Analysts have predicted for some time that augmented- and virtual-reality technologies will quickly grow into a lucrative industry. And by the way that venture capitalists are pouring money into this sector, it’s obvious that they have bought into the hype.

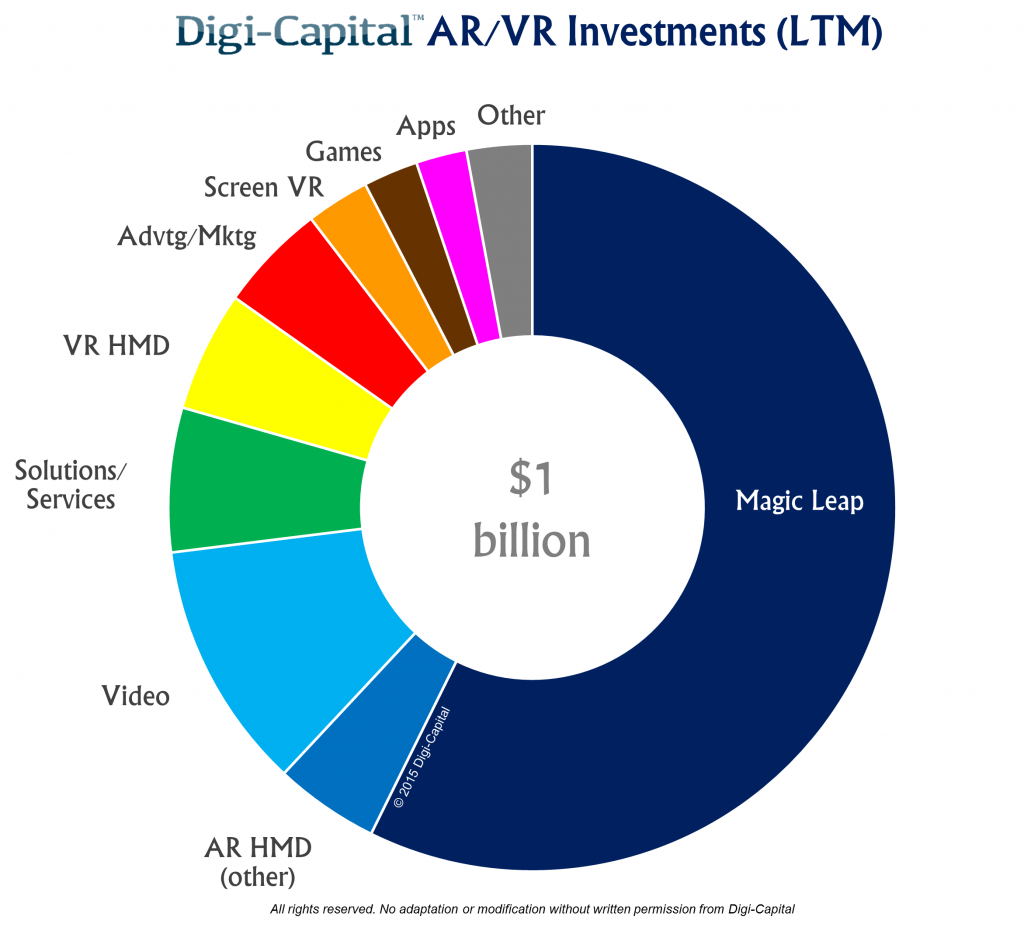

In the last 12 months, capital firms and other businesses have made more than $1 billion in investments in AR and VR tech companies, according to a Digi-Capital report. That does not include the $2 billion that Facebook spent to buy Oculus VR in March 2014. Most of that $1 billion came when Google dropped $542 million on the AR startup Magic Leap. That investment represented more than half of the money put into this space in the 12 month period from quarter four of 2014 through quarter three of 2015. But that was also only the beginning as Google’s interest, which seems like an understatement, signified this could turn into the next big thing for tech.

Digi-Capital told GamesBeat earlier this year that the AR and VR market could grow into a $150 billion industry as soon as 2020. If that’s the case, Google and the other firms funding the progress toward that future stand to gain a lot.

“There have been significant investments in AR/VR head-mounted displays, video, solutions/services, advertising/marketing, games, and apps,” reads the Digi-Capital report. “As the ecosystem begins to take shape, the investment community is providing the fuel to take AR/VR skywards.”

And while investors are putting their cash behind these ideas, no one knows yet if those bets will pay off.

“Nobody thinks [VR and AR are] a safe bet,” Wedbush Securities analyst Michael Pachter told GamesBeat. “It is the flavor of the month, and the firms looking for capital are raising capital while the getting is good. It’s just a hot area right now — nothing more.”

Pachter’s take on this trend has data to support it. In the last 12 months, this sector has only had $250 million in mergers and acquisitions, which would give venture capitalists the opportunity to exit with a profit. But, as you have probably figured out, $1 billion put into the space is a lot more than the $250 million pulled out of it.

We are, however, right on the edge of getting some very important data that could fuel an even larger rush on VR and AR. We’re just a few months, at most, away from the planned releases for the Oculus Rift, HTC Vive, and PlayStation VR headsets. Additionally, Samsung and Oculus just released the Gear VR head-mounted peripheral that turns Galaxy phones into impressive (if limited) VR helmets.

With these devices finally going on sale for consumers, we may get some important answers. For example, sales results will help investors learns who is willing to spend money on first-generation VR tech and who is keeping their purses sealed until they know more.

If early sales results are positive, and if early adopters and critics come away raving, the people putting billions of dollars on the hopes that VR and AR will turn into a mammoth business will look razor sharp.