Google has seen a massive spurt in its app install ad business over the past few months, making serious progress toward closing the gap with the longtime leader in the business, Facebook.

Google may even surpass Facebook soon, if its latest initiatives work out as planned. Google has seen a twofold increase in the volume of app installs over the past year from search ads on Google.com and Google Play. That puts Google at 3 billion app installs, according to several sources — significantly up from the more than 2 billion installs Google announced in May.

Facebook shared at its F8 event in April that its ad platform has driven 2 billion installs to date.

Google’s growth is significant, considering that only last year its business in driving app installs looked moribund in comparison with Facebook’s. The app install market is a lucrative one, estimated to reach $7 billion by 2020 in the U.S. market alone, according to BI Intelligence.

Google is closing in

Definitive information on who is leading is hard to come by. There’s no central source for data in the highly fragmented world of apps. A good place to start, though, are the four independent companies — Adjust, AppsFlyer, Kochava, and Tune — that track attribution for successful install campaigns. And those firms all report strong evidence that Google has closed the gap with Facebook. The trend is further supported by anecdotal conversations with several advertisers, who say they have increased spending on Google lately, in some cases moving budget away from Facebook.

To be sure, most data about app installs is backward looking, meaning that the results of most of Google’s significant new ad offerings announced in May haven’t shown up in attribution statistics yet. But they could over the next few months — and it’s possible that any remaining gap between Facebook and Google might evaporate altogether.

Take the example of Joe Robb, who runs a health and fitness app business called SparkPeople. In an interview with VentureBeat, Robb said he’d shifted budget away from Facebook to Google this year, after finding that AdWords outperformed Facebook ads for most of his apps.

Google’s cost per install was lower, he said, and over the past few months Google’s campaigns had consistently driven more volume too. He’s increased his budget for Google campaigns by 125 percent monthly over the past two months, and his management team just agreed to ramp up even more over the next twelve months, he added. “It’s fantastic,” he said. “You pull the trigger, and the app downloads come in.”

Even if most data is backward looking, it already shows a massive surge by Google.

Facebook is still on top, but…

Ad attribution company AppsFlyer last week became the latest to note the trend. While Facebook continued to dominate most metrics overall through June, Google was climbing quickly, according to an AppsFlyer survey. The survey analyzed four billion app installs and the media sources that drove them. In sum, by June, Google had climbed past Facebook and Twitter into the No. 1 position in global retention of users on Android in the lucrative area of games apps. On iOS, where Google has only recently started pushing aggressively, Google rose to third from fifth on overall ranking, which includes retention and number of installs for games apps. Google also saw gains among non-gaming apps.

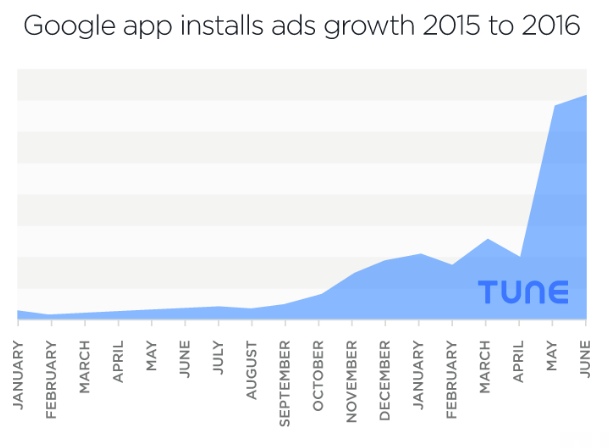

By the measure of another player, Tune, Google’s growth was even more impressive. Tune analyzed 150 million installs by about 74 million devices owned by about 48 million Americans. It showed that Google showed sudden massive growth of mobile app install ads last year, and that the growth continued into 2016 at an “almost unprecedented pace,” according to John Koetsier, economist at Tune. Specifically, Tune saw a sevenfold growth by Google last year and fourfold growth through June of this year, Koetsier said. (See chart at left.) Tune and other attribution companies typically decline to release absolute numbers, saying the data is proprietary. “While it’s easy to generate big growth multiples on tiny businesses,” Koetsier said, “to see this kind of ramp-up for a company the size of Google is impressive, to say the least.”

Kochava and Adjust, two other attribution companies, found similar evidence. Facebook is still driving higher install volumes, but Google is narrowing the gap. Since 2015, Google has consistently grown at a faster clip than Facebook, said Jeremy Grimm, director of publisher development for Kochava.

Above: Google vs. Facebook, Install Volume Variance Trend, shows Google closing the gap. Source: Kochava

Other large advertisers say their businesses reflect these findings. Pocket Gems, a large game app developer, said that it has increased spending on Google by 50 percent in the past six months. But while Google’s ad products have improved a lot over the past year, the company still spends less on Google than on Facebook, said David Rose, director of performance marketing for Pocket Gems.

Google is pulling out the stops across all of its properties

So what’s driving the Google surge?

Most of it comes from Google’s initiative, launched a year ago, called Universal App Campaigns (UAC), a simple way for publishers to tap into all of Google’s ad formats, which include Google’s AdWords, its display network, YouTube, and more. It was a big move by Google because its multiple formats and properties had become almost too complex for advertisers to master. Many advertisers preferred Facebook’s simplicity: Just put ads on the social network’s single feed, serving 1.7 billion users, and you could reach those people most aligned with your goals. By bringing all of its offerings together, Google was essentially offering the same simplicity, but with arguably even greater reach: Google Search, YouTube, Maps, Gmail, Android, Play, and Chrome now serve over a billion users each, according to Google.

The launch of UAC last year coincided with the launch of ads in the Play Store, an obvious place to grab the attention of millions of users searching for apps.

Google further stepped on the gas this May at its I/O event, when it said it was making multiple improvements to UAC, including extending it to iOS.The company also said it would help publishers automate targeting, improve bidding, and generate creative to optimize campaigns to find users who offer the highest value: those likely to retain the app and spend more on it over time.

This includes letting publishers tell Google what app events matter the most to them, and then offering ads that fulfill those events. Lee Jones, Google’s global product lead, provides the example of a game company called Pixonic, which deemed users who completed level 5 of its game to be highly valuable. The company used a beta version of Google UAC to quadruple its average revenue per user (ARPU) and increase downloads by 40 percent, Jones said.

Google uses machine learning to track signals and then adjusts constantly, in an effort to save users time they usually spend manually tweaking bids as they get more data about how campaigns are doing. “We process millions of signals in real time,” said Jones.

(See my interview with Lee Jones on stage at GamesBeat two weeks ago. Video below.)

Gloves come off

Two months after Google’s announcement about optimizing for any in-app event, Facebook responded on July 19 with a product that sounded very similar. Called App Event Optimization, it lets advertisers optimize and bid for users likely to complete 14 types of events.

In another challenge to Facebook, Apple in June said it was going to launch ads on its own App Store to drive app downloads. This put further pressure on Facebook, which doesn’t have an app store of its own.

Google also plans to expand its UAC offerings, for example, to Trial Run Ads, which Google launched in May. Those ads give users a way to test-drive a game app directly within the ad, before even having to install the app. Google’s also looking to extend UAC ads to other areas, including possibly expanding units in places where ads are already shown — for example, in the Google Play store — according to sources. Google says it’s also deepening integration between Android and the Play Store to allow better user targeting.

Another area where Google is turning up the heat is video, a dominant ad format, where YouTube has been the center of Google’s efforts. Google says 90 percent of avid gamers visit YouTube at least once a week for tips and to watch gameplay, and 64 percent of these gamers download an app after seeing an ad on YouTube. (Pokémon Go is an example of a successful games community on YouTube, which has racked up millions of hours of watch time and about 90 million views on its official YouTube page.)

We reached out to Google and Facebook about their latest app install figures. Both companies declined to comment on anything beyond their recent announcements.