Social poker game income is on the way down — and out of PCs, according to a new study by market analyst SuperData Research.

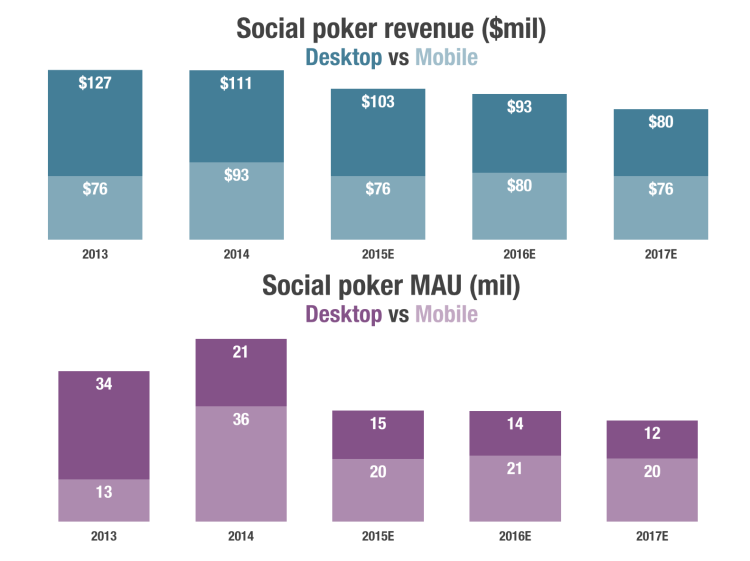

The firm estimates that total revenues are dropping, from $203 million in 2013 to $179 million estimated this year and to $156 million estimated in 2017. Much of that drop is due to the struggles of Zynga’s Poker app, which dominates the marketplace. Analysts believe that the segment’s revenues will become majority-mobile by 2018, SuperData representative Sam Barberie said.

“User numbers are dropping more sharply than revenue, as the market matures and fickle players fall by the wayside,” the Social Casino Metrics, May 2015 report said. “More casual poker players now gravitate toward poker games included in casino-style apps like DoubleDown Casino. … Changes in the overall social market are largely due to Zynga Poker’s fluctuating revenue and falling player base.”

That one game commanded 61 percent of the total social poker revenue market last year, the firm found, earning between $9 million and $13 million a month. But its users and spending have fluctuated wildly.

“Because of Zynga Poker’s overwhelming command over social poker, their performance has been reflected in the overall market,” said senior analyst Stephanie Lllamas. “Their poker game has largely been fueled by the volume of its users, since average spending is low for this type of game. So we are seeing casual poker players move on to casino-style apps causing a deflation in poker figures.”

Zynga Poker’s audience dropped 44 percent last year, ending at just under 20 million monthly active users, with revenues dropping more gently as some high-rollers stayed to play. While Poker had a minor rebound to just over 20 million players at the start of this year, the competing World Series of Poker app from Playtika/Caesars is still set to overtake Zynga Poker on mobile in 2015, the report said.

Zynga Poker has struggled since launching a massive revamp last year. Players eventually forced the publisher to bring back the old version of its poker game as a new “Classic” offering, and both the company’s chief executive and games studio head recently left the company.

SuperData suggested that building an all-in-one casino app would help Zynga win back that market.

“With Zynga Poker, the company can cater to the desires of poker enthusiasts who prefer the experience of a standalone poker app. Meanwhile, casual poker players are drawn to casino-style apps that include poker alongside other games like slots and blackjack,” the report said.

WSOP players doubled since a year ago, ending around 3.25 million this April, thanks in part to its well-known brand and its appeal to hardcore poker players, SuperData said. KamaGames is turning its Pokerist/Texas Poker app into a branded platform for other casinos and brands that want to get into the space. Its first game in that vein was Manchester United Social Poker, which released in February.

“Poker games require sophisticated artificial intelligence. This makes them more difficult to develop from the ground up than other casino game types like slots, giving publishers an opportunity to leverage their existing apps,” the report said. On the flip side, Llamas said, some really good poker apps have hit the market and failed because they lacked brand name recognition, so partnering can help.

“This was likely the impetus behind GSN’s acquisition of Idle Gaming, and this is the approach KamaGames has taken with Pokerist by teaming up with Manchester United,” she said.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More