Mark Zuckerberg controls a majority of Facebook’s voting rights, and will continue to enjoy that control after it goes public, according to an unusual arrangement he struck with some key investors and colleagues among Facebook’s shareholders.

A string of voting arrangements outlined in Facebook’s SEC filing show that some of the company’s most powerful shareholders have ceded their voting rights to Zuckerberg, the company’s chief executive. While Zuckerberg only owns 28.2 percent of the Facebook’s shares, the additional “shares subject to voting proxy” gives him an additional 30.6 percent of the voting power, leaving him with a total of 56.9 percent of the shareholder voting power. That gives Zuckerberg full control of the company’s decisionmaking.

Under the arrangement, Dustin Moscovitz, Sean Parker, and a host of other Silicon Valley bigwigs have given Zuckerberg “irrevocable proxy” to control their votes. That means that their shares will swing with his shares.

Read more about Facebook

Facebook files its S-1 (Read full filing)

Facebook says “mobile” is big risk — starting with Android and iOS

How “The Hacker Way” helped propel Facebook to market dominance

Mark Zuckerberg owns 28.2% of Facebook, Peter Thiel has 2.5%

Facebook’s monster mobile numbers: Over 425M users

How Zuckerberg wrested control of Facebook from his shareholders

Facebook has 845M monthly users, 2.7B likes & comments each day

Zynga accounted for $445M, or 12 percent of Facebook’s revenue, in 2011

Zuckerberg also has irrevocable control over shares held by DST, Greylock, Accel Partners, and other major firms and investors — and the voting rights that go along with those shares — in most circumstances.

“This is not common at all,” said Menlo Ventures partner Mark Siegel, who has monitored quite a few IPOs in his time in Silicon Valley and spoke to VentureBeat by phone today.

“He negotiated a very unique deal,” said Siegel of Zuckerberg’s coup. While no one knows exactly why Moscovitz, Parker, and a slew of high-powered VC firms would have given up their votes, Siegel speculated, “I’m sure there’s a point where shares were offered with that as a contingency.”

In other words, this may have been a qui-pro-quo trade of money (shares) for power (votes).

And maintaining power is something that Zuckerberg has focused on since Facebook’s inception.

“To give Mark and Sheryl their due, it looks brilliant having turned down those earlier offers,” said Siegel, referring to a past multi-billion dollar acquisition offer from Yahoo. “I think they understood before a lot of us did what the potential of the company was… Staying independent and private was a pretty smart move.”

Now, Zuckerberg will continue to exert his control over the publicly traded company; with his block of votes, he will have more sway in important decisions such as changes to the board, mergers, or splitting up parts of the company.

“Every company puts in place things like a poison pill, things that make it possible for dissenting shareholders to prevent a hostile takeover,” said Siegel. “Presumably [the voting arragement] puts more of that control in one individual’s hands… it concentrates a lot of traditional protections.”

Separately, a special “Class B” of shares has let Zuckerberg and a small group of executives and employees at Facebook exert more control than they otherwise would by giving them ten times the number of votes per share than “Class A” shares. Class A shares are the ones public investors will get.

This will also give Zuckerberg the ability to maintain control of Facebook even if some of his proxy friends decide to sell their shares. That’s because, under the rules of Facebook stock, those “Class B” shares, if sold, automatically get converted to Class A. Thus, people buying from the special proxy share owners will only get “Class A” shares with only one vote per share. Zuckerberg is thus left a greater majority of the powerful “Class B” shares, and thus will be more able to maintain control overall.

So except for unforeseen edge cases, Zuckerberg will maintain control of a huge block of Facebook shares (and votes) until he dies or divests. But as far as Facebook is concerned, Moscovitz, Parker, DST, et al. don’t constitute a group because they’re not voting together — Zuckerberg is voting for them.

For those of you fond of complicated legalese, here are the relevant paragraphs from the filing:

Our CEO has entered into voting agreements with certain of our stockholders, which voting agreements will remain in effect after the completion of this offering. These voting agreements cover approximately 42,245,203 shares of Class A common stock and 485,199,231 shares of Class B common stock, which will represent approximately _____% of the outstanding voting power of our capital stock after our initial public offering.

Under one type of voting agreement, stockholders agreed to vote all of their shares as directed by, and granted an irrevocable proxy to, Mr. Zuckerberg at his discretion on all matters to be voted upon by stockholders. The following individuals and entities hold shares of our capital stock that are subject to this type of voting agreement: ARPI 2, LLC; Matt Cohler and certain affiliated entities; Gregory Druckman; Michael Druckman; Richard Druckman; Steven Druckman; The Founders Fund, LP; Glynn Partners; Hommels Holding GmbH; Adam Moskovitz; Dustin Moskovitz and certain affiliated entities; Nancy and Richard Moskovitz and certain affiliated entities; Sean Parker and certain affiliated entities; Cara & Robert Scudder; Silicon Valley Community Foundation; certain entities affiliated with Technology Crossover Ventures; Valiant Capital Opportunities, LLC; and VHPI 2, LLC.

Under a second type of voting agreement, Mr. Zuckerberg has the authority (and irrevocable proxy) to vote these investors’ shares at his discretion on all matters to be voted upon by stockholders, except for issuances of capital stock by us in excess of 20% of our then outstanding stock and matters which would disproportionately, materially and adversely affect such stockholder. This type of voting agreement also provides that the investor shall not: (1) acquire any ownership of any of our assets or business, (2) make any solicitation of proxies with respect to the voting of any of our securities, (3) form any “group” within the meaning of Section 13(d) of the Exchange Act, (4) nominate any person as director who is not nominated by the then incumbent directors, propose any matter to be voted upon by our stockholders or initiate or vote in favor of or call for a special meeting of the stockholders, or (5) publicly announce an intention to do any of the above. Following the completion of our initial public offering, a transferee of the shares currently subject to this type of voting agreement shall no longer be subject to the terms of the voting agreement if we have a two-class capital stock structure and a party to the agreement is transferring Class B common stock that, upon completion of the transfer, becomes Class A common stock or is transferring Class A common stock. DST Global Limited and certain affiliated entities and Mail.ru Group Limited hold shares of our capital stock that are subject to this type of voting agreement.

The third type of voting agreement contains the same substantive provisions as the second type of agreement. For some of the parties to this type of voting agreement, the provisions of the agreement do not apply to shares held by the investors prior to their secondary purchases. The following entities hold shares of our capital stock that are subject to this type of voting agreement: certain entities affiliated with Accel Partners and James W. Breyer, a member of our board of directors; certain entities affiliated with Elevation Partners; Felarmon Group Limited; certain entities affiliated with Greylock Partners; Li Ka Shing (Canada) Foundation; certain entities affiliated with Meritech Capital Partners; certain entities affiliated with Anand Rajaraman; Tiger Global FB Holdings, LLC; and certain entities affiliated with Venkatesh Harinarayan.

With the exception of up to 232,542,558 shares of Class B common stock, which will remain subject to the provisions of a voting agreement until Mr. Zuckerberg’s death, if an investor sells, transfers, assigns, pledges or otherwise disposes of or encumbers the shares subject to these voting agreements after the completion of our initial public offering, the shares would no longer be subject to the provisions of the voting agreement. Voting agreements covering 42,245,203 shares our Class A common stock and 215,919,085 shares of our Class B common stock will terminate if Mr. Zuckerberg is no longer actively engaged in the management of the company.

We do not believe that the parties to these voting agreements constitute a “group” under Section 13 of the Exchange Act, as Mr. Zuckerberg exercises voting control over the shares held by these stockholders.

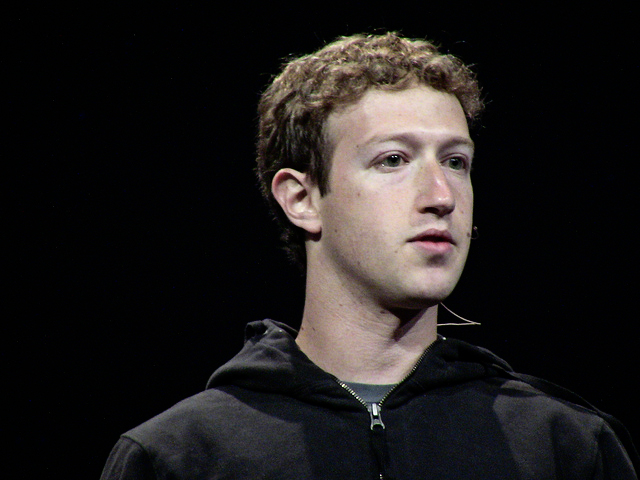

Image courtesy of Jolie O’Dell.

[This story originally published at 3:04pm]