Apple is increasing their share of the mobile advertising pie, and they’re not even trying.

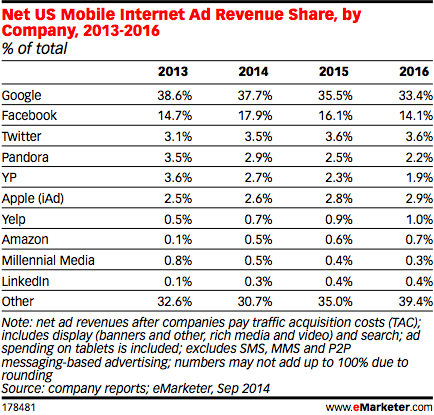

The Cupertino-based behemoth is set to see its market share of the mobile advertising spend — which amounted to nearly $10 billion last year — increase by the end of 2014. In 2013, Apple’s mobile ad slice was about 2.5 percent, a figure estimated to grow slightly when the candles are blown out in 2014, according to a new data report by eMarketer.

While the figure trails far, far behind mobile ad revenue leader, Google, followed by Facebook and Twitter, the news comes at a good time for Apple, which is expected to unveil a slew of new products, including the much-anticipated iPhone 6, tomorrow at a blowout event at DeAnza College in Cupertino, just down the road from Apple’s new headquarters.

“Advertisers are spending more on mobile. And for Apple, the more time people spend on their iPhones and iPads, the more their share grows,” Dan Marcec of eMarketer told VentureBeat.

We’re studying mobile analytics.

Take 5 minutes to fill out our survey, and we’ll share the results with you.

Apple’s mobile ad intake is not extensive: Their focus is building beautiful consumer products. But the number is noteworthy because as Yahoo, Twitter, and Google continue their buying binge of mobile analytic companies, which help them drive targeted campaigns, for example, Apple has thus expressed little interest in replicating the buyout spree.

This may be because Apple is fiercely protective of its customer’s privacy and data, Marcec posited, despite the celebrity nude iCloud hack that reverberated last week, in which numerous celebrities saw their accounts breached and naked photos plastered across the ether.

Indeed, many mobile ad firms rely on very specific client data to drive campaigns. Apple is in a separate category when it comes to this, and Marcec said the company does not openly share data on its iTunes customers with mobile analytic firms.

The mobile ad sector is massive — and growing quickly. Approximately 500 players comprise the ecosystem, including ad companies, ad brokers, exchanges, data analytic and gaming firms, and others. Analysts said the space, including advertising, was worth more than $17 billion last year. By the end of the 2014, that number is expected to crest to $35 billion.

“Apple has not worked that hard, or spent much effort here, their focus is on consumer products. With advertising, you need to be really careful. Apple is very hesitant to share information with their marketers,” Marcec said.

So, simply being Apple, the name itself, and marketshare of smartphones and tablets, sends a strong message to marketers that their client ads need to be emanating from their portable offerings. In fact, eMarketer disclosed that iPhone users accounted for nearly 40 percent of U.S. smartphone users last year, and that will increase by the end of the year.

“They haven’t made a lot of acquisitions, and advertising (revenue) has never been a focus of their business,” said Marcec.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More