Michael Skok is a general partner at North Bridge Venture Partners and author of the Startup Secrets series.

The “lean startup” methodology is great and has done a lot to revolutionize the way we create startups.

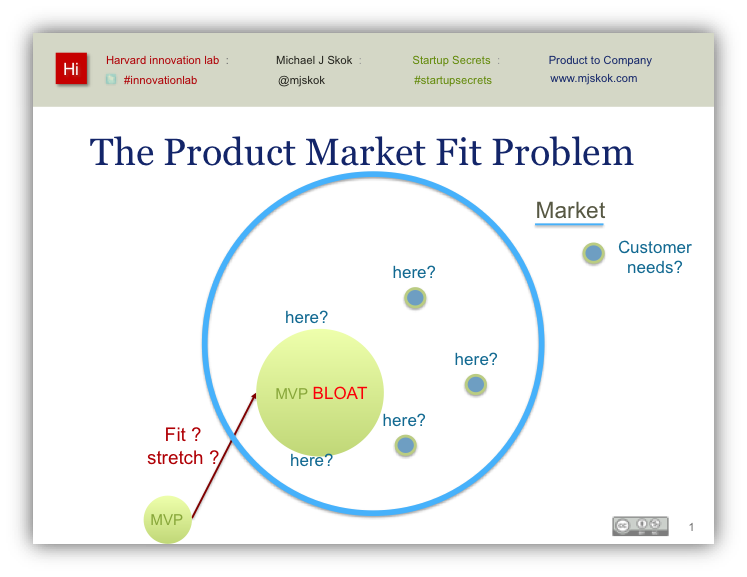

But too many entrepreneurs who follow the lean methodology get stuck in a product spin, consumed with making and honing their Minimum Viable Product. While the MVP is critical, it’s missing its dance partner, the Minimum Viable Segment (MVS). And that’s ironic, because I often hear about product market fit, yet we all know your product isn’t going to fit the entire market from day one!

MVS is about focusing on a market segment of potential customers who have the same needs to which you can align. Defining and focusing on your MVS is vital because without it, potential users who have divergent needs will quickly pull your MVP in many different directions. This in turn will bloat rather than minimize your product requirements and drain your limited startup resources.

That sucking sound won’t just be heard in product development, it will also get amplified in any Go To Market (GTM) activities, and then later on in service and support, potentially paralyzing your business model.

For example, securing strong reference customers is critical in the early days of your GTM activities. And they can’t reference each other if they have different needs!

Likewise, when it comes time to serve and support them, if you’ve had to build different solutions to their different needs, they aren’t likely to have the same support problems. As a result, they’ll stretch your customer services teams.

Instead, if they had the same needs and solutions, guess what: They may even be able to support each other in a customer community. That could save you a lot of time and money, especially if it fosters a “self-service” community, which I often encourage my investments to consider.

Find the same, similar or very closely-related needs

What can you do about this? Focus. Focus on finding a set of customers who have the same (or similar) need, pain or problem. You want each customer’s need to closely match that of the other customers in your MVS.

To be explicit about this, it is the same needs you are looking to fulfill — and not, for example, features you want to build into your product.

What’s the difference, you ask? For starters, customers don’t think in terms of features. They think in terms of their own business pain and need. And while a feature might address their initial need, it’s not likely to stay on course with their needs as they evolve if they’re different from other customers.

Is MVS another way of saying ‘vertical market’?

Your MVS might be a vertical, or be partly defined within a vertical, but it needn’t be. That isn’t likely the only way to define and focus on your MVS. What you are really looking for are customers who have the same problem with the same attributes that causes the same response or behavior, and that therefore seek the same solution.

Let’s imagine you can’t resist the hype around Big Data and Hadoop and have developed an MVP that you think should appeal to Financial Services as a vertical because they are often considered early adopters…

Well, “early adopter” is a good attribute for a startup, but it’s not a “problem” statement and then financial services is way too broad to be an MVS. Even as a vertical you’d want to break it down into banking, brokerage, insurance, etc. And for an MVS you’d want to keep breaking it down further until you found a set of potential customers with the same need.

Maybe you do some work and find out that banks are showing most interest and have shared a need to crunch data for at least two reasons: regulatory compliance and fraud detection. Then try to drill deeper into which of those needs is most underserved, urgent and painful?

You do your field work and get convinced that it’s Tier 1 investment banks and they have huge amounts of money at stake in compliance. (Data point: “Our estimate of revenue impact for global investment banks from various regulations is 8.3 percent on average,” a JPMorgan report said.)

Now you need to get clear on what impact you can have for a specific regulation. I’m sure you get the point by now, but these scenarios will likely all have very different needs, target users/buyers and therefore product implications.

And if you took the fraud detection path, it actually applies outside financial services too, for instance in e-commerce. That is the starting point to think about needs that cross verticals. In fact, your segment could ultimately be anywhere where fraud detection is needed. Hence, it’s not constrained to a vertical at all — but to a segment where anyone needs to manage fraud. At this point I’d encourage you to prioritize by other attributes such as how valuable your solution is to each potential MVS. An easy example is whether you are helping generate revenue versus just save costs. (Generating revenue is almost always more attractive and valuable, and reducing risk usually falls in between.)

Minimum = small enough to dominate

The “minimum” part of the MVS is about keeping your segment as small as possible to be able to dominate it with your limited startup resources. Once you dominate it, you can claim leadership. Even if this leadership is just in your MVS, it’s valuable to your positioning and credibility for the next segment you want to go after.

So in our example of fraud detection, you might choose to limit it to just one vertical as well as just one application such as luxury goods e-commerce, where you are finding all those customers who exhibit the same need and behavior that when you reduce fraud, your customers are willing to market more aggressively and drive more revenue. Now we’re talking!

Whatever the case, don’t be afraid to focus at the start. You can always build on success, but it’s hard to cut back on failure if you’ve already spread yourself too thin and failed to meet any one need fully. That’s where the Viable part comes in.

Viable = where you can succeed with your MVP

As you ponder your MVP, look at which segment will have the least product requirements. So again, in our Big Data example, is that compliance for financial services or fraud detection for e-commerce?

Let’s say you determine e-commerce applications are a better bet for your small startup, because they are less stringent. And perhaps you have some related domain expertise on your team, making it more likely to set you up for success.

Iterate your MVS, together with your MVP

Let’s try refining our e-commerce MVS. Could we see all customers having the same requirement? Perhaps as we interview them, we find that we have independent software vendors (ISVs) offering e-commerce solutions and we also see merchants having the same need. Which should we focus on? Again, as we iterate, we may find we’re better suited to serving the ISVs and even gaining some leverage as part of their solution rather than going direct to merchants.

And excitingly we discover we can offer our MVP as a SaaS solution that is easier to deliver and consume with a restful API through ISVs. Great! Now we’re really getting leverage.

Refine and refocus your MVS and MVP just as if they are dance partners – always in synch.

What else comes into play?

There can be many factors to help you with your MVS. At least a few I’d recommend thinking about:

- How tightly knit are the customers in your segment?

Do they talk to each other in (for example) community forums, trade associations and the like? The closer tied they are, the more likely they are to reference each other efficiently. Think of this as the beginning of your viral loop.

- Channels to your MVS

Following the point above, if you can reach all the members of your MVS via the same channel, that can be a big boon to your marketing focus. - Product and whole product

This is back to your MVP. Think about what MVS requires the smallest MVP and could for example be combined with other player’s solutions to complement you, creating a whole product. This could not only reduce development but also increase your GTM leverage and credibility with a partnership.

And of course there can be many other factors that could help, like finding an MVS in a single close geography so you can easily reach them — this may be a critical attribute in a low-resourced startup with a high-touch oriented solution. Put them down, rate and score them.

Thinking ahead to adjacencies

If you can, think ahead from where your first MVS is to the next ones. It can be very helpful to pick adjacent segments that closely align to each other and which might have similar attributes. That will help you leverage work from one MVS to the next. For example, on your roadmap to becoming the Big Data company, you realize that fraud detection is really “pattern recognition and anomaly detection” and that is huge in Bioinformatics. But Bioinformatics is not very adjacent to eCommerce, whereas, say, Payments Processing clearly is and would therefore be a better next MVS.

Look for leverage of all the points discussed above from one MVS to the next.

Conclusion

Minimum Viable Segment is such an obvious concept once you see it in practice. However, it’s amazing how I see it elude entrepreneurs in one form or another. In particular, they tend to see everything as a product problem, rather than stepping back to look at where their product is focused.

Others simply can’t resist the temptation to take money from random early customers and stray from their MVS in the belief that money cures all ills and they will succeed regardless. Yet with some simple work on an MVS to intersect with your MVP you can really get focused on the right product issues to address — such as those that will address the common needs of your MVS customers. And you’ll build a much more profitable GTM and Business Model thereafter.

So nail your MVP by focusing on MVS and enjoy the results!

Michael Skok is a general partner at North Bridge Venture Partners. His investments include Apperian, Acquia, Unidesk, and Demandware (NYSE: DWRE).

Michael Skok is a general partner at North Bridge Venture Partners. His investments include Apperian, Acquia, Unidesk, and Demandware (NYSE: DWRE).

Top image: Michael Skok.