Intel reported second-quarter earnings that beat Wall Street estimates.

The world’s largest chip maker is a bellwether for the PC economy and the larger electronics industry. The company’s fundamental challenge remains finding footholds in mobile and Internet of Things markets even as its core business of making chips for PCs shrinks. Microsoft is about to launch Windows 10, one of its biggest operating system launches in recent years. Demand for new Windows 10 PCs could help Intel, but the full impact of that boost isn’t yet clear.

Intel reported earnings of 55 cents a share on revenues of $13.2 billion for the second quarter ended June 30. Analysts had expected a consensus of $13.06 billion and earnings per share of 50 cents. The earnings were flat compared to a year ago, and revenues were down 5 percent. In after-hours trading, Intel’s stock price is up 2 percent.

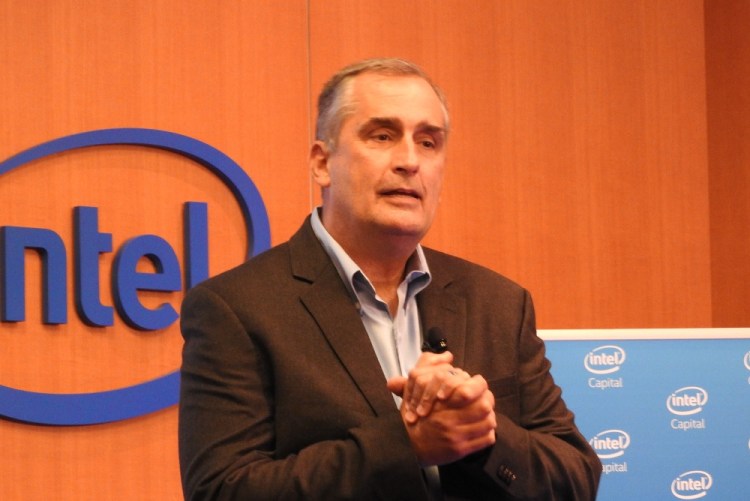

“Second-quarter results demonstrate the transformation of our business as growth in data center, memory and IoT accounted for more than 70 percent of our operating profit and helped offset a challenging PC market,” said Intel CEO Brian Krzanich, in a statement. “We continue to be confident in our growth strategy and are focused on innovation and execution. We expect the launches of Skylake, Microsoft’s Windows 10 and new OEM systems will bring excitement to client computing in the second half of 2015.”

In a research note, Bernstein Research’s Stacy Rasgon said that Intel may report weak sales in its data center group, which makes chips for servers and has been the company’s mainstay source of profits.

Intel drew some headlines recently as it announced that Renee James, president of Intel, will step down in January in pursuit of a CEO job elsewhere. Arvind Sodhani, head of Intel Capital, also said he planned to retire. Intel also announced the departures of Hermann Eul, corporate vice president and general manager of the mobile and communications group (which was losing about a billion dollars a quarter), and Mike Bell, corporate vice president and general manager of the new devices group. Neither mobile devices nor wearables have been weak spots for Intel. Software and services, which James supervises, have also had a mixed record.

Intel said that its actual second-quarter Client Computing Group revenue was $7.5 billion, up 2 percent sequentially and down 14 percent year over year. Data Center Group revenue was $3.9 billion, up 5 percent sequentially and up 10 percent year over year. Internet of Things Group revenue was $559 million, up 5 percent sequentially and up 4 percent year over year. And software and services operating segment was $534 million, flat sequentially and down 3 percent from a year ago.

For the third quarter ending September 30, Intel said it expects revenues of $14.3 billion, plus or minus $500 million. It expects a gross profit margin percentage of 63 percent. Research and development expenses are expected to be $4.9 billion, and restructuring charges will be $175 million.

For the full year, Intel expects revenue will be down 1 percent, and gross profit margins will be 61.5 percent. R&D will be $19.8 billion, and full-year capital spending is expected to be $7.7 billion.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More