The S&P 500 crashed through a level of support — a numerical value that sends a signal to automatic trading algorithms to stop selling stocks — the index held at around 1,150 during a massive market sell-off in early August, but it quickly re-established that level of support throughout the rest of the month. The index closed Thursday under that same level of support at 1,130 at the bell. Falling through a level of support is usually a bad sign for the major indices and indicates that further losses might be en route.

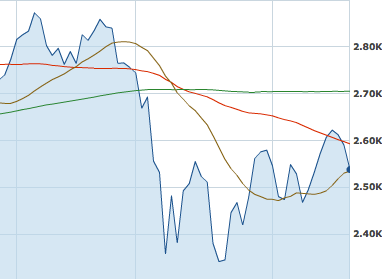

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":334761,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"media,","session":"C"}']The NASDAQ composite index (pictured above), which includes a number of the largest tech companies in the world, fell 3.3 percent while the Standard & Poor’s 500 index fell 3.2 percent. The NASDAQ composite index established a level of support at around 2,475 after a brief crash through that support level during August’s massive sell-off. The tech-heavy NASDAQ closed at 2,455 today — below its previous level of support.

Other technical values suggest continued weakness for the tech-heavy NASDAQ. The index’s 20-day moving average (beige line), a widely-followed technical by investors, remains well below its 50-day moving average (red line). Both moving averages dipped below the 200-day moving average (green line) during August’s broad market crash in what’s typically called a “death cross.”

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

That doesn’t bode well for fresh initial public offerings (IPO), which fell broadly during regular trading on Thursday. Only Zillow and Pandora, two web services that tackle real estate and music streaming respectively, notched gains amid the market’s sell-off. Spotify, a competing music streaming service to Pandora, announced today it would work with Facebook to simplify streaming music on the website.

Here are some of the market’s most recent initial public offerings, and how they performed as of the end of trading on Thursday:

LinkedIn (Debut: May 19) — $76.07, down 3 percent

Zipcar (Debut: April 14) — $16.84, down 1 percent

Renren (Debut: May 4) — $5.02, down 9 percent

Pandora (Debut: June 15) — $10.05, up 1 percent

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":334761,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"media,","session":"C"}']

Zillow (Debut: July 20) — $28.00, up 1 percent

Fusion-io (Debut: June 9) — $15.11, down 10 percent

Tudou (Debut: August 17) — $16.92, down 15 percent

Upcoming IPOs may encounter stronger headwinds given the market conditions. For example, in July Zynga filed to go public, hoping to raise up to $1 billion at an expected valuation between $10 billion and $20 billion. It made around $90 million in 2010 and $11.8 million in the first quarter this year. Despite that strong performance, investors may still prove skittish.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":334761,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"media,","session":"C"}']

Groupon isn’t looking quite as rosy, with significant losses in its first operating year. A pair of $100 million IPSs in insurance software provider Guidewire and revenue performance management software provider Eloqua are in the pipeline. And Yelp chief executive Jeremy Stoppelman said his company is on track to file for an initial public offering later this year.

“My sense is that if you have a very compelling story, a robust business and there’s moats around it and it isn’t going away over night, the IPO window is still very much open,” Stoppelman told VentureBeat in an interview.

Consumer electronics super-giant Apple fell 2.5 percent while enterprise tech provider and computer manufacturer Dell was down 4.7 percent. Online retailer Amazon was down 3.7 percent while search giant Google was down more than 3.4 percent.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More