China continues to take a larger piece of Asia’s gaming market.

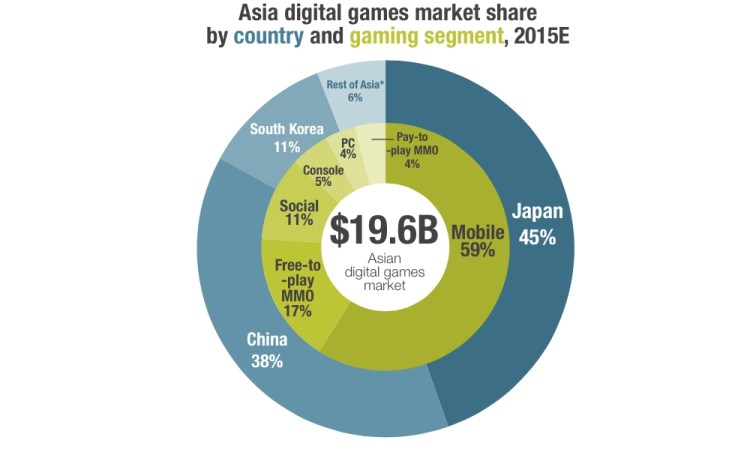

According to a report research firm SuperData released today, China’s digital game market hit $7.5 billion in revenues already. The country ranks No. 2 in terms of digital sales in Asia, counting for 38 percent of the region’s revenues. Led by MMOs and free-to-play games, the forecast for Asia’s digital games market is to hit nearly $19.6 billion by the end of the year and climb to $21.2 billion by 2016. SuperData predicts that China’s digital game revenues will hit $8.2 by then.

China ranks just under the region’s leader, Japan, which currently holds 45 percent of digital game revenues. The Japanese market has seen $8.82 billion in revenues over the same time period while having only a tenth of China’s population thanks to heavy spending on mobile games. But China’s growth rate is five times that of the region’s average, and it’s set to grow another 8 percent next year, says SuperData.

It won’t be long before China catches up.

“By the end of 2015, Asia’s digital games revenue will reach almost $20 billion, carving out 38 percent of the worldwide market,” said Stephanie Llamas, the lead analyst on Superdata’s Digital Games in Asia 2015 report. “The region’s revenue will increase by just 5 percent this year after enormous growth through 2014, making it key for Western publishers to be increasingly strategic about their entry into the market.”

Mobile Game Developer?

Learn how to drastically increase your mobile revenue.

Both Microsoft and Sony entered China at the right time for this growth, with both launching its latest game consoles, the Xbox One and PlayStation 4, in the territory earlier this year. To do so, both partnered with Chinese-owned companies to gain access to the country. SuperData says this work should pay off as both are expected to drive growth. Similarly, major players such as King (Candy Crush Saga) and Activision (Call of Duty) have worked out deals with Chinese giant Tencent to gain access on the software side.

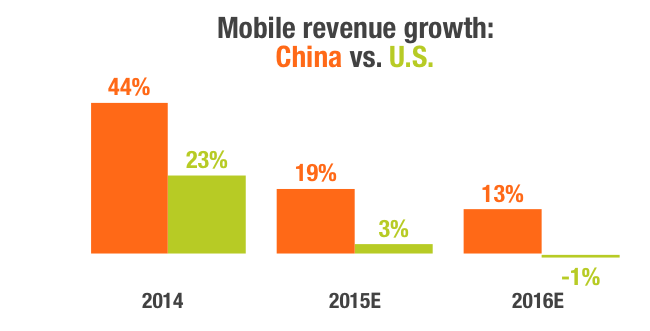

But mobile gaming shows the most promise, according to the report. While the U.S. mobile game market is nearing saturation, China’s is still growing, and that’s expected to continue through 2016. SuperData says that the country has 650 million monthly active users and that it’s set to surpass 800 million by next year — which would count for more than twice the U.S. total population.

Averages revenues per paying customer in Asia are the highest in the world, with each gamer spending $32.44. SuperData says that despite conversion rates being among the lowest in the world, the average paying user is 30 percent higher than anywhere else.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More