Israel, as Eric Schmidt said last week in a fireside chat at Google Tel Aviv, is producing an unprecedented level of innovation, which makes it one of the hottest places on earth to find new and exciting technology.

Enough has been said about the Israeli tech ecosystem over the years, but while the country continues to grow quarter over quarter in terms of both capital raised and valuations and acquisitions, I thought I would take a closer look at what is happening in terms of innovation. While the region continues to show signs of instability, the one thing that remains stable is Israeli innovation.

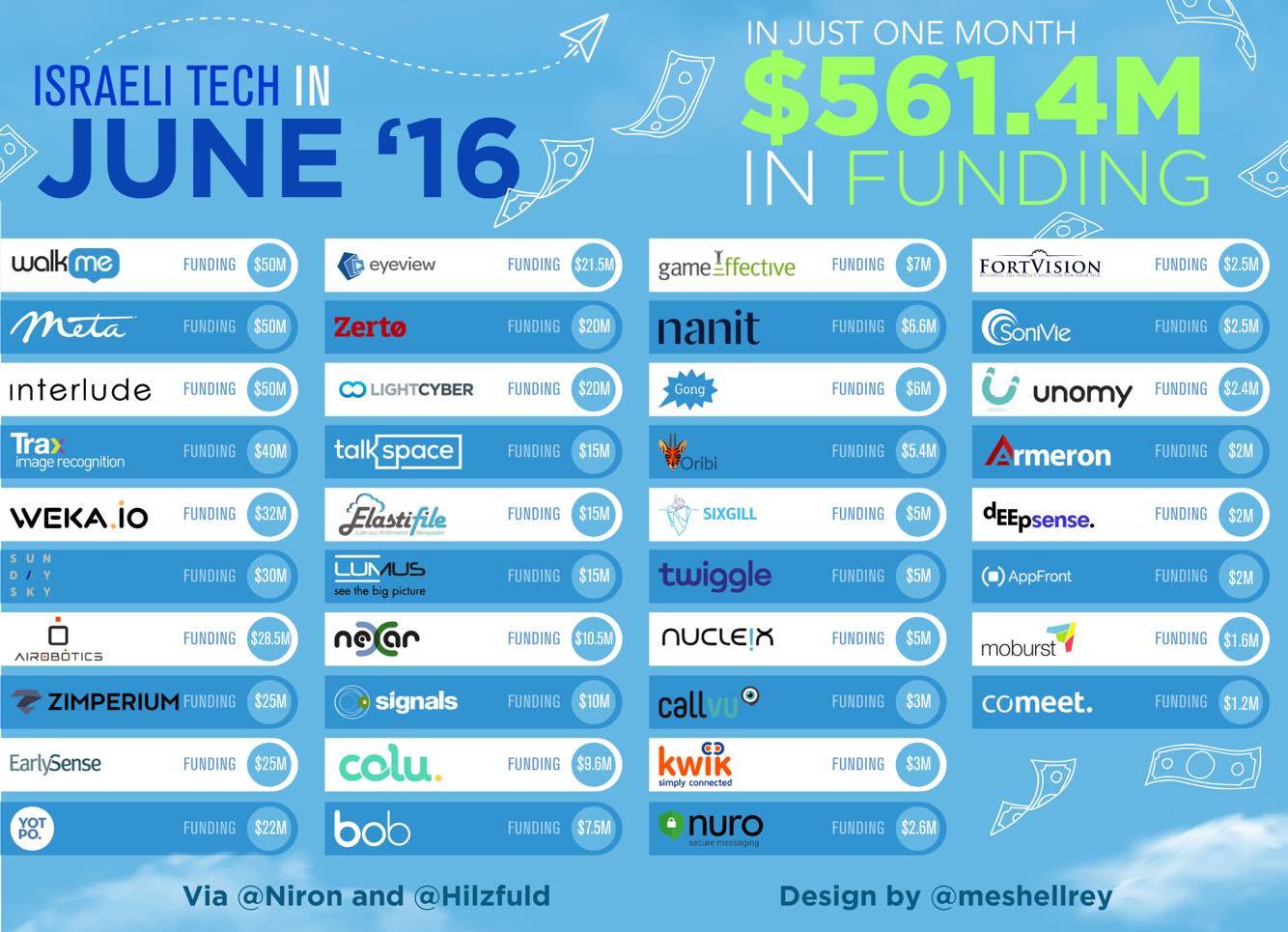

Israel has traditionally been known for its expertise in cyber security, understandable in a country in which everyone serves a mandatory three years in the army and which is facing serious cyber threats on a near-daily basis. However, the growth is still impressive — in June 2016 alone, Israeli startups have raised over $561 million in capital, across almost all verticals.

Looking at the names in the graphic below, as well as the capital raised, you can see clearly that the days of Israeli companies being unable to raise Silicon Valley-level rounds are over. You will also notice that the companies that raised rounds this month in Israel represent almost every single vertical of technology in both consumer and enterprise.

Israel has companies operating on the web, like WalkMe; companies in the hot VR space, like Meta and Lumus; companies in the mobile space, like Moburst; entertainment companies, like Interlude; and even companies in the transportation space, like Nexar.

Taking a broader look, it is rare to find one top-tier VC that does not have a presence in Israel, and the latest to join the party is, of course, Accel, which brought on Facebook exec Nir Blumberger to run its Israel operation. Other funds that have a local presence include Sequoia, Battery, Bessemer, and many others. Of course, let’s not forget what Marc Andreessen told me in an interview: “If we ever break our one office rule, it’s pretty likely office number two would be in Israel.”

As for 2015 numbers, according to IVC:

- 2015 Israeli high-tech exits hit $9.02 billion — up 16% from 2014 proceeds

- VC-backed exits reached $4.98 billion — highest in 10 years

- M&A deals below $1 billion strongest in 10 years — at $7.2 billion

So far in 2016, Israeli companies have raised over $2.5 billion in funding, including strategic money from companies such as Sony, Volkswagen, MGM, Alibaba, Qualcomm, and others.