Flint Mobile‘s target audience is the businessperson whose operating equipment is mostly “your phone, keys, and wallet,” CEO and co-founder Greg Goldfarb told VentureBeat.

Today the company announced it has landed a $9.4 million round to help businesses keep their equipment inventory low.

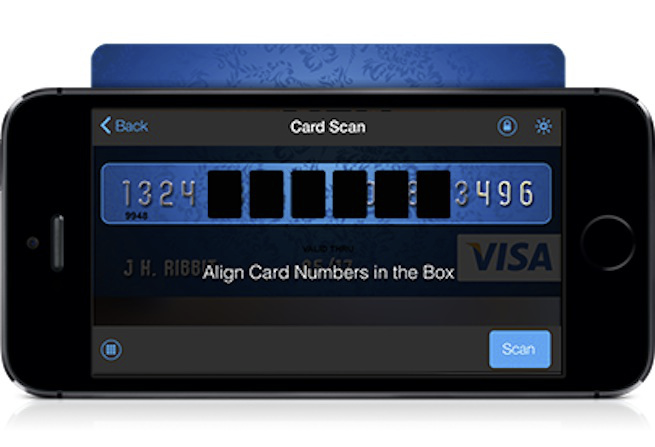

Founded in the spring of 2011, the company offers an iOS or Android app that can accept credit cards without a card reader. Credit card numbers are scanned, and additional card verification info is entered manually.

The app can also generate and send branded invoices or create, issue, and redeem Apple Passbook-compatible loyalty coupons. There’s an interface with QuickBooks Online, and a Merchant Portal maintains transaction history, as well.

With this Series C funding announcement, the Redwood City, Calif.-based company also unveiled a new Sell Online feature. Customized Buy Now buttons can be generated and added to a website, or ecommerce links with payment processing can be created and inserted into emails or social media messaging.

Flint does not charge for the Sell Online feature and loyalty coupons, but credit card transactions have a fee of 2.95 percent, while debit cards’ are 1.95 percent.

Flint focuses on the handyman, the photographer, or the traveling insurance salesman. By contrast, Goldfarb said, such competitors as Square, PayPal or PayAnywhere are oriented toward businesses that might have a shop. In addition to using a smartphone, for instance, Square also promotes the idea of using an iPad tablet as a cash register on a countertop.

Flint’s software-only approach, Goldfarb said, contrasts with Square‘s hardware add-on option. Other differentiators, he said, include his company’s ability to invoice and send loyalty coupons or to add e-commerce functions from the app.

Goldfarb also noted that Flint offers lower pricing for debit cards, and its app automatically syncs all transaction data into a QuickBooks Online ledger and customer profiles. It’s “almost using QuickBooks as a CRM [customer relationship management system,]” he said.

The Series C round was led by Verizon Communications’ investment arm, Verizon Ventures, with participation by previous investors Digicel, Storm Ventures, and True Ventures, and by new investor Peninsula Ventures.

The new funding, Goldfarb said, will be used to “build out our ability to scale,” as well as additional product development to make the offering “easier and easier.” In two previous rounds, the company had raised $11 million.