Let’s do math. Math is fun.

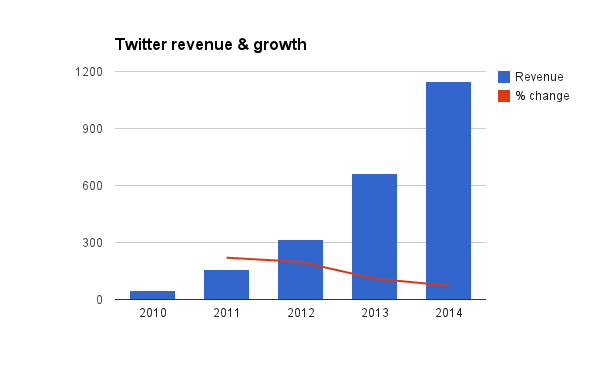

In advance of Twitter’s earnings call today, the company reported $243 million in revenue for the fourth quarter 2013 and $665 million for all of 2013. This represents, the company said, a 110 percent increase from 2012.

Meanwhile, Twitter projected $1.1 billion to $1.2 billion for the whole of 2014 and $230 million to $240 million for the first quarter of 2014. Depending on where Twitter falls in its annual range, its growth will slow to 65 percent or 85 percent year-over-year.

For any other company, this would be great news. Companies like Google and Facebook and Apple see comparatively minuscule YOY growth.

But for a company as young as Twitter — and with a business model as relatively untested as Twitter’s — this is a problem. The first quarter after an IPO is not the time to project slowing growth.

Take Facebook. The company itself is a huge financial success. But in 2009, its revenue grew 120 percent year over year. By 2013, that number had slowed to 55 percent. Now, we can start to project Facebook’s revenue growing even more slowly and leveling off, to a certain extent, as it comes to the bottom of its barrel of ad revenue sources.

With a $2.5 billion Q4, that’s not a terrible place to start leveling off.

Let’s visualize all that lovely math, which according to eMarketer looks like this:

Here’s what we know based on earnings today, the company’s S1, and its 2014 projections:

With Twitter’s $275 million projected quarters for 2014 — as projected by Twitter — that’s a really terrible place to start leveling off. It means Twitter will take a decade or more to have a $10 billion year. And who knows if Twitter has a decade’s worth of staying power.

We long held that Twitter lacks the capability to be a true contender in online ads. Its reach of a quarter billion accounts is dwarfed by its competitors, and its ads’ return on investment is still more or less unproven.

Of course, these projections could be so much conservative bullcrap — something teensy so the company can trumpet that it “beat estimates” by a huge margin this time next year. In fact, that’s highly probable. But if Twitter doesn’t pummel those estimates, it’ll reach the end of its growth curve mighty soon.