Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

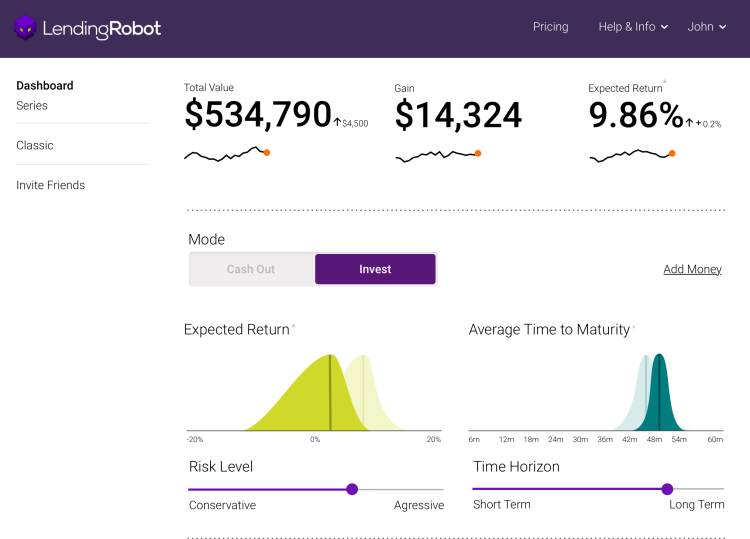

Bots are taking over — we all know that — and one of the latest sectors to succumb to the trend is fintech. LendingRobot, a robo-advisor for peer-to-peer (P2P) lending, announced today the launch of LendingRobot Series, an automated hedge fund designed as an alternative to fixed income investments.

The new fund uses machine learning to provide predictable returns and blockchain technology to offer transparency on performance.

The Seattle-based startup has 6,500 clients, who are accredited investors looking to invest in consumer, small business, or real-estate loans diversified across multiple peer lending origination platforms.

Starting today, investors will be able to use both LendingRobot Classic, which is the robo-advisor designed for P2P lending, and LendingRobot Series, a hedge fund that invests and diversifies investors’ money across four lending marketplaces — Lending Club, Prosper, Funding Circle, and Lending Home.

AI Scaling Hits Its Limits

Power caps, rising token costs, and inference delays are reshaping enterprise AI. Join our exclusive salon to discover how top teams are:

- Turning energy into a strategic advantage

- Architecting efficient inference for real throughput gains

- Unlocking competitive ROI with sustainable AI systems

Secure your spot to stay ahead: https://bit.ly/4mwGngO

The fund factors in the various time horizons and risk tolerance of investors (i.e. short-term aggressive, short-term conservative, long-term aggressive, and long-term conservative), which give the algorithm the inputs it needs to create the right investment mix.

In addition, LendingRobot Series’ use of blockchain provides a high degree of transparency to investors. Every week, the hedge fund will publish a detailed ledger of its holdings, down to the value of individual payments made to each note. Each weekly ledger will receive a “hash code” signature and be notarized in Ethereum’s blockchain to ensure the data is tamper-proof.

“All investors would be well served by diversifying into multiple marketplaces, but that process is tedious, complicated, and requires a high degree of domain expertise to accomplish correctly,” said chief executive Emmanuel Marot in a statement. “That’s why we’ve created LendingRobot Series, to provide investors that understand the value of investing in alternative lending with the confidence that comes from intelligent automation, easy liquidity, and complete transparency.”

While hedge funds typically charge management fees of 2 percent, plus 20 percent of performance (although those rates are falling), LendingRobot Series charges 1 percent of assets under management and caps fund expenses at 0.59 percent. It does not charge any additional performance fees.

LendingRobot Classic has received more than 4 million investment orders so far and currently has over $120 million in assets under management. It claims to have a net annual return of 9.2 percent. Competitors include Betterment and Wealthfront.

The startup was founded in 2012 and has raised $3.7 million to date. It currently has seven employees.