Money transfer company Xoom received a $25 million round of funding today, according to a Form D filed with the SEC. The round comes from existing investors, including Sequoia Capital and Keith Rabois, chief operating officer of payments service Square.

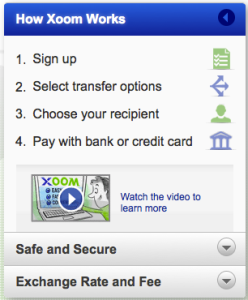

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":356337,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"entrepreneur,","session":"B"}']The company allows people from 30 different countries to transfer money to one another without needing a bank account. In lieu of a bank account, you can use a debit card or credit card, though bank account transfers are also accepted. Associated fees are dependent on your country and the amount of money changing hands. Xoom assures privacy and is “accredited by third party privacy organizations.”

This round of funding follows a $33 million round, which closed in March 2010, another “inside round” from this round’s same investors, including DAG ventures, Fidelity Ventures, and New Enterprise Associates. The company stayed with these investors because it’s an easier route to raise money when you have supportive existing investors.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

“It was easier to do it as an inside round,” said Xoom chief executive officer John Kunze said in an interview with VentureBeat, “And our business is just on fire. We needed to expedite the raise.”

The company needed to raise the round for working capital to cover expenses in the money transfer business. Kunze cited the speed of Xoom’s transactions as “moving money in seconds,” which becomes taxing on a company’s P&L sheet. The funding will also be used for regular operating costs, as the company expands into new areas of the industry. Xoom recently launched its mobile website m.xoom.com for international money transfers on the go, which Kunze says counts for a third of the company’s Mexican sign-ups. Xoom also recently announced a partnership with Walmart.com to allow online money transfers to Latin America, Europe and Asia through the website.

“[The Walmart partnership] foreshadows a strategy where we are willing to co-brand with offline customers,” said Kunze, “Basically it makes Xoom more ubiquitous.”

In terms of competitors, Western Union takes the number one spot. Xoom sees Western Union as more inconvenient, however, as a physical presence is necessary to complete transactions, as well as a bank account. The company does not, however, look at online transaction companies such as PayPal as competitors.

“We don’t compete at all with [PayPal] because they’re very focused on commercial payment and serving merchants,” said Kunze, “Thought they’re thinking peer-to-peer.”

Xoom’s board of directors includes Keith Rabois, who once worked for PayPal, and early investor Peter Thiel who co-founded the e-commerce payments company.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":356337,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"entrepreneur,","session":"B"}']

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More