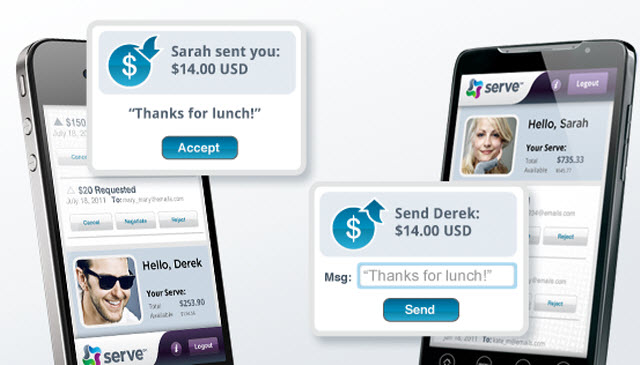

The deal will give American Express a high-profile partner that can help it move from the age of credit cards to the age of digital payments. With Serve, users will be able to “spend, send and swipe — online, offline, and mobile.” People can use Serve to use their phones to pay for lunch (pictured above) or buy virtual goods in online games.

Announced in March, Serve is American Express’s way to compete with digital payment companies such as PayPal, Boku, eBay-Zong and Visa (the latter bought PlaySpan for $190 million in February). The agreement is Serve’s first relationship with a mobile carrier and it will enable Sprint to offer convenient payment methods for its mobile customers.

“We believe that customers will benefit greatly from taking advantage of Serve’s functionality as a quick, user-friendly way for tackling the often tedious task of paying bills and making mobile payments.” said Dan Schulman, group president of enterprise and growth at American Express.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

With Serve, American Express wants to go after a new demographic of consumers, including those who are young and tech savvy, but perhaps not fans of credit cards or other traditional payments. It will also help American Express penetrate emerging markets overseas where cash rules. Until now, American Express wasn’t reaching a lot of consumers who don’t use traditional credit cards.

Serve unifies online, offline and mobile payment options into a single account that can be funded from a bank account, debit, credit or charge card, or by receiving money from another Serve account. Serve’s aim is to get rid of cash, check, or debit cards by being more convenient. Serve accounts can be accessed from apps on Apple iOS and Android devices. Users can also access accounts on Serve.com and on Facebook.

Sprint customers who register and qualify for a Serve account will be able to use their Serve card for making purchases at American Express participating merchants, paying their Sprint mobile bill, and in the future, for redeeming offers on goods and services. The hope is that Serve will put American Express and Sprint in sync with the buying habits of a new generation. Serve supports Android, Apple iOS, Microsoft operating systems and Research in Motion.

Sprint Nextel is the nation’s third-largest mobile carrier with more than 51 million customers.

At some point, user can use their Serve account to send and receive money to friends, pay bills and make purchases online. The account comes with a reloadable Serve prepaid card that you can use at any merchant or automated teller machine that accepts American Express cards.

In contrast to debit cards, Serve lets you create sub-accounts, for spouses or children. That allows parents to set allowances for children or others in the family. Parents can specify what the money can be spent for, such as allowing cash withdrawals or limiting spending to merchant transactions only. Parents can also receive reports back on how their children spent the money. The same accounts could be used for small businesses, such as authorizing sub accounts for delivery drivers who incur expenses on the go.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":310274,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"entrepreneur,mobile,","session":"D"}']

American Express got the foundation for Serve from its acquisition of Revolution Money in early 2010. Other partners for Serve include Ticketmaster, expense reporting firm Concur and Flipswap. Serve is also working with five charities: Autism Speaks, Best Friends Animal Society, Malaria No More, Save The Children and Stand Up For Kids.

Users can make donations to those charities via a donations widget that can be downloaded from Serve.com or its Facebook site. That widget can be shared on other web sites to solicit donations. American Express will match contributions via the widget, up to $100,000 for each charity. After a six-month free period ends, American Express will charge 30 cents per spending transaction and a 2.9 percent fee for each transaction where a user transfers money into a Serve account. The first ATM transaction in a given month is free, but subsequent transactions cost $2 each.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More