused mostly on infrastructure development.

Newer, seed-stage companies, such as Own, are taking on opportunities to disrupt traditional retail e-commerce by providing cross-channel and platform solutions that hold the promise of increasing sales, customer engagement and loyalty at the point-of-sale (PoS).

VentureTrends is a research service of VentureDeal, a national venture capital database based in Menlo Park, Calif.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More