Despite a still sluggish economy, venture capital firms poured a total of $28.4 billion into 3,673 deals last year—one of the highest levels of dollar investments of the decade—with the majority of deals going into the software and biotechnology industries.

The annual figures represent an increase of 22 percent in dollar terms and a 4 percent increase in the number of deals compared with the 2010 figures, according to The MoneyTree Report by PricewaterhouseCoopers and the National Venture Capital Association, based on data from Thomson Reuters.

This year’s VC funding figures represent the third highest annual investment (in dollar terms) of the past decade.

While the overall annual figures were positive, there was a year-end dip: The fourth quarter numbers saw a 10 percent decrease in dollars and an 11 percent decrease in deals when compared to the previous quarter—with $6.6 billion invested into 844 companies last quarter.

Comparing last year’s quarters, the third quarter saw the strongest numbers of the year both in terms of dollar investments and number of deals, with $7.3 billion invested into 953 deals.

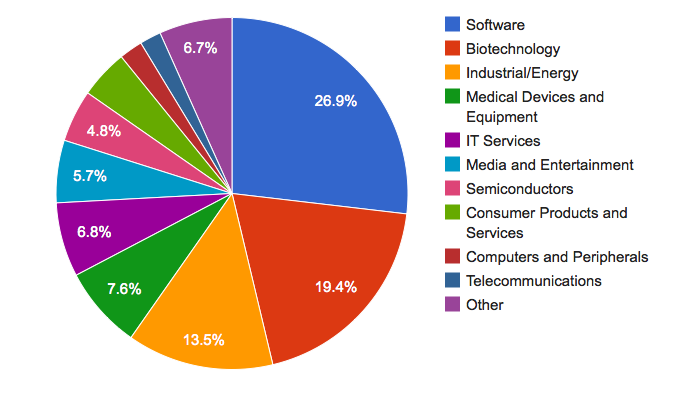

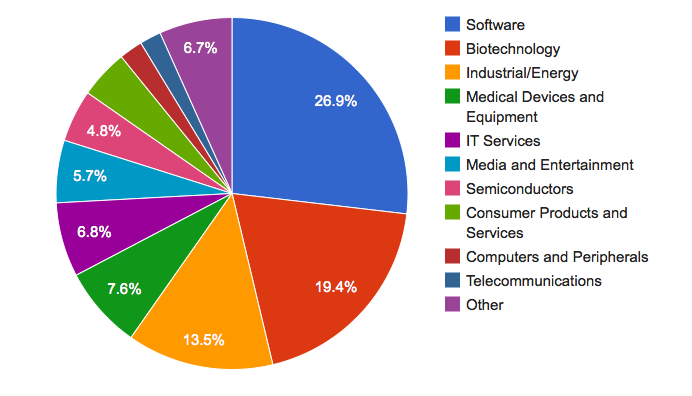

Most-funded industries

The industries that experienced some of the largest dollar increases in 2011, according to data from Thomson Reuters, included

- Consumer Products and Services (103 percent increase);

- Media/Entertainment (53 percent increase);

- Electronics/Instrumentation (52 percent increase); and

- IT Services (39 percent increase)

But despite these high increases, the software and biotechnology industries continued to dominate, receiving the largest overall investments of the year according to The MoneyTree™ Report.

The software industry saw the largest investments with $6.7 billion invested into 1,004 deals. The 2011 figures for software represent a 38 percent dollar increase and a 7 percent increase in deals when compared to 2010 numbers. The year didn’t end as high for the software industry, as investments fell in the fourth quarter, with $1.8 billion going into 238 deals. But despite a dip in investment in the fourth quarter, the software industry retained its hold as the number one sector in terms of dollars invested and number of deals in the fourth quarter.

The biotechnology industry was the second largest sector of last year, increasing 22 percent in dollar terms but dropping 9 percent in deals, with $4.7 billion going into 446 deals. The industry also saw gains in the fourth quarter, with an increase of 10 percent in dollar terms and an increase of 6 percent in the number of deals, as compared to the third quarter.

The medical device and clean technology sectors also saw large investments; the medical device sector increased 20 percent in dollars to $2.8 billion and decreased 2 percent to 339 in terms of deals, while the clean technology sector increased 12 percent in dollars to $4.3 billion and 12 percent to 323 in terms of deals, when compared to 2010. Last year was the highest level ever recorded for the clean tech sector.

Investments by stage of development

Last year, early stage investments saw the highest increases in terms of both dollars invested and deals—increasing 47 percent in dollar terms and 16 percent in number of deals as compared to 2010. Early stage investments also saw the highest number of deals last year, but it was the expansion-stage investments that brought in the most dollar investments.

- Expansion: $9.7B (+9%) in 999 deals (-8%)

- Later stage: $9.5B (+37%) in 864 deals (-5%)

- Early stage: $8.3B (+47%) in 1,414 deals (+16%)

- Startup/Seed: $919M (-48%) in 396 deals (no change)

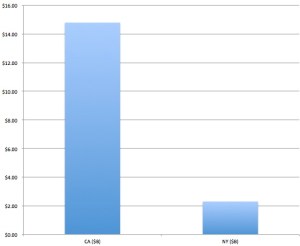

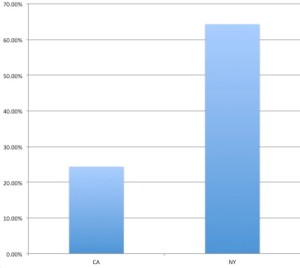

California leads but New York rising faster

Comparing California and New York VC investments and deals, Silicon Valley continues to overshadow Silicon Alley, with California-based investing almost 6.5 times that of New York-based investing in terms of dollars, and almost 5 times in terms of deals. (See first graph below.)

But when comparing 2011 numbers to 2010 numbers, VC investments in New York are rising 64.3 percent in terms of dollars and 10.2 percent in terms of deals, while investment in California is only rising 24.4 percent in terms of dollars and 5.0 percent in terms of deals (as shown in the second graph below).

Predictions for 2012: Which industries to watch

According to predictions by the NVCA and Dow Jones VentureSource, the IT sector is the one to watch this year. Venture capitalists and VC-backed CEOs predict this year will see investment increases in consumer IT, healthcare IT and business IT. On the other hand, VCs predict investment decreases in the biopharmaceutical, medical device sectors and clean technology companies.

Kevin O’Connor, founder of FindTheBest, O’Connor Ventures and DoubleClick, predicted increased investments in the consumer web, energy-efficient devices and the 3D industry. (Disclosure: FindTheBest contributed this article to VentureBeat, and also provides the product comparisons that appear on our site.)

“The consumer Web will see huge increases this year, as well low-energy components and devices,” O’Connor said. “The crossover hasn’t happened yet, but in the near future our mobile devices are going to become our primary device. Another industry that will see big gains is the 3D industry, especially in the adult and gaming areas. On the flip side, I think investing in social companies will be more discerning.”

While California’s Silicon Valley still trumps all other regions in terms of VC funding and the start-up ecosystem, VCs predict New York will provide a more fertile ground than even Silicon Valley this year. Thirty-four percent of VCs and 42 percent of CEOs see the start-up ecosystem in Silicon Valley improving, while 46 percent of VCs and 41 percent of venture-backed CEOs predict the start-up ecosystem in New York will improve this year.

VC predictions on the presidential elections

Interestingly, when VCs were asked about the upcoming presidential elections, 79 percent predict Mitt Romney would be the Republican presidential nominee with Gingrich coming in a very distant second, according to the NVCA. But despite strong predictions that Romney will win his party’s vote, 56 percent of VCs predict President Obama will be elected to a second term.

Grace Nasri is the managing editor at FindTheBest.com, a data-driven comparison engine.

Related articles

- Venture capitalists focus on later stages, but Silicon Valley still rules (venturebeat.com)

- Rainn Wilson calls on Silicon Valley to give back this holiday season (video) (venturebeat.com)

- FindTheBest upgrades with even more visual comparisons of almost everything (venturebeat.com)

- Dylan’s Desk: Is it time to occupy Silicon Valley? (venturebeat.com)

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More