Almost famous, almost golden

Microsoft sold its 10 million units, but the Red Rings of Death hurt its early lead. Microsoft barely made a dent in Japan.

Sony and Nintendo got into the market in the fall of 2006 and they didn’t have the same quality problems. The PlayStation 3 came in at a hefty $500 to $600, making it a non-starter for many gamers. But Nintendo created something altogether different with the Wii.

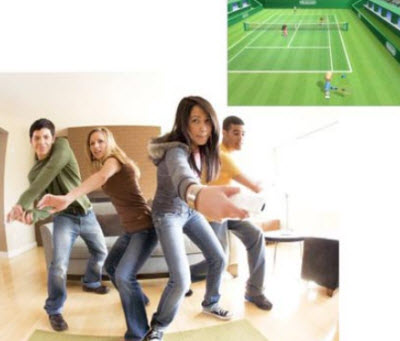

The Wii had a non-traditional controller with a built-in accelerometer (and later a gyroscope) that could sense motion. It was more like a remote control than a controller, so it was less intimidating to non-gamers. Gamers picked it up and started laughing as they played games such as Wii Sports together. Non-gamers, from little kids to women to the elderly joined in on the fun. Nintendo sold the Wii everywhere, even in sports stores where it could highlight its Wii Fit game for non-gamers. The demographics of the game industry broadened as Nintendo invited more of the masses to become gamers in a way that Microsoft never imagined possible.

When the Wii went on sale in the fall of 2006 for a mere $250, it was the smash hit of the new console generation. Microsoft had ironically beaten Sony on just about every front with the PS 3 vs. Xbox 360 battle. But it had taken its eye off an even broader mass market that Nintendo had targeted. Microsoft executives had written Nintendo off as a non-entity, and it came back to haunt them. In hindsight, the executive team wished they had done something more innovative with the Xbox 360. Nintendo had just subjected Microsoft to a classic case of disruptive innovation.

Apple interruptus

Apple interruptus

Even as Nintendo began doing its victory dance, Apple sideswiped the game industry, by accident. It created the iPod in 2001, the iPhone in 2007, and the iPad in 2010. All of the devices became capable of playing games that could be easily distributed as apps. Nintendo and Sony felt the impact first, as sales of their handheld game devices slowed down. It turned out that playing games took off like wildfire on the Apple devices.

At Microsoft, J Allard turned his attention to this new threat. Under the direction of Robbie Bach, he led the team that designed the Zune music player, as well as its sequel the Zune HD. Both were abject failures, since Apple’s iPod hardware and iTunes media store proved to be unbeatable. In this regard, Allard’s attempts to take on Apple were regarded as copycat maneuvers, too little to late.

The same fate befell Windows Mobile, the phone operating system whose market share has tanked with the rise of the Apple iPhone. Bach orchestrated an effort to take on the iPhone with the Windows Phone 7 operating system, which tightly integrates PC functions with a phone. But Apple’s iPhone already has a huge advantage in that market and Microsoft barely made a dent.

Allard’s last project at Microsoft was Courier, which Ballmer canceled earlier in 2010. It was viewed as an attempt to take on the Apple iPad. Allard claimed he did not quit because of Courier, but he wanted to do more personal adventures such as bike and off-road truck racing. The iPad continues to attract a swarm of game developers.

While Bach’s division is profitable now, it may be remembered for its inability to take on Apple in the increasingly critical mobile business. The failure to take on Apple may be why both Bach and Allard left the company last year. And that may explain why Apple’s market capitalization has become bigger than Microsoft’s. Of course, this endless cycle of disruption in the game industry continues, as Google’s Android is now disrupting Apple.

Zynga’s emergence on Facebook

Zynga’s emergence on Facebook

Microsoft was also taken by surprise with the rise of Zynga on Facebook and the popularity of social games on the world’s biggest social network. Microsoft didn’t completely miss the boat, as it was able to make a $240 million investment in Facebook. But Microsoft hasn’t taken the plunge into the social game market yet, as it argues that it already has a huge stake in social with Xbox Live.

Facebook now has more than 800 million users, or about eight times the number of Xbox Live users. Zynga captured Facebook’s users with cute cartoon-like titles that didn’t even seem like games, such as the FarmVille farming game.

Zynga became a financial juggernaut using the free-to-play model, where gamers pay for free and pay real money for virtual goods.That, in turn, is forcing many traditional online game publishers to follow suit.

Much of the excitement around the consoles shifted to Apple and to social games from Zynga. As Zynga prepares for its initial public offering, the traditional game industry has become jealous of all of the attention it is getting. Free, or free-to-play games remain a huge threat to the consoles, which have seen flat to negative sales during the past two years.

Blackley’s perspective on the impact of Apple and Facebook on gaming is different.

“The console makers have been trying to suck new users into playing on dedicated hardware,” Blackley said. “Now there is this pressure that is driving the consumers to play games wherever they can. The audience is demanding games on every new platform, on every new device with a display. The game business will become an entertainment business that is slowly going to be divorced from dedicated hardware.”

With new technologies like cloud gaming from companies such as OnLive and the proliferation of gaming on every kind of device, it is quite possible that the dedicated game console is now an endangered species.