But what about the huge incumbents, like MySpace or Facebook? Will they thrive on the mobile web?

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":92163,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"mobile,social,","session":"A"}']Well, the 47 mobile-only networks will probably tell you that mobile is a whole different animal, and downplay the threat of a switch by their millions of users to those big guys. But in reality, even though some mobile-only social networks have gotten big — Mocospace, for example, has 1 billion page impressions worldwide, most of it in the US — their computer-based rivals are catching up now that new wireless devices, such as the iPhone, are making it easier for internet apps to transition to mobile.

My goal for this article was to find the top ten most significant social mobile companies.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

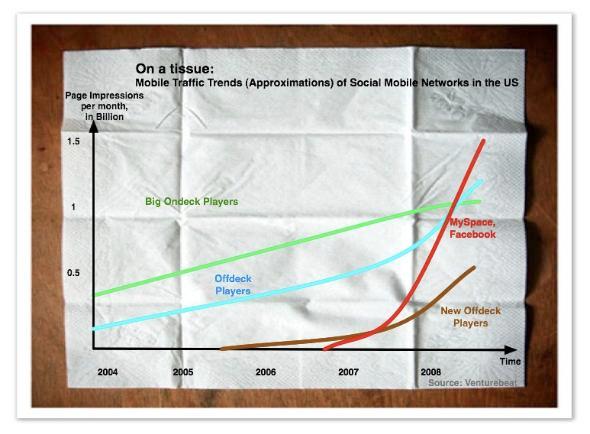

It was difficult reporting. With so many different players competing in the mobile social network space, we’re seeing a lot of different approaches and fragmentation. For my own thinking, I sketched out a diagram during lunch with an entrepreneur (see above for a cleaned up version of it). It’s partly based on generalizations, but it’ll give you an idea of what’s happening here in the U.S.

I’ve organized the mobile social companies into four groups. In addition to heavyweights MySpace and Facebook, I’ve picked eight companies — based on market share, differentiation through features, niche market and technology — that seem to be emerging as the most significant players.

[Disclosure: I consult for one of the companies named here, Peperoni.]

Group 1: The internet heavyweights – MySpace and Facebook

When I talked to MySpace and Facebook to see what kind of uptake they’d been seeing on their mobile sites (eg. m.myspace.com) I got quite a surprise. According to the user numbers they provided, both companies have already passed Mocospace.

MySpace’s Brandon Lucas, Senior Director of Mobile Business Development told me MySpace Mobile USA had 1.4 billion impressions last month. That’s compared to 1 billion visits to Mocospace this March, according to Mocospace CEO Justin Siegel. A source at Facebook confirmed to me that Facebook Mobile has also passed Mocospace’s numbers in the USA, too, but didn’t give me specific numbers. Expect announcements on that in the coming weeks.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":92163,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"mobile,social,","session":"A"}']

The barrier to traffic growth, according to Lucas, is awareness. Expect more banner ads for MySpace Mobile on its web site very soon to raise awareness. MySpace is willing to split revenue with operators, he says. Despite the split, “mobile advertising has grown in the last six months to be a real business for us”, he adds. He sees MySpace as playing the same role on mobile devices as it does on the web. He wants MySpace to be a “mobile advertising driver” for the industry — and wants to lure the brands advertising on its online version to add mobile advertising too. He said MySpace Mobile “wants to build a business for everybody” and that “we will share insights for everybody to profit.”

I also asked Lucas to comment on a MySpace strategy statement I came across in Stuart Dredge’s recent article on social mobile networking in New Media Age: ”We expect that half of our total traffic will be coming from mobile devices within the next five years,” the article quoted a MySpace representative as saying. Brandon said that’s a January quote from MySpace CEO Chris De Wolfe and reaffirms that mobile is one of the most important strategic initiatives for MySpace.

Meanwhile, Facebook has also come out with an “operator” platform designed to let wireless carriers integrate Facebook features like simple login and built-in Facebook multimedia messaging (MMS) — and that includes a revenue-sharing deal for both parties.

Facebook has also focused on the smartphone market and come out with an easy-to-use application for the iPhone. It ahas an application for RIM’s Blackberry. The app’s stat counted 212,238 daily active users when we checked yesterday. Facebook has also included links to its iPhone application from within its web site, which has doubtlessly increased traffic. Still, we can only speculate on how large the traction really is. Most iPhone users, from what he hear, access the “web” site and not the “mobile” site of both social networks. Neither Facebook nor MySpace has revealed data how much traffic they get from the iPhone to their web sites.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":92163,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"mobile,social,","session":"A"}']

Group 2: The big on-deck players — AirG, Jumbuck

Both AirG and Jumbuck offer mobile community products to operators. They are the biggest of those that rely mostly on ondeck traffic. They’re also the most mature. (Most of the other 47 mobile social network players fall into the on-deck category, too, but are smaller.) The term “mature” refers here to their company structures, the number of deals they have with operators, their effectiveness in developing new mobile products, and their current financial possibilities.

Their maturity puts the companies in a good position to move in a variety of directions. However, at the same I think they may be the most vulnerable to MySpace and Facebook. They’re very dependent on deals with the carriers, and I see harder negotiations with the carriers ahead as carriers ask them how they’re different to MySpace/Facebook. We may see them react by shifting their models to some degree.

Group 3: The mobile off-deck players — Mocospace, Buzzcity’s MyGamma, Peperoni’s Peperonity, GoFresh’s Itsmy

Distribution is one of the key challenges in the emerging mobile industry. The biggest advantage this second group has, I think, is that they all have their own, early and successful approaches to how a shift from the traditional on-deck model can be done.

Singapore-based Buzzcity has both a mobile community and mobile ad network. Its MyGamma mobile community has reached 2.5 million users since 2003, according to CEO KF Lai. Lai claims that Buzzcity is the second biggest mobile ad network behind Admob. It only trails Admob in the US and served 1 billion ad pages last month, worldwide. These numbers, mind you, do not relate to traffic at MyGamma only: They include ads served to the 500 publishers on Buzzcity’s inventory platform (up from 50 last year).

[aditude-amp id="medium3" targeting='{"env":"staging","page_type":"article","post_id":92163,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"mobile,social,","session":"A"}']

Peperonity, founded by parent company Peperoni in 2001, lets users design their own mobile pages [again, I’ve done consulting work for this company]. It started out as on-deck service but is now driven by both on-deck and off-deck traffic. With the off-deck segment, Peperonity is one of Admob’s biggest publishers, with 350 million ad pages displayed this February. Initial traffic growth at Peperonity was driven by on-deck deals with operators. Because Peperoni has standing operator partnerships with large, sticky user communities, new users are easier to pick up. The company doesn’t disclose exact numbers, but I’m comfortable saying it’s in a similar range to MocoSpace’s worldwide.

Last but not least in this group is social mobile network Itsmy from German company GoFresh. The company had 500 million page impressions in March, half of MocoSpace. The company offers a similar mobile network service to the others in the group with over a million users and has also created its own ad network. Many mobile ad networks launched in the last couple of months, of course, and they all face challenges. Still, it seems a good move for both Buzzcity and GoFresh.

Key to the success in this group of off-deck players is their ability to understand mobile features that have been working well in the bigger mobile markets, particularly in the US, and compile them into a coherent whole — features such as photo, video, chat and microblogging. In marketing, they do well in focusing on particular demographics, such as low-income users. Take Buzzcity, for example. Says CEO Lai: “We want to offer a compelling service to low-end phone users…Look at the worldwide market and this is what you will see.” Most of MyGamma’s traffic is located in Asia, Africa and Eastern Europe, in that order. In many of the countries it serves, mobile is not only the premier way of communication, but also of internet access. The company just entered the US market this April.

These offdeck players have mixed feelings about MySpace/Facebook arriving on the scene. Says Mocospace’s Siegel: “I knew since the day we started MocoSpace that every internet company would move to mobile over the next few years. However, I believe, and the reality is today, that companies focused entirely on mobile will deliver a better mobile experience and product than companies where only a small fraction of their resources are spent on mobile.”

[aditude-amp id="medium4" targeting='{"env":"staging","page_type":"article","post_id":92163,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"mobile,social,","session":"A"}']

To Buzzcity’s Lai, (off-deck) competition boils down to volume and understanding trends in mobile usage. In regards to MySpace/Facebook Mobile, he says calmly: “It’s still early days” and there are “different niches for different players.” Online and mobile community users constitute two different types. Online users use their web network and mobile users use their mobile one, and they haven’t mixed much, he said. Marcus Ladwig, COO Peperoni, on the other hand believes MySpace/Facebook will pose real competition, “however we’re not really afraid of this development,” he says. “I’m glad about competition from this field, as they’ll help emerge the mobile market and open it up for web-centric audiences. Customers will choose the network that fits their needs best anyway.”

Group 4: The new off-deck players — Bluepulse, Zannel

I lump these two companies together because both manage to connect messaging services to sizable off-deck markets. Bluepulse is a free mobile messaging service that’s very easy to use on most mobile devices (VentureBeat coverage). The question for Bluepulse, really, is how important that feat really is. If you believe CEO Ben Keighran, then Bluepulse is ready to take on Yahoo and Google as the mobile starting page. Quite ambitious, if not clever marketing, to make that claim, one may argue.

Bluepulse launched at the end of 2006 and served 150 million messages last month. In terms of user base, it’s mostly US and mostly off-deck, Keighran says. He says that “traffic grew considerably” since their re-launch in October 2007 but did not disclose enough about numbers to give me clues about its traction, so it’s difficult to say how well the re-launch has served Bluepulse’s ambitions so far.

In terms of monetization, Bluepulse follows an off-deck, advertising model. I asked Keighran what effects the iPhone, Google’s Android platform and location-based services would have on Bluepulse, and he says he views all of those developments positively. “The iPhone changes the awareness in the USA, in particular, on what mobile can do.” For Bluepulse, the iPhone is one of the top ten devices in the USA. Bluepulse doesn’t plan to offer any particular services based on Android or location-based services until it sees the market maturing more.

[aditude-amp id="medium5" targeting='{"env":"staging","page_type":"article","post_id":92163,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"mobile,social,","session":"A"}']

Zannel is a messaging service that lets users post video, picture and texting updates to communication with others across various devices. It offers additional value to customers via content partnerships. Many reviews I’ve seen describe Zannel as “a multimedia Twitter.” Reviewers tend to assess Zannel in the context of various Twitter clones, and Zannel’s features compare well in that light. Yet Zannel is the only company in the group of Twitter clones I contacted for input on this story that was repeatedly identified as a competitor.

Zannel did not disclose detailed traffic figures to me, beyond saying “we currently serve millions of users per month.” Assuming that’s true, that easily makes them one of the big players in the field, and their claim to be “mobile’s first Instant Media Messaging service” may be valid, when you look at market acceptance and consider that rich media apps are its No. 1 traffic driver, according to the company. The majority of Zannel’s business is off-deck where Zannel sees “incredibly fast, viral uptake,” suggesting strong recent growth. Over two thirds of Zannel’s traffic comes from the mobile web, the remainder comes from online.

Zannel sees the iPhone as a transformative product for mobile industry — it increases awareness of mobile’s potential and is a great platform for distributing rich media apps (Zannel’s traffic driver). As a mobile media messaging hub, Zannel lets users visually communicate with other users across all major social networks vs. just one. Therefore, Zannel sees the major social networks as complementary services rather than direct competitors. As these social networks open up their social graphs/platforms/APIs, Zannel believes its own services will become interwoven with theirs and that they’ll provide more value to end-users together than apart. Although that approach may be no news in an internet world, Zannel’s one of the first “working” mobile models to pursue that direction.

Final thoughts

MySpace and Facebook’s sudden growth in mobile will certainly have big implications. Mobile startups that are already big will need to continue trying hard to differentiate themselves in the face of increasing competition. People invested in small mobile networks will also need to think hard about the ability of those networks to scale up. Smaller players are also unlikely to gain traction as easily as they used to. On the other hand, there are still some verticals, like location-based services, waiting to be tapped.

In addition to the ten companies I’ve profiled, a number of other interesting players hit my radar while I was doing interviews to piece this story together. Some of the other companies people suggested I include were: Mig33, icebreaker.mobi, Juicecaster, Zyb, Frengo, Intercasting and Treemo. Of course, smaller online social networks like hi5, Friendster and Bebo are also looking at mobile services. There may also be players that I didn’t manage to unearth, either because I didn’t drill hard enough for competitors in the segments I looked at, or because I didn’t rigorously scope out international offers. But VentureBeat will be keeping a close eye on this market, so plan to hear more from us on this again soon. In the meantime, send us your comments and suggestions of any other players you think we should be taking a look at.

Matthäus Krzykowski is a freelancer, covering mobile for Venturebeat.

Eric Eldon contributed to this article.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More