If you’d like to invest in Bitcoins, but you’re nervous about associating with the unshaven hacker types who came up with the whole idea of the decentralized digital currency, you’re in luck.

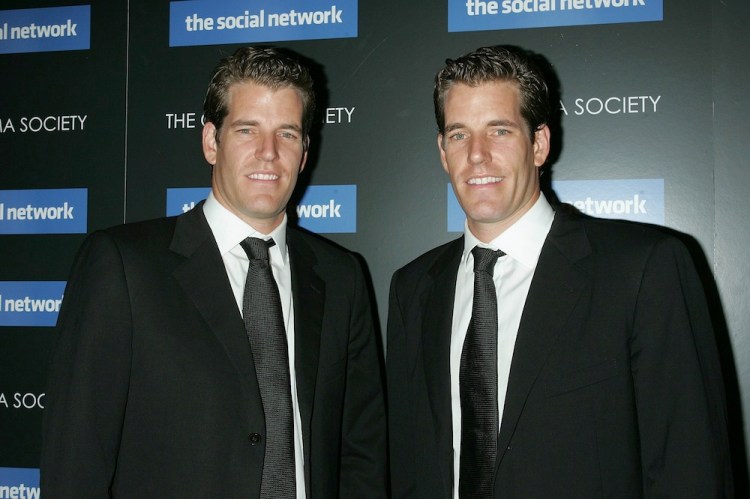

The Winklevoss Bitcoin Trust recently filed paperwork with the Securities and Exchange Commission to begin publicly trading in Bitcoins. With this trust, you’ll be able to safeguard your Bitcoin investments with a pair of blonde, Harvard-educated rowers instead of a bunch of neckbeards who can barely keep their websites from being hacked.

Cameron and Tyler Winklevoss are the twin brothers who sued Facebook, alleging that they played a role in founding the social network and that CEO Mark Zuckerberg shorted them in with a 2008 cash-and-stock settlement. In 2011, they ended their appeals and agreed to accept the terms of the settlement, then worth $65 million. (It could be worth as much as $300 million now.)

(I know, I know. First Uber starts offering helicopter rides to the Hamptons — then Bebo founder Michael Birch buys back Bebo for $1 million because, why the hell not? — and now this. The rich are out of control today.)

They’ve now styled themselves as venture capitalists, with investments in SumZero and Bitcoin processor BitInstant. But Bitcoin, despite that an increasingly large number of companies accept it as payment, is not an easy investment vehicle, the Winklevii believe. (Bitcoin may be a good investment, however.) Into the gap comes the Winklevoss Bitcoin Trust.

“The investment objective of the Trust is for the Shares to reflect the performance of the Blended Bitcoin Price of Bitcoins, less the expenses of the Trust’s operations,” the prospectus reads. In other words, the Winklevoss Bitcoin Trust is much like an index fund, except the underlying asset are “Digital Math-Based Assets (DMBAs),” as the prospectus describes Bitcoins.

The parent company, incorporated in Delaware, was founded on May 9 of this year. Apparently it doesn’t take too long to whip together some SEC boilerplate and get into this Bitcoin fund business.

The filing seeks to raise about $20 million by selling 1 million shares of the Winklevoss Bitcoin Trust at up to $20.09 per share.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More