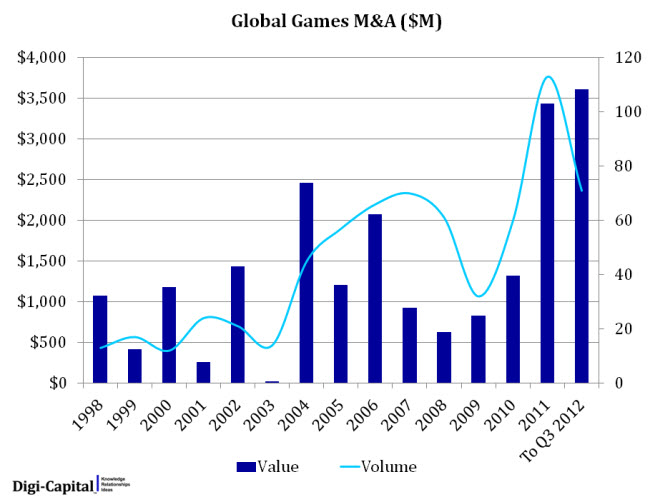

Game acquisitions reached an all-time high in the first three quarters of the year as Asian game companies swooped in on bargains in the U.S. and Europe, according to game investment bank Digi-Capital. At this rate, by the end of the year, game industry transactions could total more than $4.76 billion.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":546816,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"entrepreneur,games,","session":"B"}']Six of the top 10 largest merger and acquisition transactions were made by Chinese, Japanese, and South Korean acquirers. The number of mobile deals now exceeds all other categories, but investments in massively multiplayer online games generated more value year-to-date through the end of the third quarter.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The Zynga initial public offering was the high-water mark for social games investment. Venture capitalists have now moved sharply away from that sector into mobile game investments. Yet despite Zynga’s weak stock price, game companies in some sectors and geographies are trading at 12-month highs. Strategic pivots into social, mobile, online, and new geographies are becoming more common.

Digi-Capital’s records show that 2011 was a record year for games M&A, with 113 transactions generating $3.4 billion in transaction value and the average deal worth $30 million. Even though there are still three months to go in 2012, that record has already been beaten. In 2012, 71 transactions generated $3.6 billion in value at an average deal worth $51 million.

The run-rate for deal value is 40 percent higher but 16 percent lower by volume than 2011 because of fewer and larger M&A deals. Besides MMOs and mobile, the other categories for deals include social/casual, middleware, console PC, and advertising. Digi-Capital expects the trend of popular mobile and MMO deals to continue through the end of the year.

“Our largest Chinese, Japanese, and South Korean clients are particularly focused on M&A and investment in mobile-social, free-to-play MMO and middleware to leverage their strengths both domestically and internationally,” said Merel. “Our large U.S. and European clients are fishing in a similar waters but bring different strengths to the table. For the strongest independents that we work with, the accelerating M&A market is prompting some to consider their strategic options.”

The full review is available for purchase on Digi-Capital’s site. Check out Digi-Capital’s report on investments in game companies, as well.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More