While game acquisitions are at an all-time high, investments in game startups have slowed dramatically, according to the third-quarter investment report by investment bank Digi-Capital. Blame it on the decline of new investments in social and casual games.

So far this year, investors have put money into 130 game companies at a value of $591 million, with an average value of $4.5 million. That’s pretty far below the $2 billion invested into 152 deals at an average value of $13 million for 2011. Of course, one of the positive trends is the emergence of Kickstarter, where fans can “crowdfund” a company with their own donations. This helps pick up the slack when it comes to investments in independent game developers and publishers.

So far this year, investors have put money into 130 game companies at a value of $591 million, with an average value of $4.5 million. That’s pretty far below the $2 billion invested into 152 deals at an average value of $13 million for 2011. Of course, one of the positive trends is the emergence of Kickstarter, where fans can “crowdfund” a company with their own donations. This helps pick up the slack when it comes to investments in independent game developers and publishers.

Transaction volume is up by 14 percent for the year to date through the third quarter, but the transaction value is down by 60 percent. The biggest funding to date was Trion Worlds’ $85 million in January.

“Should this trend persist, games investment for 2012 might return to the still respectable levels of 2010 (the second highest year),” said Tim Merel (pictured above, far right), the managing director of Digi-Capital.

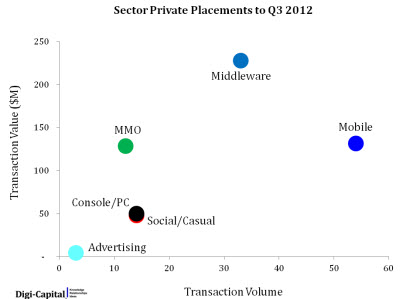

Digi-Capital says that investments in game middleware, mobile, and massively multiplayer online games dominated the transactions. The decrease in investments is the result of a decline in the social/casual game startup sector. In 2011, social/casual accounted for 57 percent of transaction value and 32 percent of transaction volume, but year-to-date through Q3 2012, it accounted for 8 percent of transaction value and only 11 percent of transaction volume.

Games middleware investments generated 39 percent of transaction value and 25 percent of transaction volume, with gamification (particularly the use of game mechanics to increase engagement in nongame applications in education and health), cross-platform mobile technology, game discovery platforms, and games peripherals/hardware emerging as investment trends.

“Given VC market fondness for platform investments, this trend seems highly consistent,” said Merel.

Digi-Capital said that mobile games investment accounted for 22 percent by transaction value and a significant 42 percent by transaction volume. Mobile (mobile-social in particular) games investment could continue through the fourth quarter.

The success of free to play continues to attract investors to MMOs, which account for 22 percent of transaction value and 9 percent of transaction volume. The mobile and tablet game market are still in the midst of raising money and lots of acquisitions. Social-casual is consolidating. MMOs are consolidating through acquisition but generating new investments in the free-to-play sector. Console and PC gamemakers are pivoting into mobile or online games. Games middleware companies are raising funds or being purchased. And game advertising is simply growing organically.

“It could be interesting to see if emerging games investment and merger-and-acquisition trends continue through Q4 2012 and [also] how they play out for what we anticipate could be a fascinating 2013,” said Merel.

The full report is available for purchase here.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More