I’m increasingly asked these days for the nitty-gritty details on this whale den we call Saudi Arabia.

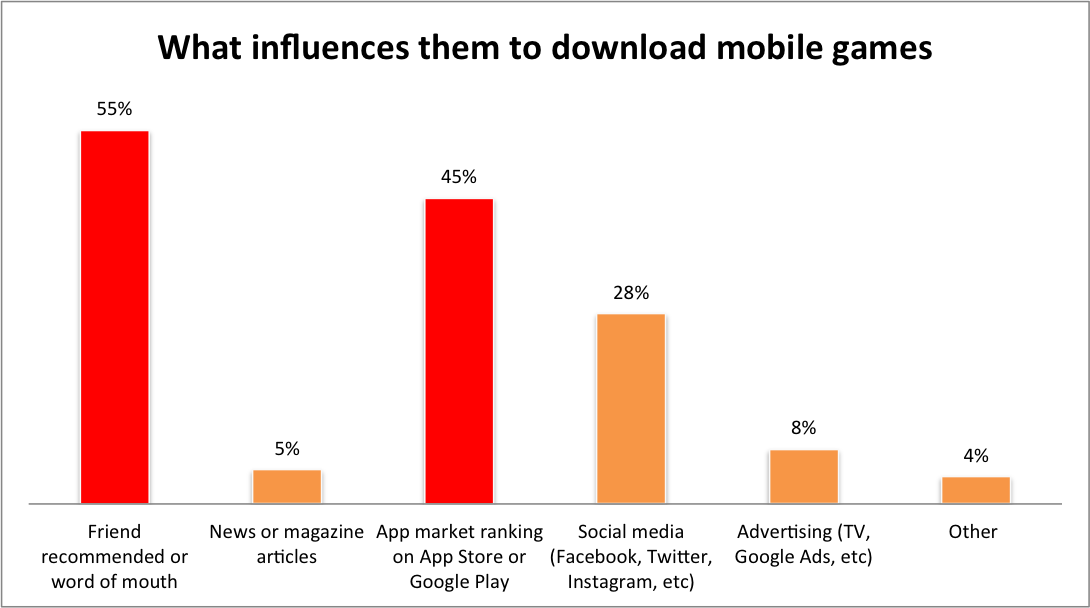

As I approach a talk in Dubai this month on the subject, I decided to run a survey that eschews all freeloaders and minnow low-paying players, targeting only dolphins and whales. Or in other words, it’s a survey that shares insights about mobile players who pay a minimum of 50 Saudi Riyals (USD $13) per month on in-game purchases, which we will define here as dolphins and whales. These are the gems that pay us back and pay us well in terms of lifetime value if they stick around. During the course of two weeks (September 12 to September 26), 747 of these Saudis responded to the survey . Here’s what they had to say.

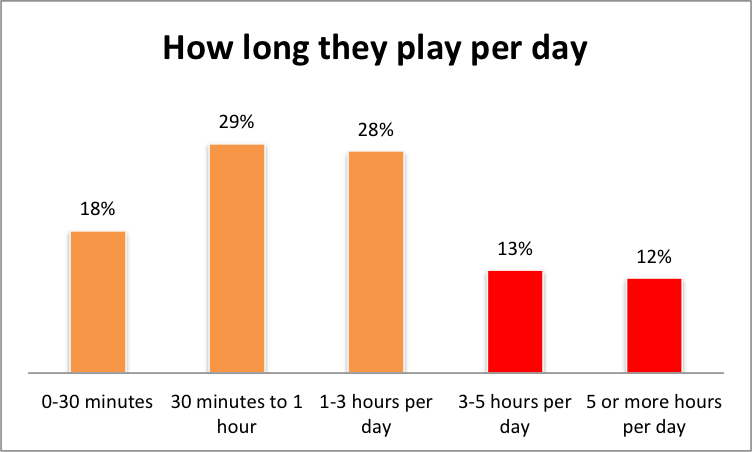

First off, we’re talking about a pretty hardcore bunch: 25 percent play mobile games 3 or more hours per day.

The survey found an above-average concentration of bona fide whales, too — at least 13 percent, depending on your definition of these high spenders. (SAR 500 is $133 USD at an exchange rate of 3.76.)

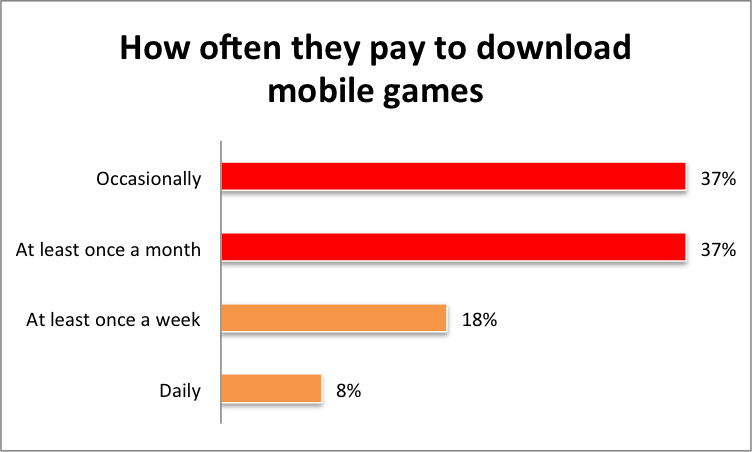

As I only screened players based on freemium or free-to-play game spending, it’s interesting to see that only 56 percent of these folks pay to download games. Seventy-four percent state they pay to download either once per month or only on occasion.

Adventure (55 percent), action (42 percent), casual (27 percent), strategy (26 percent) and puzzle (24 percent) are their top genre categories. Sports (20 percent), hardcore (19 percent) and racing (18 percent) trail closely behind. The survey found no particular surprises here, as it more or less follows global trends — i.e., Saudis are just as susceptible to Supercell title and Candy Crush addictions as any other gamer, no matter their locale.

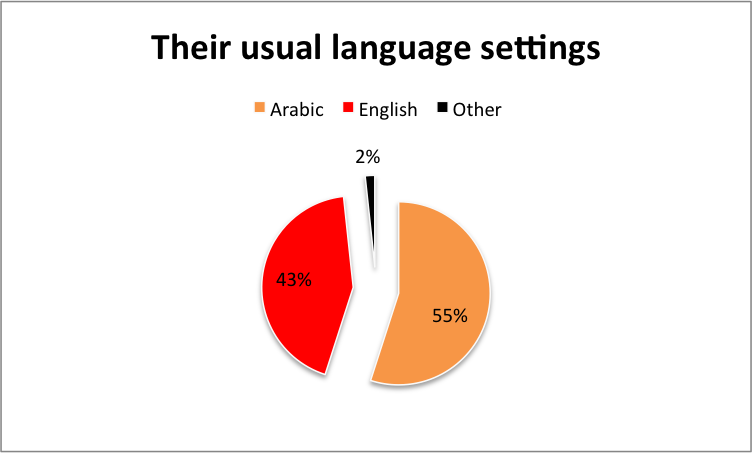

What’s surprising to us preachers of localization is the language setting they state they usually play games on.

It’s misleading of us to say that it is essential to localize games to Arabic, particularly when it comes to casual titles that have minimal text to wade through. Even if Saudis prefer the game to be in their native tongue, they clearly won’t find language to be an absolute barrier from them getting their hands on what they perceive to be the coolest and most popular games.

What we game localizers do know that is in favor of localization is that it almost always improves conversion rates across the board — by at least single-digit shifts. And this is especially important for medium-performing games or those that are plateauing. It is naturally also pretty mandatory for narrative-heavy games or for those where “server worlds” need to be separated in order to foster the right local community dynamics.

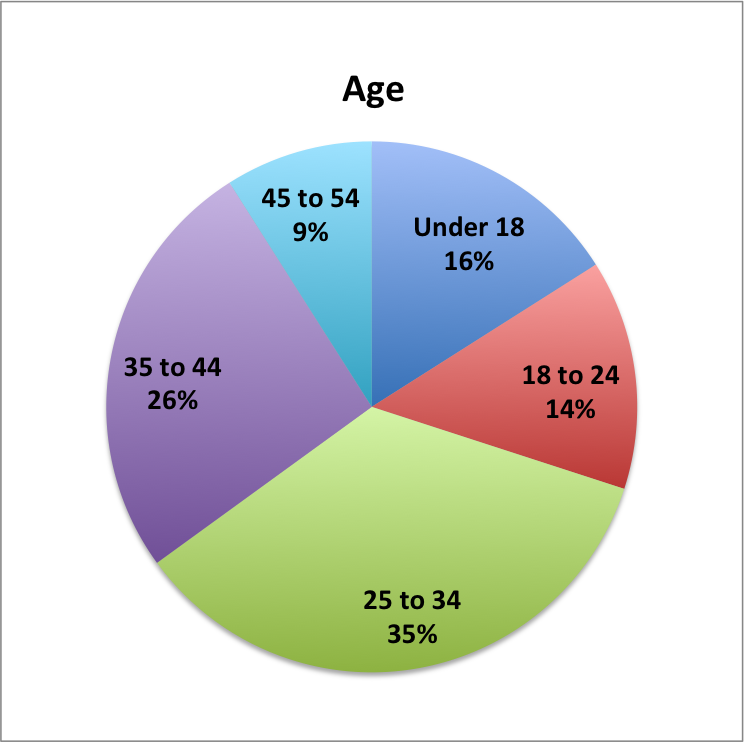

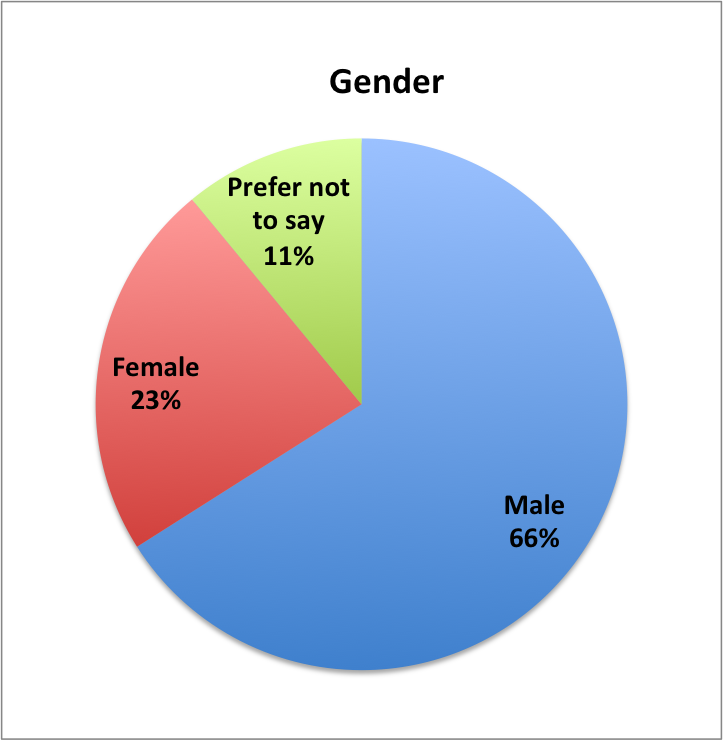

So who are these paying players who make us a lot of money if we acquire and tickle them in the right way? Sixty-one percent are between 25-44 years of age, and 30 percent are 24 and younger. Twenty-three percent are women. But as is usually the case in Saudi, the majority of the “prefer not to say” category (11 percent in this survey) are usually women, so keep that in mind when reflecting on the gender disparity.

Fifty-one percent of the payers are on iOS while 45 percent are on Android. Usually the latter has the upper hand in terms of user base, but it makes sense in this case since I’ve never tailored a survey strictly to payers before. We all know the lion’s share of app store revenue continues to flow into Apple’s pocket, and this proves true in Saudi all the same, so it’s rational that the dolphin ratio leans iOS.

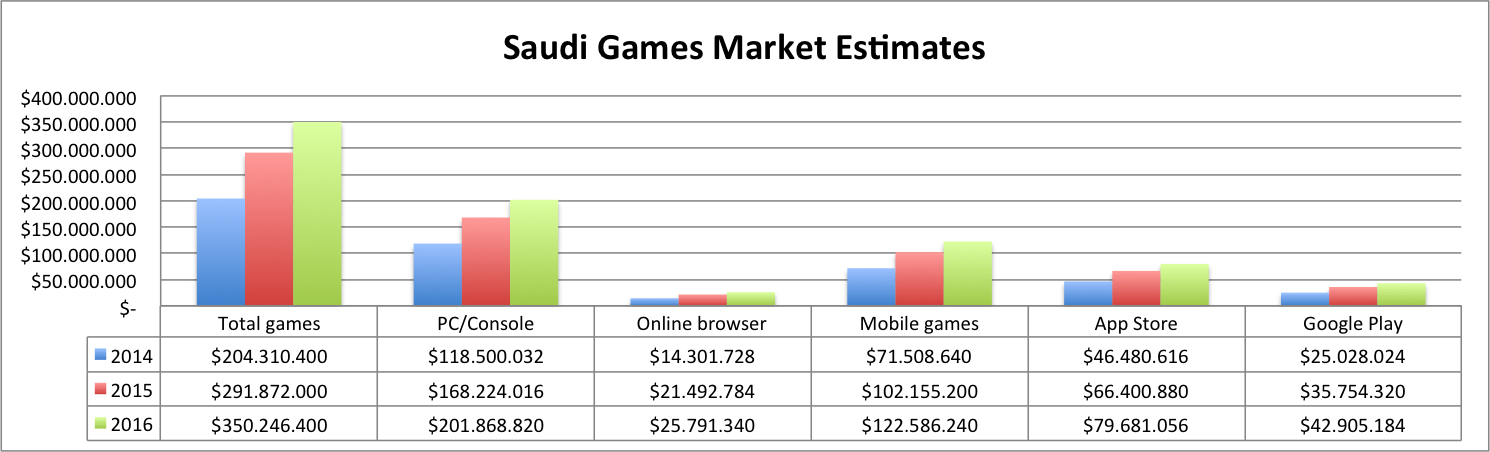

For some extra context, here is my current market breakdown of Saudi games revenue based on Newzoo’s latest report (October 19).

Amir-Esmaeil Bozorgzadeh is a cofounder at Gameguise, a Dubai-based publisher of online games in the Middle East and a consultancy to global game developers and publishers that need local help in understanding and operating in the market.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More