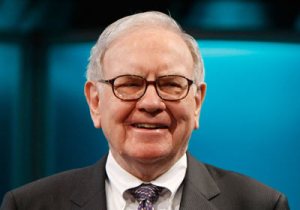

Billionaire Warren Buffett’s Berkshire Hathaway now has a stake in IBM worth $11 billion, making it the largest single stakeholder in the company. With fully 5.5 percent of the all common shares, Buffett, who is the president, chairman and chief executive officer of conglomerate Berkshire Hathaway, has been snapping up as much IBM as he can over the past eight months.

Billionaire Warren Buffett’s Berkshire Hathaway now has a stake in IBM worth $11 billion, making it the largest single stakeholder in the company. With fully 5.5 percent of the all common shares, Buffett, who is the president, chairman and chief executive officer of conglomerate Berkshire Hathaway, has been snapping up as much IBM as he can over the past eight months.

“I don’t know of any large company that really has been as specific on what they intend to do and how they intend to do it as IBM,” Buffett told CNBC reporters today. Known as the “Oracle of Omaha,” Buffet’s investment strategy has been characterized as “buy and hold forever.”

IBM would seem to be pretty safe bet. The company, which started off making typewriters and adding machines has been in business of helping businesses since 1911. Buffett has traditionally shied away from technology companies, in spite of keeping very close company with tech impresarios such as Microsoft co-founder Bill Gates, because he says he doesn’t understand technology and can’t accurately judge the quality of tech company stocks.

Buffett has quietly amassed 64 million shares of IBM for Berkshire Hathaway since March of 2011, and made the disclosure only after crossing the disclosure threshold in the third quarter, according to Reuters. The investments had been so hush-hush that even IBM was unaware it was Buffet, according to the Reuters article.

Only a portion of IBM’s revenue comes directly from technology and software. The company spun off its personal computer division to Lenovo in 2004, and a significant percentage of its operating income is generated through business consulting, logistics, supply chain management, infrastructure planning and other related activities.