Apple easily beat estimates for its third quarter results today. It had the best June quarter for both revenue and earnings in the company’s history and the best quarter ever in terms of Mac shipments. Great news right?

Apple easily beat estimates for its third quarter results today. It had the best June quarter for both revenue and earnings in the company’s history and the best quarter ever in terms of Mac shipments. Great news right?

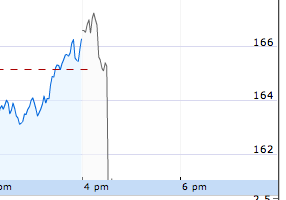

Well, not from Wall Street’s perspective. The stock is tanking in after-hours trading. The reason? A weak outlook for the next quarter.

Right now the stock is down over 9 percent in after-hours trading (update: Now down over 10 percent), plunging towards the $150-a-share mark — a level it hasn’t been at since April.

If this seems familiar to you, it may be because it’s like deja vu all over again from Apple’s last earnings report. Apple blew away second quarter expectations in April and set guidance very low for the third quarter. Now it’s doing the same thing for the fourth quarter. I see a pattern, but apparently the rest of Wall Street doesn’t and is once again buying into Apple’s “set the bar low” game.

Apple is expecting fourth quarter earnings to be $1.00-a-share with revenue of $7.8 billion. Wall Street averages were looking for something more along the lines of $1.25-a-share and $8.3 billion in revenue.

For the third quarter, Apple posted revenue of $7.46 billion and net quarterly profit of $1.07 billion, or $1.19 per-diluted-share. Wall Street had been looking for $7.36 billion with $1.08 earnings-per-share.

This strong third quarter happened despite no iPhone 3G sales having been counted yet — and actually no iPhone sales since March 6th having been counted for this quarter. Apple still beat the estimates on iPhones shipped.

All told, Apple shipped just under 2.5 million Mac computers, 11.01 million iPods and 717,000 iPhones in the quarter.

Some other notes of interest from the call:

- 25 million iPhone applications have already been download through the App Store.

- 242 Apple stores will be open by the end of FY 2008.

- Numerous times those on the call for Apple mentioned a “future product transition” as a reason for a weak guidance next quarter. Apple chief financial officer Peter Oppenheimer wouldn’t elaborate on what this means since Apple doesn’t comment on future products, but after being prodded relentlessly by questions about it, he did say: “We have some investments in front of us that I can’t discuss with you today.” and continued that there will be “state of the art new products.”

- On the topic of Apple chief executive Steve Jobs’ health Apple representatives were silent other than to say: “He [Jobs] has no plans to leave Apple,” and “Steve’s health is a private matter.”

- When one reporter asked about the Apple TV, the quote was: “The Apple TV remains a hobby as we call it.” This does not bode well for Apple launching a counter-punch to meet the announcements made at E3 by rivals Microsoft (with Netflix) and Sony.