Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

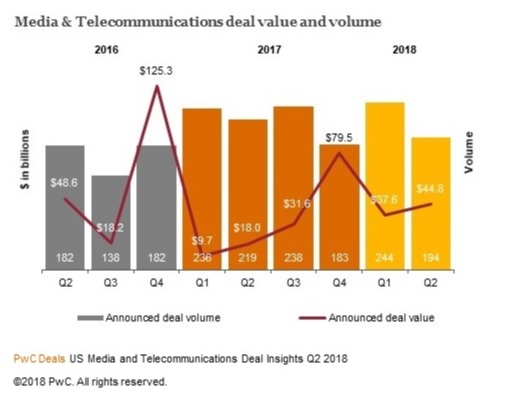

In the first half of 2018, the value of deals in the media and telecommunications markets rose 197 percent in comparison to the first half of 2017, according to a quarterly survey by accounting firm PwC. The second quarter of 2018 saw deal values rise 19 percent compared to the first quarter, but the number of deals decline.

Meanwhile, the value and number of technology company deals fell in the second quarter. There were 420 tech deals values at $30.6 billion in the second quarter of 2018, compared with 506 deals valued at $59.4 billion in the first quarter and 519 deals valued at $35.8 billion a year earlier in the second quarter of 2017.

Above: Media and telecommunications deals are on the rise.

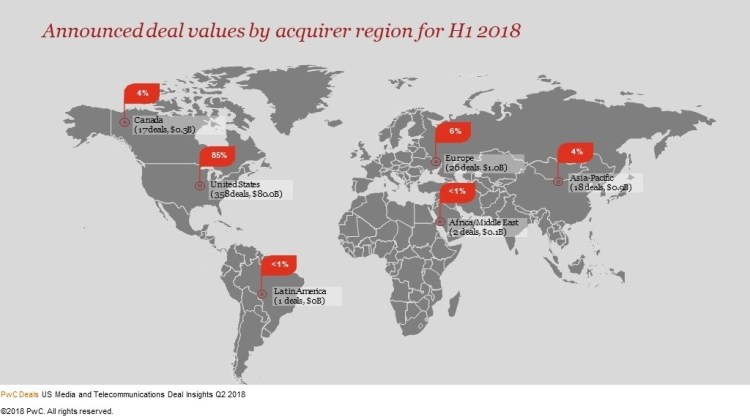

During the first half of 2018, there were three mega deals in excess of $5 billion in media and telecommunications, compared to no such mega deals in the first half of 2017. The merger of T-Mobile and Sprint for $26.8 billion was the biggest announced deal, although still subject to regulatory approval. The U.S. commanded 85 percent of the acquired companies in media and telecommunications.

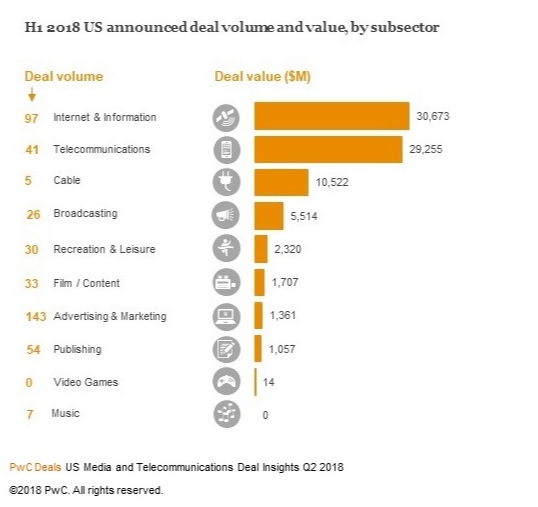

PwC noted that it has started to see more deals involving companies that have harnessed artificial intelligence technology. Hot sectors within media and telecommunications were the advertising/marketing and internet/information subsectors. Private equity deals grew in volume, but private equity’s share of deal values declined in the second quarter.

The value of tech companies deals in Q2 were at a five-year low. The number of deals also declined as high valuations and other uncertainties caused buyers to sit on the sidelines. Looking ahead, tech dealmakers face a series of unknowns that will affect not only their appetite for deals, but also the type of transactions available to them.

Above: Here’s the hot media and telecom sectors in terms of merger activity.

These include regulatory uncertainty, trade war impacts, and tech backlash distractions. The single largest inhibiting factor for deals continues to be high valuations.