Apple posted another record-breaking quarter by making $7.3 billion — or $7.79 in earnings per share — in income off $28.6 billion in revenue.

Apple posted another record-breaking quarter by making $7.3 billion — or $7.79 in earnings per share — in income off $28.6 billion in revenue.

That’s up 82 percent from $15.7 billion in revenue in the same quarter one year earlier. Income was up 140 percent from $3.25 billion in the third quarter last year.

The company sold more than 20 million iPhones and more than 9 million iPad tablet computers in the third quarter this year. It sold 8.4 million iPhones in the third quarter last year and 3.3 million iPads in the same quarter.

The company also sold nearly 4 million Mac computers, up from around 3.5 million Macs in the same quarter one year earlier. iPod sales were up 20 percent to 7.5 million iPods in the third quarter this year, up from 6.25 million iPods in the same quarter a year earlier.

Wall Street analysts expected the company to bring in around $25 billion in revenue, with earnings per share of $5.42. Apple projected fourth-quarter revenue of $25 billion and $5.50 in earnings per share, below Wall Street analyst expectations of $27.7 billion in revenue and $6.42 in earnings per share.

Here are the highlights from the company’s earnings conference call today.

2:01 p.m.: Apple COO Tim Cook and CFO Peter Oppenheimer are on the call this afternoon — CEO Steve Jobs is absent as usual.

2:03 p.m.: “We set a new all-time quarterly record for iPad and iPhone sales and a new June quarter record for Mac sales,” Oppenheimer said.

2:04 p.m.: Mac sales were particularly strong in the Asia-Pacific segment, where the company experienced a 57 percent increase in year-over-year models sold, Oppenheimer said.

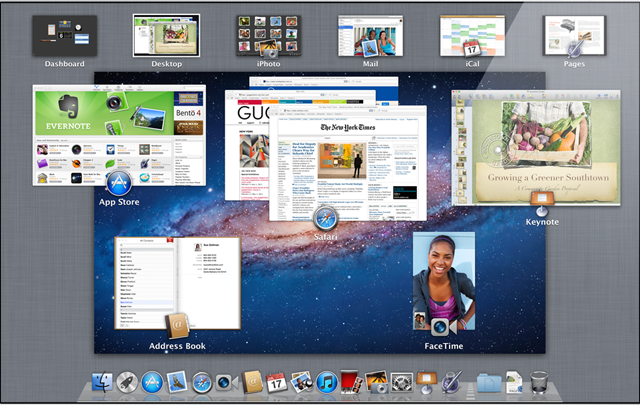

2:05 p.m.: Mac OS X Lion (pictured above) is launching tomorrow, Oppenheimer said.

2:05 p.m.: Mac OS X Lion (pictured above) is launching tomorrow, Oppenheimer said.

2:06 p.m.: iTunes generated $4.4 billion in revenue, up 36 percent from the third quarter last year. Customers have downloaded more than 15 billion songs.

2:07 p.m.: Revenue from iPhone sales this year was $13.3 billion, up from $8.5 billion in the same quarter a year earlier, Oppenheimer said. The company has around 5.9 million iPhones in channel inventory. The company is expected to begin selling the next version of its iPhone soon.

2:08 p.m.: 91 percent of Fortune 500 companies have deployed the iPhone as the company’s primary smartphone, Oppenheimer said.

2:09 p.m.: “We sold every iPad we could make,” Oppenheimer said. The company has around 1.05 million iPads in channel inventory, well below the company’s target range of having enough iPads to last 4 to 6 weeks.

2:10 p.m.: 86 percent of the Fortune 500 companies are deploying iPads, up from 75 percent of companies on the Fortune 500 list in the last quarter.

2:11 p.m.: Apple has sold 220 cumulative iOS devices as of the end of the third quarter this year. That includes iPod Touches, iPhones and iPads.

2:11 p.m.: No new release date for iOS 5, the company’s next mobile operating system unveiled at WWDC this year. “It will come out later this Fall,” Oppenheimer said. Same for iCloud, the company’s cloud storage program.

2:13 p.m.: Revenue from Apple’s retail stores rose to $3.5 billion across the company’s 327 retail stores internationally. Each store brings in around $10.8 million in revenue. The company plans to open 30 new stores in the fourth quarter this year. Apple opened 4 new stores in the third quarter this year, and expects to open 40 stores in the 2011 fiscal year.

2:13 p.m.: Revenue from Apple’s retail stores rose to $3.5 billion across the company’s 327 retail stores internationally. Each store brings in around $10.8 million in revenue. The company plans to open 30 new stores in the fourth quarter this year. Apple opened 4 new stores in the third quarter this year, and expects to open 40 stores in the 2011 fiscal year.

2:14 p.m.: Stronger mix of iPhones and lower commodity costs attributed to higher profit and revenue for Apple, Oppenheimer said.

2:14 p.m.: Apple has $76.2 billion in cash.

2:18 p.m.: The question and answer session is starting now.

2:19 p.m.: For the education buying season, September has been more weighted to higher education. Apple expects this to be the same this year and the company expects year over year increases in iPhone and Mac sales, along with iPad. The company expects to see a sequential year-over-year decline in sales for the iPod.

2:20 p.m.: The company has a future product transition that “it will not talk about today” that will affect the performance of its September quarter. This could be the next version fo the company’s iPhone, which is expected to come out sometime in the fourth quarter this year.

2:21 p.m.: Some customers purchased an iPad instead of a Mac in the third quarter, which cannibalized Mac sales. But there’s a large portion of the Windows PC market that the iPad will cannibalize, Cook said.

2:23 p.m.: “Sales of iPad 2 have absolutely been a frenzy,” Cook said.

2:23 p.m.: “China was very key to our results, revenue year over year, it was up over 6 times and the revenue was approximately $3.8 billion during the quarter. That makes the year-to-date numbers for the three quarters we’ve had thus far around $8.8 billion,” Cook said. “This has been a substantial opportunity for Apple and I firmly believe we are just scratching the surface right now.”

2:25 p.m.: “Most components (like NAND memory and DRAM) are generally in a very positive supply position currently, and pricing is expected to sell at or above historical demand,” Cook said. “Hard drive demand is constrained.”

2:26 p.m.: “We love competition, we think it’s great, but we want people to invent their own stuff,” Cook said. “We’re going to make sure we defend our portfolio appropriately.” He’s referring to the company’s patent victory over HTC, a manufacturer of Android phones.

2:27 p.m.: Apple added 42 new carriers in 15 new countries in the third quarter this year, which contributed to iPhone sales. Those occurred throughout the quarter, and the real sequential improvement in iPhone sales was due to emerging and developing markets like China, Latin America and Brazil — as well as the Middle East.

2:30 p.m.: “You can kind of go to our data sheet and add the iPhone and iPad and make a reasonable approximation, you can quickly see in the June quarter that we sold more than 33 million iOS devices,” Oppenheimer said. “Our numbers are straightforward and transparent and are reported quarterly.” He said it in response to a question of how iOS activations are comparing to Android activations. Analysts estimated that iOS activations were up 20 percent quarter-over-quarter, while Android activations were up 50 percent.

2:31 p.m.: Oppenheimer is giving a schpiel about how huge iOS is becoming in response to the analyst’s question. “We don’t see any other tablets like Android getting any traction right now,” he said.

2:33 p.m.: Apple TV continues to do well, Oppenheimer said. “But I don’t want to mislead, we still call it a hobby here and we do that because we don’t want anyone to conclude that it’s another leg of the stool because it’s not in the size market that the iPhone or iPad is in.”

2:36 p.m.: When asked about diversifying manufacturers for its devices, Cook said the supply chain a part of the magic and a part of the things that the company feels it has some “secret sauce.” “I prefer not to share it,” Cook said.

2:43 p.m.: iPads cannibalized new Mac sales in the third quarter this year, Cook said. Some customers have also decided to delay Mac purchases until the company’s next operating system, OS X Lion, comes out — which is tomorrow. In the same quarter last year, the company launched new Macbook Pros, compared to new iMacs launched this year. The Macbook Pro makes up a majority of new units sold in the Mac area, Cook said. All three factors contributed to weaker Mac sales, he said, “but I don’t want to lose sight that sales are 5 times that of the industry.”

2:43 p.m.: iPads cannibalized new Mac sales in the third quarter this year, Cook said. Some customers have also decided to delay Mac purchases until the company’s next operating system, OS X Lion, comes out — which is tomorrow. In the same quarter last year, the company launched new Macbook Pros, compared to new iMacs launched this year. The Macbook Pro makes up a majority of new units sold in the Mac area, Cook said. All three factors contributed to weaker Mac sales, he said, “but I don’t want to lose sight that sales are 5 times that of the industry.”

2:47 p.m.: Concerning ravenous iPad demand and shortages, “This is a good problem to have,” Cook said. In the first three weeks of the fourth fiscal quarter this year starting in June, supply has improved, Cook said.

2:49 p.m.: Last quarter, Apple sold more iPads to K-12 enterprises than Macs for the first time. “We would have never predicted this,” Cook said. “It’s clear it has a universal appeal in any market from consumer to business to government.”

2:51 p.m.: “We can’t wait to get iCloud into the hands of customers in the fall, we really think we’ve done it right with iCloud,” Oppenheimer said. One of the reasons cited why iOS devices are number one in terms of intent to buy is the iCloud, he said.

2:53 p.m.: Prepaid or unlocked phones are key in China and a number of emerging markets, Cook said, where the credit systems are not as well established as they are in the U.S., Japan, western Europe and Australia. “We haven’t figured out how precisely to play perfectly in the environment and we have more to learn, but I feel very, very good about our progress,” he said.

2:56 p.m.: “In terms of playing at different price points, we do offer the 3GS as an example today at $49,” Cook said. “We will only make products we are proud of, and if we can do that and the price is lower, then we’ll do that.” Cook refers to the iPod shuffle, the company’s low-cost music player that has seen some success.

2:57 p.m.: “It’s up to us to convince people to maybe spend a little more for a materially better product,” Cook said. “We’ve seen that people will do that if the product is messaged properly.”

2:59 p.m.: “Look for some more content (videos for rent) on the iTunes store later this year,” Oppenheimer said. “We think you’ll be pretty pleased.”